As the public grows more supportive of recreational marijuana, states deciding to legalize it must figure out their approach toward taxing cannabis sales.

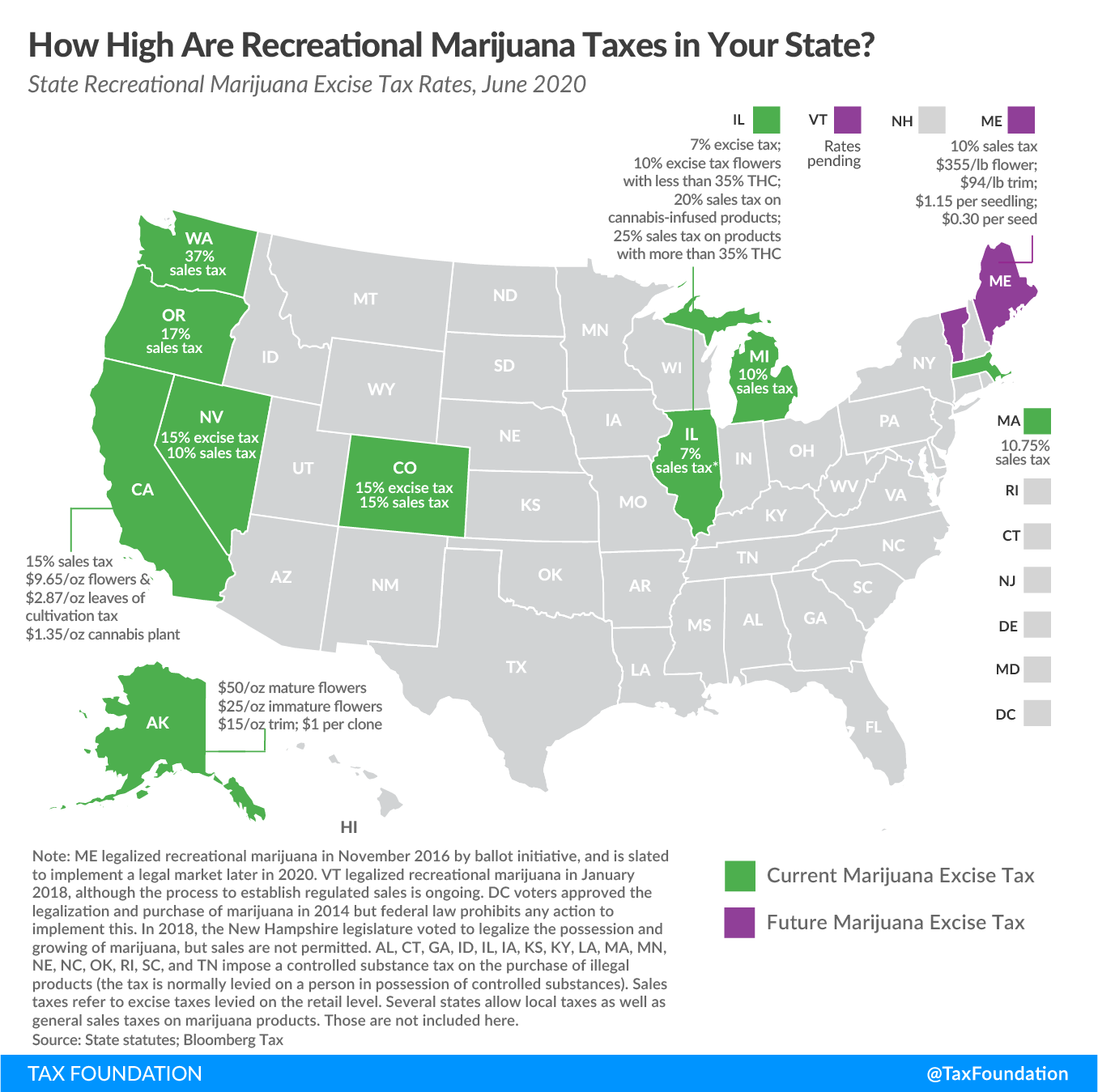

Eleven states (Alaska, California, Colorado, Illinois, Maine, Michigan, Massachusetts, Nevada, Oregon, Vermont, and Washington) and the District of Columbia have legalized the use and possession of recreational marijuana, but only nine of these jurisdictions have established legal markets for the substance.

Maine legalized recreational marijuana in 2016 and plans to implement a legal market later this year. Similarly, Vermont legalized the substance in early 2018, although the state is still in the process of setting up a legal market and taxing regime. D.C. also allows for the possession and cultivation of marijuana but the District’s relationship with the federal government prohibits the city to spend any funds on establishing a legal market.

The map below highlights the states that have legal markets and levy taxes on recreational marijuana.

As the map suggests, states have chosen many different methods for taxing marijuana. The multitude of approaches makes any apples-to-apples comparison of rates difficult.

Of the states with legal markets, all but Alaska, Oregon, and Colorado levy the general sales tax on marijuana sales in addition to excise taxes. Alaska and Oregon do not levy a statewide general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. in the first place, and Colorado levies a 15 percent special sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. in place of its general rate. In each of the other states, marijuana purchasers are facing another kind of high: taxes on marijuana sales which far exceed the states’ general sales taxes. Washington has the highest statewide retail-level excise tax, at 37 percent.

While states differ widely in practice, there are several basic guidelines they should follow when structuring excise taxes on recreational marijuana. These taxes should be levied to target the externalities, not as a general fund revenue tool. When designing excise taxes for recreational marijuana policymakers must balance significant trade-offs: High taxes might limit adoption by minors and non-users but hurt the legal market’s ability to compete with illicit products. Low tax rates better allow conversion from the illicit market but could encourage consumption by minors and non-users. Taxes based on price, weight, and potency all have their own trade-offs, although a potency- and weight-based tax on THC levels may be the best short-term option.

For more discussion on the trade-offs of marijuana tax structures, see our recent report.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe