FAQ: The One Big Beautiful Bill Act Tax Changes

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

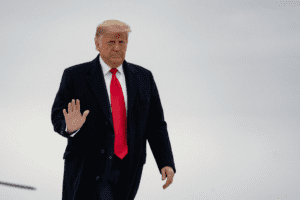

24 min readPresident Trump has proposed a number of tax proposals, including imposing a universal baseline tariff on all US imports, imposing a 60 percent tariff on all US imports from China, making the individual and estate tax cuts of the 2017 Tax Cuts and Jobs Act (TCJA) permanent, maintaining the 21 percent corporate income tax rate, and making all tip income tax-exempt. From analyzing the economic impact of US tariffs and retaliatory actions to the upcoming TCJA expirations, Tax Foundation experts continue to serve as trusted thought leaders, providing research, modeling, analysis, and commentary on how the Trump tax proposals would impact U.S. competitiveness, economic growth, government revenue, and everyday taxpayers. The posts below include our research and analysis on a variety of Trump tax proposals. You can also explore our economic modeling via Options for Reforming America’s Tax Code and our 10 Tax Reforms for Growth and Opportunity. See Trump’s latest trade actions with our Tariff Tracker and explore the latest tax developments and analysis our Budget Reconciliation Tracker.

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

We estimate Trump’s proposed tariffs and partial retaliation from all trading partners would together offset more than two-thirds of the long-run economic benefit of his proposed tax cuts.

12 min read

Exempting overtime would unnecessarily complicate the tax code, increase compliance and administrative costs, and reduce neutrality by favoring certain work arrangements over others.

5 min read

“No tax on tips” might be a catchy idea on the campaign trail. But it could create plenty of headaches, from figuring out tips on previously untipped services to an unexpectedly large loss of federal revenue.

6 min read

Using tariff policy to reallocate investment and jobs is a costly mistake—that’s a history lesson we should not forget.

6 min read

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

Given the poor state of the budget process and worsening debt trajectory, lawmakers should move boldly and quickly to address the issue, including via a fiscal commission process. Issues to consider should include reforms to both spending and taxes.

42 min read

Our experts explain how this major tax legislation may affect you and how policymakers can better improve the tax code.

24 min read

Several major new tax breaks are scheduled to expire at the end of 2028, setting the stage for another tax fight to either extend them or allow them to expire.

5 min read

If the federal government really wanted to make saving more accessible for taxpayers, it would swap the proposal for Trump Accounts to replace the complicated mess of savings accounts currently available with universal savings accounts.

5 min read

Our analysis finds that the Trump tariffs threaten to offset much of the economic benefits of the new tax cuts, while falling short of paying for them.

3 min read

The tariffs amount to an average tax increase of nearly $1,300 per US household in 2025.

38 min read

The One Big Beautiful Bill Act makes many of the individual tax cuts and reforms of the TCJA permanent. It improves upon the TCJA by making expensing for R&D and equipment permanent. However, for the most part, it does not include further structural reforms, and instead introduces many new, narrow tax breaks to the code, adding complexity and raising revenue costs.

7 min read

We estimate the One Big Beautiful Bill Act would increase long-run GDP by 1.2 percent and reduce federal tax revenue by $5 trillion over the next decade on a conventional basis.

11 min read

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025.

16 min read

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

Lawmakers should consider maintaining QBAI and applying the several billion dollars from the Senate’s change toward other pro-growth international tax reforms instead.

6 min read