FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

As the US House hashes out its “One, Big, Beautiful Bill,” statehouse lawmakers are watching closely, given the impact of both its tax and spending provisions on state budgets.

12 min read

Lawmakers should push against efforts to lift the SALT cap, and they should keep an eye toward bringing additional transparency to the tax system.

The better we understand taxes, the better we can manage our finances, but it starts with familiarizing ourselves with basic tax concepts like how tax brackets work.

3 min read

As a rule, an individual’s income can be taxed both by the state in which the taxpayer resides and by the state in which the taxpayer’s income is earned.

52 min read

By streamlining, simplifying, and reducing tax burdens for remote and nonresident workers, a newly proposed bill could make Arkansas a more attractive state for both employees and employers.

4 min read

According to a new poll from the Tax Foundation and Public Policy Polling, more than half of taxpayers lack basic tax literacy, regardless of educational attainment, income level, or political affiliation.

Taxes and their broader impact are generally overlooked in American education. Taxes influence earnings, budgets, voting, and decisions on where to live, but do American taxpayers understand the US tax system?

25 min read

As we prepare for the tax code’s “move,” it’s time to start cleaning out the proverbial attic of our messy system. For the sake of our economy, moves toward growth must win the day.

As lawmakers prepare for the debate over the expiration of the 2017 Tax Cuts and Jobs Act (TCJA), they may face increasing pressure to offset the cost of lowering tax rates by changing other parts of the tax code. One potential option to raise additional revenue to cover the cost of the TCJA’s reforms—like lower rates, a larger standard deduction, and a larger child tax credit—would be to repeal the head of household filing status.

5 min read

Today marks 55 years since two students sent the first message across the Advanced Research Projects Agency Network (ARPANET) between computers at four universities, which would later become the internet we enjoy today.

5 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

The stakes for next year’s expiring tax provisions are quite high. If Congress does nothing, then 62 percent of households will see their taxes go up in January of 2026.

Americans will spend more than 7.9 billion hours complying with IRS tax filing and reporting requirements in 2024. This is equal to 3.8 million full-time workers doing nothing but tax return paperwork—roughly equal to the population of Los Angeles.

7 min read

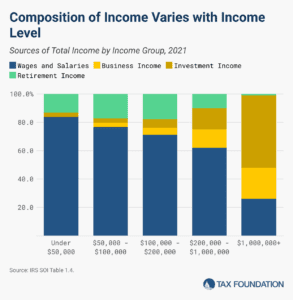

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

9 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

To make sound financial decisions and support better tax policy, taxpayers should understand the taxes they face. Unfortunately, most U.S. taxpayers do not know or are unsure of basic tax concepts.

6 min read

April means Tax Day, a yearly reminder that most people don’t like our tax code. As a recent Tax Foundation poll found, people don’t understand it either. With a looming tax battle on Capitol Hill, the need for tax policy education has never been higher.