Alabama Should Pursue Permanent, Not Piecemeal, Solutions to Federal Deductibility Issues

Alabama lawmakers are acting to ensure that federal relief from the American Rescue Plan Act does not increase tax liabilities in the state.

4 min read

Alabama lawmakers are acting to ensure that federal relief from the American Rescue Plan Act does not increase tax liabilities in the state.

4 min read

States will continue to cut taxes because revenues are skyrocketing. But some will also be keeping a close eye on litigation targeting this dubious restriction on states’ fiscal autonomy.

8 min read

Kentucky and Tennessee won an important legal victory Friday when a federal court ruled that the American Rescue Plan Act (ARPA)’s restrictions on state fiscal autonomy were unconstitutional and enjoined (blocked) the enforcement of those provisions against both states.

7 min read

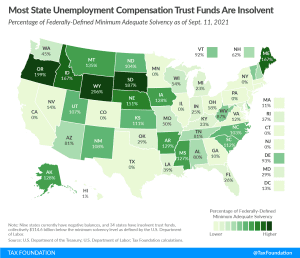

Given the restrictions on the use of federal relief funding, and the significantly higher tax burdens on employment that will result if trust funds are not replenished, applying federal aid to these trust funds should be an urgent priority.

11 min read

The Tax Foundation recently submitted regulatory comment on the U.S. Treasury’s state tax cuts limitation rule, highlighting three areas of concern and suggesting revisions to the rule.

Today, the U.S. Treasury issued an interim final rule on the $350 billion in State and Local Fiscal Recovery Funds provided under the American Rescue Plan Act (ARPA). The proposed rule resolves several important questions but continues to involve the federal government in state finances at an extraordinary level.

7 min read

Tax cut legislation is not just a red state phenomenon, and tax reductions come in many forms other than rate reductions. The American Rescue Plan Act’s state tax cuts limitation is a problem for more states than you think.

2 min read

The government of Hartford County, Connecticut is in line to receive $173 million in local aid under the American Rescue Plan Act (ARPA). There’s only one problem: the government of Hartford County doesn’t exist, nor do any of Connecticut’s other counties have county-level government despite being allocated a collective $691 million under the bill.

4 min read

The American Rescue Plan Act’s restriction on states’ Fiscal Recovery Funds being used to directly or indirectly offset a net tax cut is vague and raises difficult questions of interpretation and application. A broad interpretation of this prohibition may be unconstitutional.

19 min read

The major tax-related benefits in the $1.9 trillion economic relief plan are a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

6 min read

Senate amendments to the American Rescue Plan Act prohibit using any of the $350 billion in State and Local Fiscal Recovery Funds to cut taxes, but many are concerned that states which accept the funds could be prohibited from implementing tax cuts between now and 2024—an astonishing level of federal interference in states’ fiscal affairs.

8 min read

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min read

Improving trust fund solvency and staving off costly business tax increases is a win-win proposition for federal and state governments alike.

4 min read

President Biden’s plan builds on previous relief packages and would include larger payments to individuals, expanded relief for households and small businesses, funding for vaccine distribution, and aid to state and local governments.

7 min read

The $900 billion coronavirus relief package provides nearly $82 billion for the Education Stabilization Fund, $14 billion for mass transit, and $10 billion for state highways,

3 min read

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

With 2020 nearing its close, state unemployment compensation trust funds continue to struggle under the weight of so many pandemic-created beneficiaries, though some funds are beginning to stabilize as people increasingly return to work.

3 min read

Combined state and local tax collections were down only $7.6 billion across the period, representing a total state and local tax revenue decline of 0.7 percent compared to the first nine months of 2019.

6 min read

A bipartisan group of lawmakers released two compromise relief bills to address the COVID-19 pandemic, totaling about $908 billion: The Emergency Coronavirus Relief Act and the Bipartisan State and Local Support and Small Business Protection Act.

4 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read