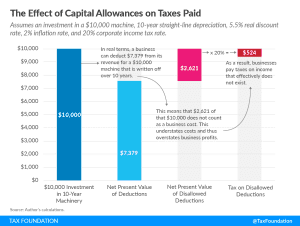

Illuminating the Hidden Costs of State Tax Incentives

In most states, tax incentives abound, usually offered as a way of promoting new investment or attracting certain industries by shielding them from the full impact of otherwise high tax rates.

6 min read