All Related Articles

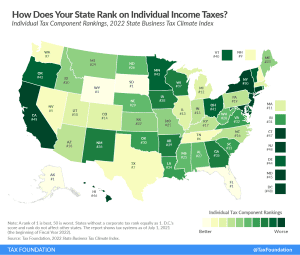

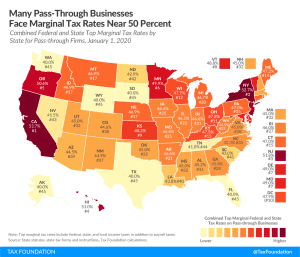

Top Tax Rate on Pass-through Business Income Would Exceed 50 Percent in Most States Under House Dems’ Plan

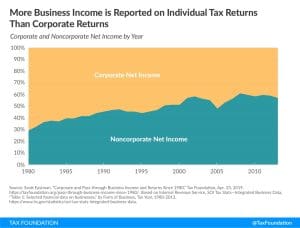

Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States.

3 min read

Analysis of Sen. Wyden’s Pass-through Deduction Proposal

Sen. Wyden recently introduced the Small Business Tax Fairness Act—the impact of which we modeled—to reform the Section 199A pass-through business deduction created in the Tax Cuts and Jobs Act (TCJA) of 2017. The provision currently allows taxpayers to deduct up to 20 percent of their qualified business income from their taxable income, subject to certain limitations.

2 min read

How Biden’s Tax Plans Could Negatively Impact Housing

While President Biden has many proposals aimed at increasing the supply of affordable housing, including tax credits, his plans to raise business taxes could hinder that goal.

4 min read

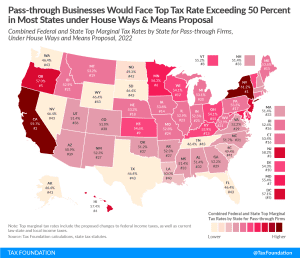

Does Your State Have a Marriage Penalty?

Fifteen states have a marriage penalty built into their bracket structure. Does your state have one?

2 min read

Biden Plan’s Higher Taxation of Businesses Would Boost Collections to Highest in 40-Plus Years

President Biden’s tax proposals released as part of his fiscal year 2022 budget would collect about $2 trillion in new tax revenue from businesses over 10 years. This new revenue would bring income tax collections on businesses as a portion of GDP to its highest level on a sustained basis in over 40 years.

2 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Tracking the 2021 Biden Tax Plan and Federal Tax Proposals

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

How Biden’s Corporate Tax Increases Could Make Tax Enforcement Harder

If Biden wants to reduce tax evasion, raising the corporate rate, increasing the incentives to engage in tax evasion, and creating a larger tax advantage to becoming a pass-through business is counterproductive.

3 min read

New Research Finds Limited Effects on Taxpayer Behavior from Pass-through Deduction

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

Portland Small Business Owners Facing Weirdly High New Taxes—and It Could Get Worse

Newly implemented county and regional taxes yield state and local top marginal tax rates in excess of 26 percent for many Portland small businesses, and if all of President Biden’s tax proposals were adopted, those owners could face all-in marginal rates of more than 80 percent, far and away the highest in the country going back decades.

5 min read

Reviewing Effective Tax Rates Faced by Corporate Income

Economists have proposed taxing corporate income more uniformly through corporate integration, which can be done in a variety of ways. Biden’s plan goes in the opposite direction by making worse the double taxation of corporate income.

5 min read

Taxing Times: One Virginia Brewer's Experience During COVID-19

We sat down with the owners of Black Narrows Brewing Company, a family-owned craft brewery situated in a small island-town on Virginia’s scenic Eastern Shore, to discuss the challenges they face as a small business during COVID-19 and what they would like to see legislators do to reduce short- and long-term barriers for entrepreneurs.

Tracking the 2020 Presidential Tax Plans

2 min read

Three-Fourths of New 2016 Investment Was Excluded from Improved Cost Recovery

New data sheds light on what share of new business investment was eligible for bonus depreciation as it existed before 2017 tax reform, and what share of new investment was excluded from improved cost recovery. This matters because the income tax is biased against investment in capital assets to the extent that it makes the investor wait years or decades to claim the cost of machines, equipment, or factories on their tax returns.

3 min read

Improving the Federal Tax System for Gig Economy Participants

Advances in technology have enabled workers to connect with customers via online platform applications for work ranging from ridesharing to home repair services. The rise of gig economy work has reduced barriers to self-employment, bringing tax challenges like tax complexity and taxpayer noncompliance.

32 min read

A Preliminary Look at 2018 Tax Data

Initial 2018 IRS tax return data shows that the TCJA expanded the use of several credits and deductions, made the standard deduction more favorable than itemizing, reduced tax refunds, and lowered taxes for most Americans.

4 min read