Proposal to Raise Vapor Taxes in Washington State Gets Base and Rate Wrong

Lawmakers in Washington need not revisit their vapor tax. The current tax is levied at an appropriate level and it has the right tax base.

3 min read

Lawmakers in Washington need not revisit their vapor tax. The current tax is levied at an appropriate level and it has the right tax base.

3 min read

A proposal to introduce a wholesale tax on vapor products in Alaska could make switching from combustible tobacco products very expensive for smokers.

4 min read

In an effort to raise roughly $100 billion, the House proposal would double cigarette taxes and increase all other tobacco and nicotine taxes to comparable rates—a strategy with severe unintended consequences.

5 min read

House Democrats’ newly released $3.5 trillion tax legislation includes a tax increase on tobacco, nicotine, and vapor products levied on tobacco manufacturers. But ultimately it would fall heavily on tobacco consumers—many of the group that earns less than $400,000 that President Biden pledged would not see a tax increase.

6 min read

Thirteen states have notable tax changes taking effect on July 1, 2021, which is the first day of fiscal year (FY) 2022 for every state except Alabama, Michigan, New York, and Texas. Individual and corporate income tax changes usually take effect at the beginning of the calendar year for the sake of maintaining policy consistency throughout the tax year, but sales and excise tax changes often correspond with the beginning of a fiscal year.

11 min read

Early signs indicate that flavors bans will not decrease tobacco consumption. It is not in the interest of the District of Columbia to pursue a public health measure that merely sends tax revenue to its neighboring jurisdictions without improving public health.

3 min read

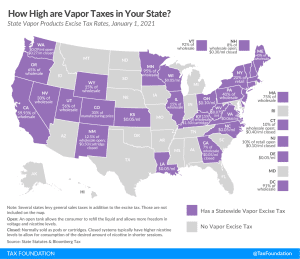

Several states are considering introducing or increasing taxes on vapor products to make up declining tax revenue from traditional tobacco products or to fill budget holes in the wake of the coronavirus pandemic. However, lawmakers should approach the issue carefully because flawed excise tax design on vapor products could drive consumers back to more harmful combustible products like cigarettes.

3 min read

In West Virginia, both Senate Republicans and Gov. Justice have offered proposals for reductions to the state’s income tax. In both of the proposals, excise taxes on tobacco and nicotine products are part of the pay-fors that are supposed to make up revenue lost due to lower income tax rates.

4 min read

The excise tax family is growing. Over the last decade, several products have become subject to excise taxes or are in the process of becoming so. Given this development, it is more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

77 min read

West Virginians would face extraordinarily high taxes on vapor products in state if Senate Bill 68 becomes law. The bill would increase taxes on liquid used in vapor products from 7.5 cents per milliliter (ml) to $1 per ml—an increase of over 1,300 percent.

3 min read

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

Washington state lawmakers have proposed a bill that would make it the second state to ban all flavored tobacco and the first to impose a nicotine cap on vapor products, and would increase taxes on vapor to among the highest in the nation.

5 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

Twenty-six states and the District of Columbia had notable tax changes take effect on January 1, 2021. Because most states’ legislative sessions were cut short in 2020 due to the COVID-19 pandemic, fewer tax changes were adopted in 2020 than in a typical year.

24 min read

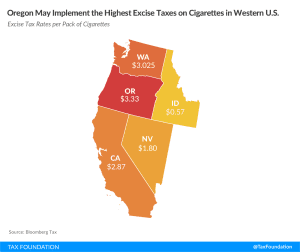

Oregon’s Measure 108 introduces a risk of increased tax avoidance and evasion activity as consumers of the products often procure cigarettes from lower tax jurisdictions. At $3.33 per pack, Oregon would have the highest excise tax on cigarettes in the region.

5 min read

Here are the state tax ballot measures to watch on Election Day 2020. Explore the most notable 2020 state tax ballot measures in 15 states.

4 min read

Nineteen states had notable tax changes take effect on July 1, 2020. Pandemic-shortened sessions contributed to less—and different—activity on the tax front than is seen in most years, and will likely yield an unusually active summer and autumn, with many legislatures considering new measures during special sessions.

12 min read

In line with the nationwide trend of taxing vapor products, the Michigan Senate has passed a new 18 percent tax on vapor products. These taxes are often intended to achieve a two-fold goal: deterring youth use and raising revenue. The Michigan bill is no exception.

4 min read