Oregon’s Chance to Limit a Flaw in the Federal Tax Code

Senator Hass’s proposal to limit the special pass-through deduction in Oregon is the right choice, protecting the state’s budget, while advancing sound tax policy.

3 min read

Senator Hass’s proposal to limit the special pass-through deduction in Oregon is the right choice, protecting the state’s budget, while advancing sound tax policy.

3 min read

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

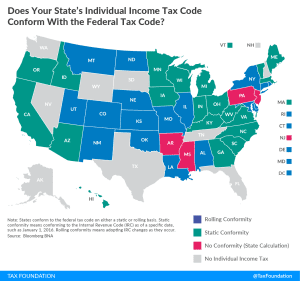

Oregon’s Legislative Revenue Office anticipates a $40 million revenue loss in fiscal year 2019, for one simple reason: absent legislative action to the contrary, Oregon will adopt the new pass-through deduction, while most other states will not.

For policymakers in most states, the fact that the pass-through deduction doesn’t affect AGI should come as a relief. For those in the six states which use federal taxable income as their starting point for conformity, decoupling from the provision is an entirely viable option.

2 min read

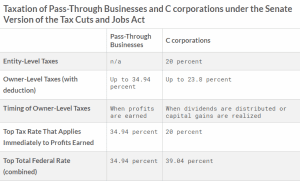

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

Even with large changes, many in the pass-through community are arguing that small pass-throughs don’t benefit since most or all of their taxable income falls below the 25 percent maximum rate. While correct on the small point, advocates miss the greater tax reform picture. Small pass-through businesses would still benefit from a number of other changes.

2 min read

Though admittedly complex, the pass-through anti-abuse rules in the Tax Cuts & Jobs Act represent a well-thought-out approach to dealing with this issue.

5 min read

Tax reform should aim to get the tax code out of the way of entrepreneurship by making it simpler, less burdensome, and eliminating its anti-growth biases.

Lawmakers interested in removing barriers to entrepreneurship should consider ways to mitigate 3 distortions in the U.S. tax code: the limited deductibility of business net operating losses, the limited deductibility of capital losses, and lengthy depreciation schedules.