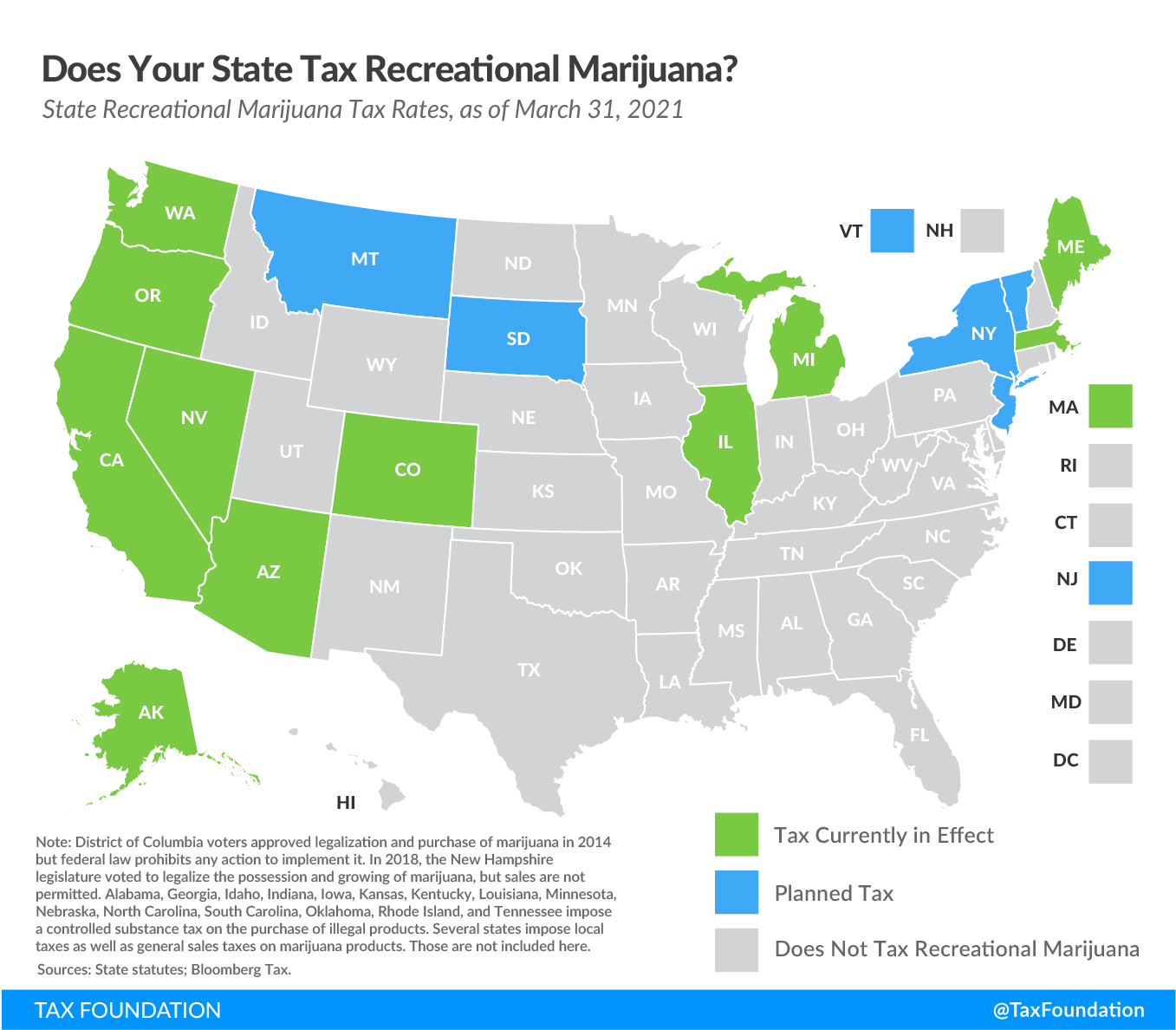

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation. Currently, 16 states (Alaska, Arizona, California, Colorado, Illinois, Maine, Massachusetts, Michigan, Montana, Nevada, New Jersey, New York, Oregon, South Dakota, Vermont, and Washington) and the District of Columbia have passed bills or approved ballot measures that allow for the sale of recreational marijuana, and more states are poised to pass legislation this session. In total, actual recreational marijuana sales are happening in 11 states.

The Virginia legislature now has passed a bill that would legalize sales starting in 2024; legislators are currently working with Gov. Ralph Northam (D) to amend and finalize legislation. New Mexico lawmakers are very likely to pass legislation during an ongoing special session.

Voters in four states approved ballot measures in November, but only one state (Arizona) has established an operational marketplace. Vermont, which passed legalization back in 2018, has finally approved legislation, and the state plans to be operational starting in 2022. Recreational sales are delayed due to pending legal action in South Dakota and federal prohibition in the District of Columbia, although change is on the horizon in DC.

The unique legal framework under which marijuana use and sales operate—that of differing state and federal legality—means that every state market is essentially a siloed market. Marijuana products cannot cross state borders, so the entire process (seed to smoke, so to speak) must occur within state borders. This unusual situation, along with the novelty of legalization, has resulted in a wide variety of taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. designs.

The following map highlights the states that have legal markets and levy taxes on recreational marijuana.

| As of March 31, 2021 | |

|---|---|

| State | Tax Rate |

| Alaska | $50/oz. mature flowers; $25/oz. immature flowers; $15/oz. trim, $1 per clone |

| Ariz. | 16% excise tax (retail price) |

| Calif. | 15% excise tax (levied on wholesale at average market rate); $9.65/oz. flowers & $2.87/oz. leaves cultivation tax; $1.35/oz fresh cannabis plant |

| Colo. | 15% excise tax (levied on wholesale at average market rate); 15% excise tax (retail price) |

| Ill. | 7% excise tax of value at wholesale level; 10% tax on cannabis flower or products with less than 35% THC; 20% tax on products infused with cannabis, such as edible products; 25% tax on any product with a THC concentration higher than 35% |

| Maine | 10% excise tax (retail price), $335/lb. flower; $94/lb. trim; $1.5 per immature plant or seedling; $0.3 per seed |

| Mass. | 10.75% excise tax (retail price) |

| Mich. | 10% excise tax (retail price) |

| Mont. (a) | 20% excise tax (retail price) |

| Nev. | 15% excise tax (fair market value at wholesale); 10% excise tax (retail price) |

| N.J. (a, b) | Up to $10 per ounce, if the average retail price of an ounce of usable cannabis was $350 or more; up to $30 per ounce, if the average retail price of an ounce of usable cannabis was less than $350 but at least $250; up to $40 per ounce, if the average retail price of an ounce of usable cannabis was less than $250 but at least $200; up to $60 per ounce, if the average retail price of an ounce of usable cannabis was less than $200 |

| N.Y. (a, c) | $0.005 per milligram of THC in flower $0.008 per milligram of THC in concentrates $0.03 per milligram of THC in edibles 9% excise tax (retail price) |

| Ore. | 17% excise tax (retail price) |

| S.D. (a) | 15% excise tax (retail price) |

| Vt. (a) | 14% excise tax (retail price) |

| Wash. | 37% excise tax (retail price) |

|

(a) As of March 2021, retail sale of recreational marijuana has not yet started. (b) Rates were determined as of February 22, 2021. (c) Rates were determined as of March 30, 2021. Note: District of Columbia voters approved legalization and purchase of marijuana in 2014 but federal law prohibits any action to implement it. In 2018, the New Hampshire legislature voted to legalize the possession and growing of marijuana, but sales are not permitted. Alabama, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Minnesota, Nebraska, North Carolina, South Carolina, Oklahoma, Rhode Island, and Tennessee impose a controlled substance tax on the purchase of illegal products. Several states impose local taxes as well as general sales taxes on marijuana products. Those are not included here. Sources: State statutes; Bloomberg Tax. |

|

The multitude of approaches makes any apples-to-apples comparison of rates difficult, but Washington state has the highest statewide retail-level excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. , at 37 percent. New York, the most recent addition, is the first state to implement a potency-based tax by milligrams of THC.

As the table indicates, most states have applied a price-based (ad valorem) tax on retail sales of recreational marijuana. Levying the tax on retail sales allows for simplicity because there is a taxable event with a transaction, allowing for simple valuation. Although ad valorem taxation is simple, it is neither neutral nor equitable. In order to tax marijuana efficiently, the tax should be levied at a rate that corresponds to the societal costs, called externalities, associated with the product. These externalities share no association with the price.

A profitable new industry to tax is understandably enticing to many lawmakers, but an excise tax on recreational marijuana should be based on the following principles:

- Tax rates should be low enough to allow legal markets to undercut, or at least gain price parity with, the illicit market;

- Taxes should be designed to offer stable revenue in the short term regardless of potential price declines; and

- Taxes should raise enough revenue to fund marijuana-related spending priorities and cover the societal cost related to consumption.

A tax system following these principles would be based on weight or potency, have relatively low rates, and allocate revenue to offset societal costs associated with recreational marijuana consumption.

Of the states that have passed legislation, all but Alaska, Colorado, Maine, Montana, and Oregon levy the general sales tax on marijuana sales in addition to excise taxes. Alaska, Montana, and Oregon do not levy a statewide general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. in the first place, and Maine and Colorado levy retail-level excise taxes in lieu of, and with higher rates, than their general rates.

One of the great challenges with tax design for recreational marijuana is the amount of product types available on the market. Today, consumers can purchase THC-containing products in many different shapes and forms. Anything from traditional pre-rolled joints and brownies to THC-containing sparkling water and the yet unknown products to come. Any tax system should either be nimble enough or updated frequently enough to capture new products as they enter the market.

There are still many unknowns when it comes to the taxation of recreational marijuana, but as more states open legal marketplaces and more research is done to understand the externalities of consumption, more data will be available.

For more discussion on the trade-offs of marijuana tax structures and general excise tax design, see our recent report.

Share this article