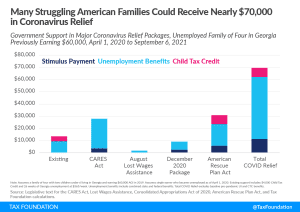

The American Rescue Plan Act Greatly Expands Benefits through the Tax Code in 2021

The major tax-related benefits in the $1.9 trillion economic relief plan are a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

6 min read