Taxes, Fiscal Policy, and Inflation

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

Consumer prices rose by 7 percent in 2021, the highest annual rate of inflation since 1982. Where did this inflation come from and what might its impacts be? Tax and fiscal policy offer important clues.

5 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

Inflation is often called a hidden tax, but in many states it yields a far more literal tax increase as tax brackets fail to adjust for changes in consumer purchasing power.

5 min read

How will the Inflation Reduction Act taxes impact inflation, economic growth, tax revenue, and everyday taxpayers? See Inflation Reduction Act tax changes.

12 min read

While exempting accelerated depreciation from the book minimum tax would reduce some of the economic harm of the tax, there remain many unresolved problems within the design and structure of the tax that make it a poorly chosen revenue option.

3 min read

In the rush to pass the Inflation Reduction Act, which features an ill-conceived tax on the book income of U.S. corporations, it is worth reminding policymakers of a well-established finding in the economic literature.

3 min read

The Inflation Reduction Act may be smaller than the proposed Build Back Better legislation from 2021, but both sets of legislation propose a reintroduced corporate alternative minimum tax (AMT). The 30-year experience with a corporate AMT shows it is not a good solution.

4 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. tax rules for large companies. However, as proposals have been debated in recent months, there are have been clear divides between U.S. proposals and the global minimum tax rules.

6 min read

The Inflation Reduction Act would raise taxes on corporations and top earners with the goal of funding a number of programs to reduce carbon emissions, address prescription drug costs, and spur the economy. Garrett Watson joins Jesse Solis to talk through what these tax changes would mean for the economy: Will they reduce inflation, and do they break the President’s pledge not to raise taxes on those earning less than $400,000?

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

43 min read

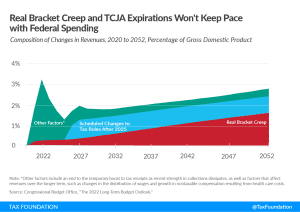

The latest CBO long-term budget outlook paints a troubling picture of fiscal irresponsibility. Rather than halt this rampant spending, Congress is actively adding programs that will exacerbate these long-term trends.

7 min read

Expediting income tax rate reductions and indexing major income tax provisions for inflation are two of the most important tax policy changes policymakers could make to provide meaningful tax relief to Hoosiers both now and in the years to come.

4 min read

Some 40 years ago, the U.S. dealt with high inflation and slow economic growth. Then as now, the solution is a long-term focus on stronger economic growth and sustainable federal budgets.

5 min read

Idaho Ballot initiative would impose an incredibly high top marginal rate that would fall on many small businesses, not just high-income earners.

7 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

The United States needs to grow its way out of inflation and set the economy up for continued growth—the tax code provides tools for policymakers to do just that.

3 min read

Amidst soaring inflation, policymakers across the political spectrum proposed many ideas to soften the blow of higher prices–especially for low-income workers and families. One idea that caught on quickly: sales tax relief on groceries. The idea had its merits, but Tax Foundation research shows that it may have missed the mark.

The CBO projections show policymakers’ top priority over the next five years will need to be cleaning up our country’s fiscal situation while maintaining a pro-growth and competitive tax code.

5 min read

If Sooner State policymakers want to use a portion of their higher revenues to make the economy work better for all Oklahomans, they should consider repealing the franchise tax, trimming the income tax, or both—paired, if desired, with targeted aid to those in the greatest need—not writing a single round of gimmicky checks.

5 min read

While the U.S. tariffs were intended to protect American industries, they have largely hurt the U.S. economy. Rather than pass on the tariffs to Chinese consumers, analysis shows that most U.S. firms simply bore the costs.

5 min read

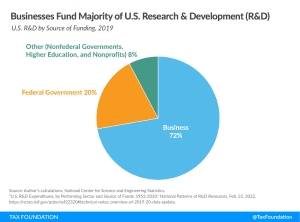

The ongoing economic uncertainty from the COVID-19 pandemic, supply chain disruptions, and current inflationary pressures have highlighted the importance of investment.

33 min read