Tracking 2024 Presidential Tax Plans

Tax policy has become a significant focus of the U.S. 2024 presidential election. Our new interactive tool helps keep track of the tax policies proposed by presidential candidates during their campaigns.

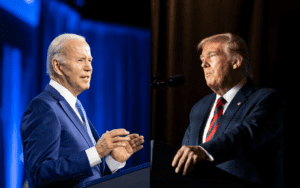

How do the 2024 presidential candidates, Vice President Kamala Harris and former President Donald Trump, compare on tax policy? Explore the latest details and analysis of Election 2024 tax proposals below.

Tax policy has become a significant focus of the U.S. 2024 presidential election. Our new interactive tool helps keep track of the tax policies proposed by presidential candidates during their campaigns.

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

A new analysis finds that the tax increase would reduce average wages by as much as $597 per US worker each year. In some states, the drop in wages would exceed $700 per worker.

4 min read

What do the contrasting tax proposals of Vice President Kamala Harris and former President Donald Trump mean for Americans as the 2024 election approaches?

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read

Exempting overtime would unnecessarily complicate the tax code, increase compliance and administrative costs, and reduce neutrality by favoring certain work arrangements over others.

5 min read

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

In her campaign for president, VP Kamala Harris has embraced all the tax increases President Biden proposed in the White House FY 2025 budget—including a new idea that would require taxpayers with net wealth above $100 million to pay a minimum tax on their unrealized capital gains from assets such as stocks, bonds, or privately held companies.

5 min read

Dive into the highlights from the DNC as we break down Vice President Kamala Harris’s tax proposals and their potential impact on everyday families. What do higher taxes on businesses and the wealthy mean for working Americans?

Depending on the 2024 US election, the current corporate tax rate of 21 percent could be in for a change. See the modeling here.

4 min read

Gov. Walz’s tax policy record is notable because of how much it contrasts with broader national trends. In recent years, most governors have championed tax cuts. Walz, rare among his peers, chose tax increases.

5 min read

If Vice President Kamala Harris is elected the 47th U.S. president, she would inherit a trade war started by former President Donald Trump and continued by President Joe Biden. But she’d also have the chance to end it.

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

“No tax on tips” might be a catchy idea on the campaign trail. But it could create plenty of headaches, from figuring out tips on previously untipped services to an unexpectedly large loss of federal revenue.

6 min read

A 15 percent corporate rate would be pro-growth, but it would not address the structural issues with today’s corporate tax base.

4 min read

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

Tariffs are a hot topic this election cycle for both President Biden and former President Trump. But why are tariffs so popular despite their economic downsides?