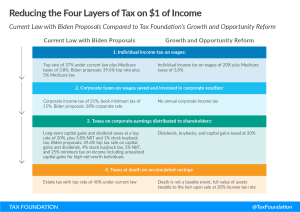

Three Corporate Tax Hikes That Would Undermine TCJA’s Improvements to Competitiveness

As lawmakers consider options for budgetary offsets, they should prioritize competitiveness and economic growth, as a heavier corporate tax burden will undermine the core purpose and achievement of the TCJA.

24 min read