All Related Articles

Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Which Provisions of the Tax Cuts and Jobs Act Should Be Made Permanent?

Lawmakers should use the year ahead to thoroughly review and debate lasting, fundamental tax reform and prioritize policies that best boost work and investment incentives in a fiscally responsible manner.

4 min read

State Tax Changes Taking Effect January 1, 2024

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Why Moore v. U.S. Won’t Get Us a Consumption Tax Base

At first glance, a ruling for the plaintiffs in Moore might seem to solve some of the timing problems with the U.S. tax system. Unfortunately, upon greater inspection, such a ruling might create new timing problems. And the more rigid the ruling, the harder it would be to fix the timing problems it would create.

5 min read

2024 Tax Brackets

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

Details and Analysis of Making the 2017 Tax Reforms Permanent

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

How the Moore Supreme Court Case Could Reshape Taxation of Unrealized Income

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

7 min read

A Tax Reform Plan for Growth and Opportunity: Details & Analysis

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

38 min read

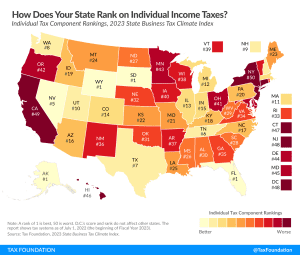

Ranking Individual Income Taxes on the 2023 State Business Tax Climate Index

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Details and Analysis of President Biden’s Fiscal Year 2024 Budget Proposal

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

Oklahoma Lawmakers’ Tax Reform Plan Would Put State in Top 10

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

Biden’s FY 2024 Budget Would Result in More Than $4.5 Trillion in Gross Tax Increases

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Taxing Distributed Profits Makes Business Taxation Simple and Efficient

Adopting a distributed profits tax would greatly simplify U.S. business taxes, reduce marginal tax rates on investment, and renew our country’s commitment to pro-growth tax policy.

6 min read

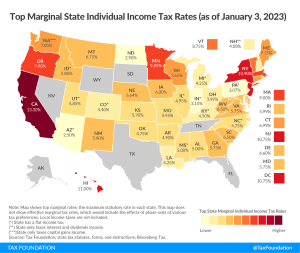

State Individual Income Tax Rates and Brackets, 2023

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

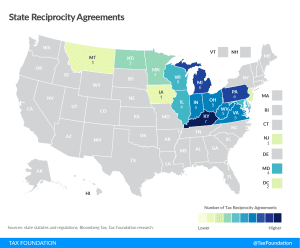

Do Unto Others: The Case for State Income Tax Reciprocity

Remote and flexible work opportunities are here to stay, whether states like it or not. With enhanced opportunities to take their job with them wherever they please, more workers can factor tax burdens into their decision of where to live.

15 min read

2023 Tax Brackets

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

Tax Hike Proposals Live on Despite Being Dropped in the Inflation Reduction Act

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

Massachusetts’ Graduated Income Tax Amendment Threatens the Commonwealth’s Economic Transformation

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read