Key Findings:

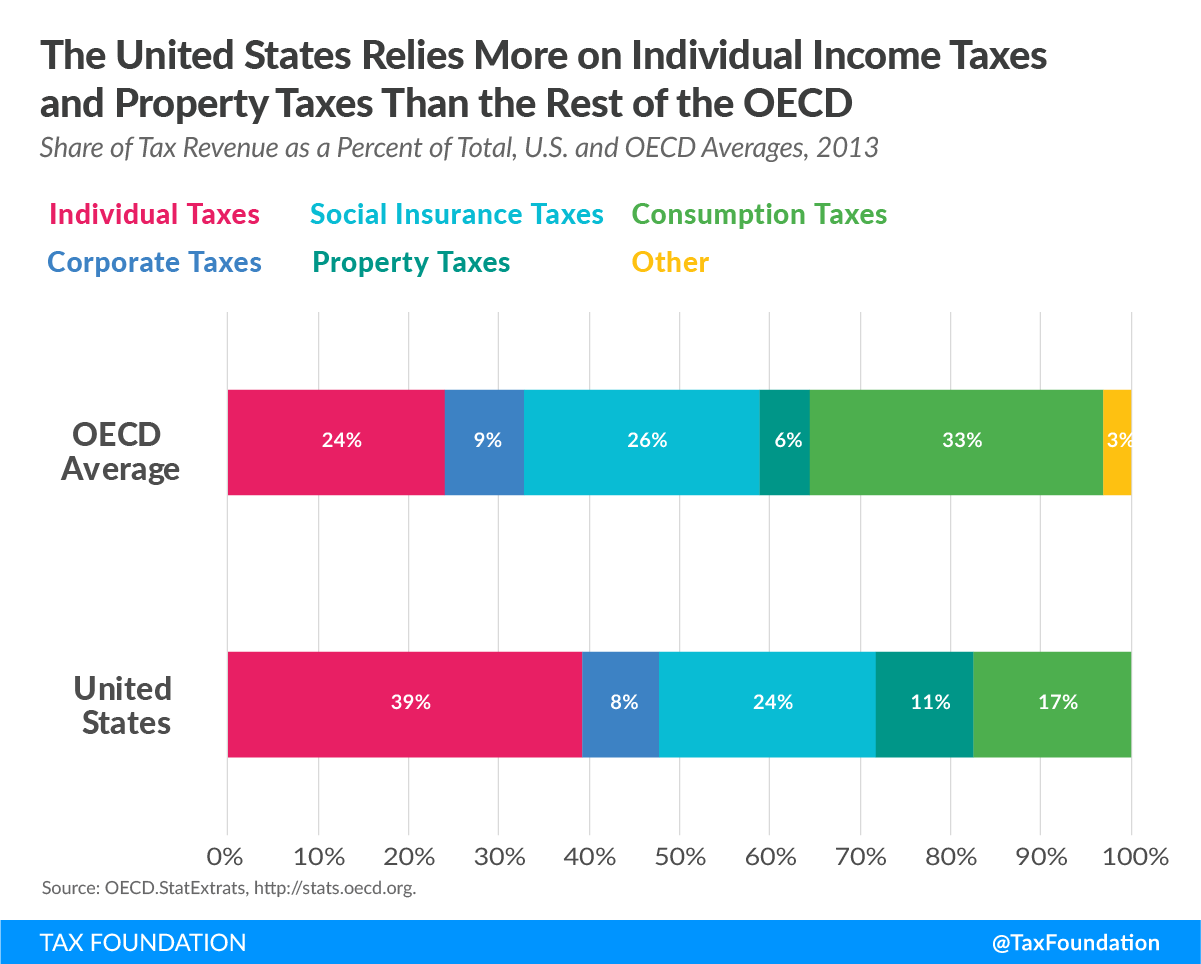

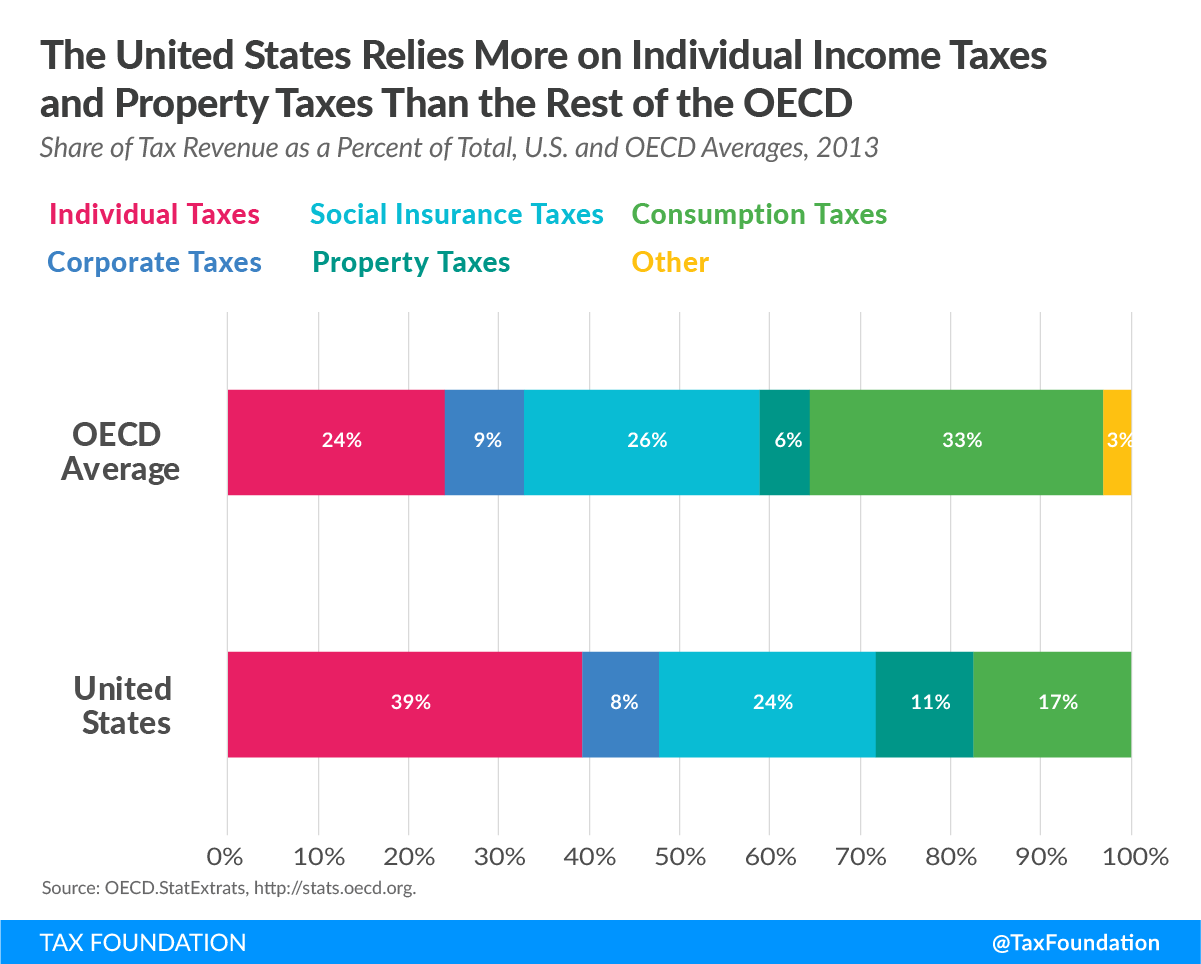

- OECD countries rely heavily on consumption taxes, such as the value-added taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , and social insurance taxes, such as the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. .

- The United States relies heavily on the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , at 39.3 percent of total government tax revenue.

- On average, OECD countries collect little from the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. (8.8 percent of total tax revenue).

Developed countries raise tax revenue through a mix of individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes. However, the extent to which an individual country relies on any of these taxes can differ substantially.

A country may decide to have a lower corporate income tax to attract investment, which may reduce its reliance on the corporate income tax revenue and increase its reliance on other taxes, such as social insurance taxes or consumption taxes. For example, Estonia raises only 5.3 percent of total revenue from corporate income taxes, but makes it up by raising a combined 75.8 percent of total revenue from social insurance taxes and consumption taxes.

Countries may also be situated near natural resources that allow them to rely heavily on taxes on related economic activity. Norway, for example, has a substantial oil production industry on which it levies a high (78 percent) income tax and thus raises a significant amount of corporate income tax revenue.[1]

These policy and economic differences among Organisation for Economic Co-operation and Development (OECD) countries have created differences in how they raise tax revenue.

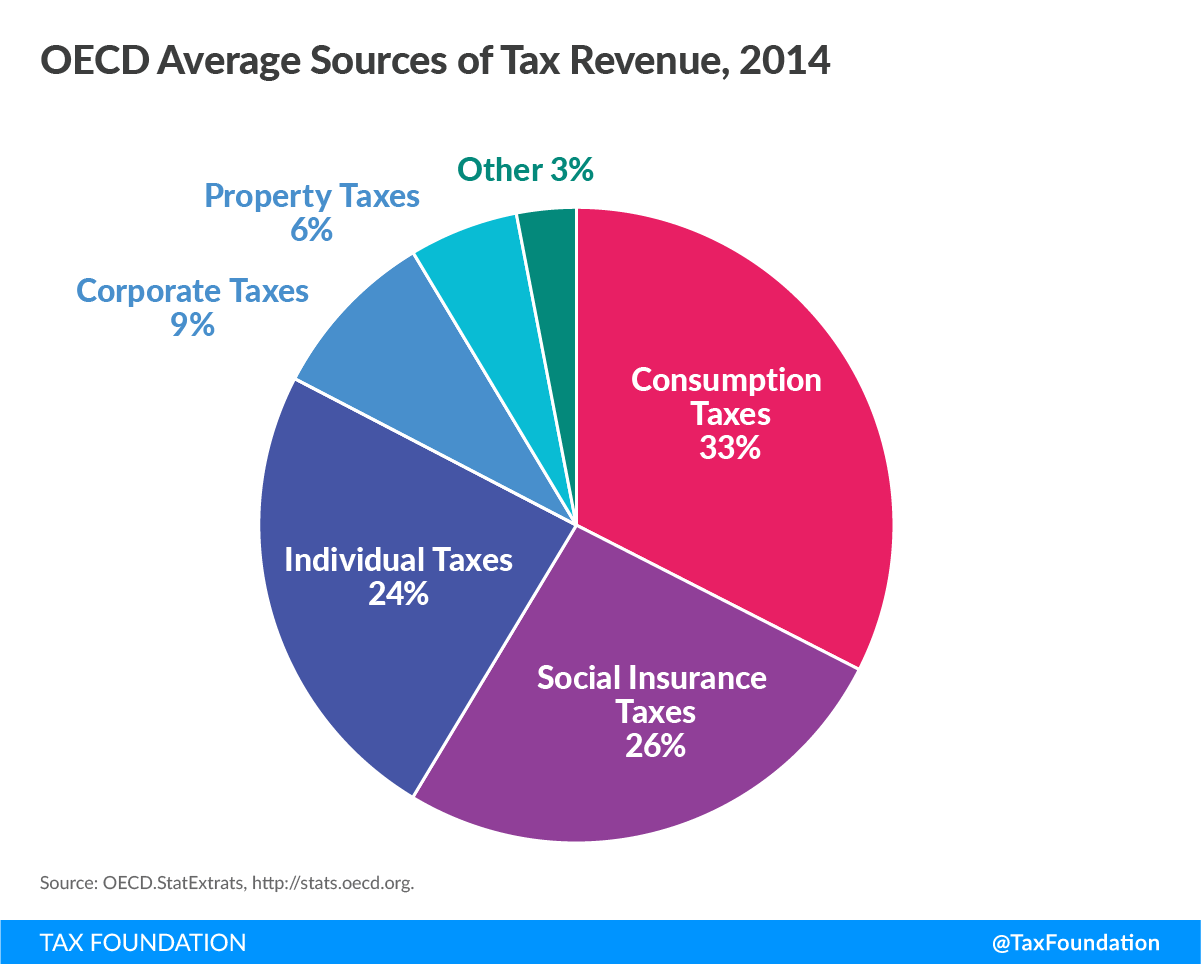

Per the most recent data from the OECD (2014), consumption taxes were the largest source of tax revenue for OECD countries.[2] On average, countries raised approximately 32.6 percent of their tax revenue from consumption taxes. This is unsurprising given that all OECD countries (except the United States) levy value-added taxes at relatively high rates.

The next significant source of tax revenue is social insurance taxes. OECD countries raised approximately 26.2 percent of total revenue from social insurance taxes.

Individual income taxes accounted for 24.0 percent of total revenue across the OECD. Corporate income taxes accounted for only 8.8 percent of total revenue. Of the main categories, property taxes raised the least across the OECD, accounting for only 5.6 percent of total revenue.

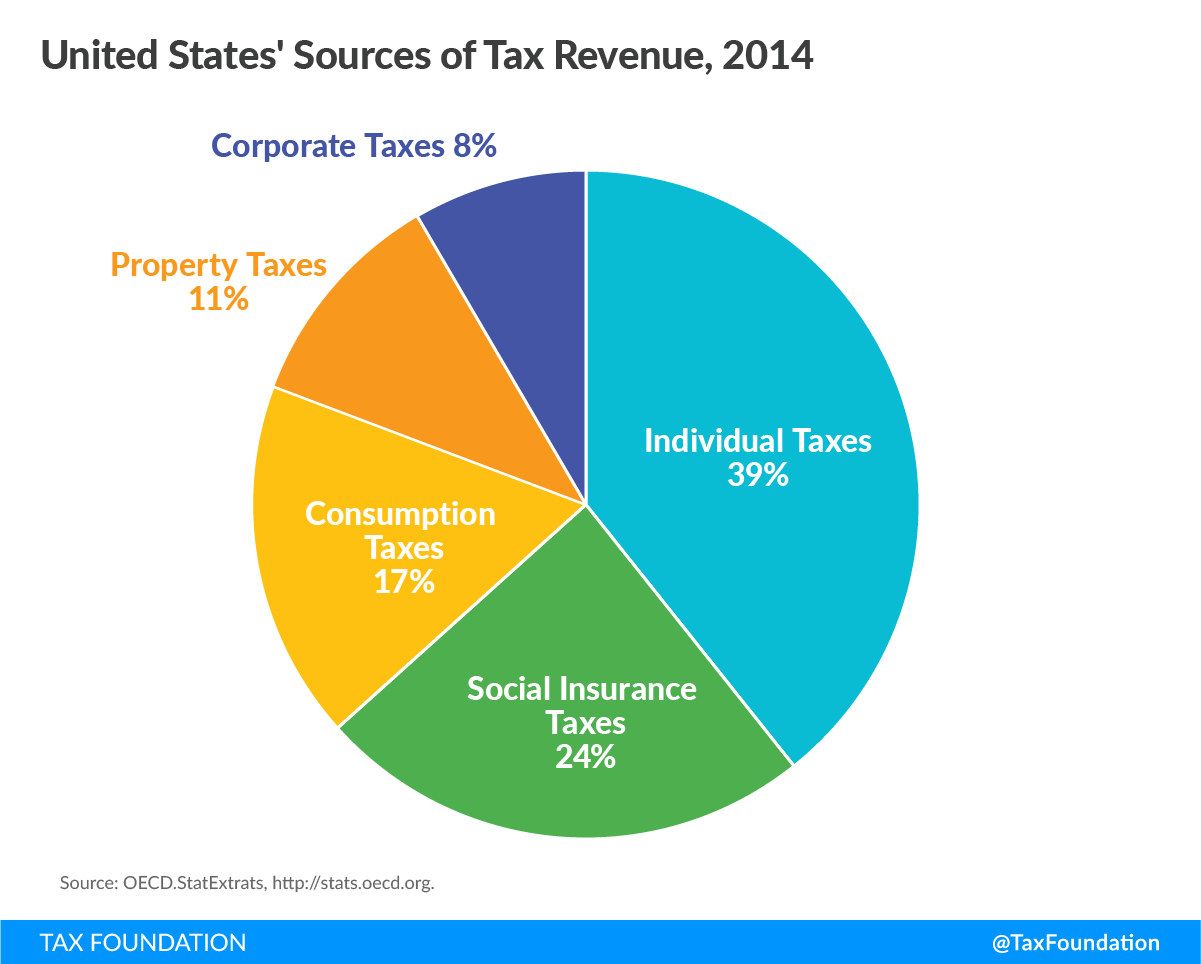

In 2014, the United States relied the most on individual income taxes. According to OECD data, the United States (federal, state, and local combined) raised approximately 39.3 percent of all tax revenue from individual income taxes (compared to the 24.0 percent among all OECD countries).

Social insurance taxes made up the second largest source of government revenue in the United States (24.1 percent of total).

The United States relied much less on taxes on goods and services than other OECD countries. In 2014, the United States raised 17.4 percent of its total tax revenue from taxes on goods and services (consumption taxes), compared to 32.6 percent among OECD countries.

The smallest source of tax revenue for the United States was the corporate income tax. Federal, state, and local governments collected 8.4 percent of their total tax revenue from corporate income taxes in 2014.

Taxes on Goods and Services

Consumption taxes are taxes on goods and services. These are in the form of excise taxes, value-added taxes, or retail sales taxes. Most OECD countries levy consumption taxes through value-added taxes and excise taxes. The United States is the only country in the OECD with no value-added tax. Instead, most state governments apply a retail sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. on the final sale of most products and excise taxes on the production of goods such as cigarettes and alcohol.

In 2014, Chile relied the most on taxes on goods and services, raising approximately 55.3 percent of its total tax revenue from these taxes. Chile was followed by Turkey (44.1 percent) and Hungary (44.0 percent). (Table 1, below.)

The United States raised the least amount of tax revenue in the OECD from consumption taxes, as a share of total revenue, at 17.4 percent in 2014. Japan raised slightly more, at 19.8 percent, followed by Switzerland, at 22.4 percent.

Social Insurance Taxes

Social insurance taxes are typically levied in order to fund specific programs such as unemployment insurance, health insurance, and old age insurance. In most countries, these taxes are applied to both an individual’s wages and an employer’s payroll. For example, the United States levies social insurance taxes at both the state and federal level in order to fund programs such as Social Security, Medicare, and Unemployment Insurance.

The Czech Republic relied the most on social insurance taxes (43.8 percent of total revenue) followed by the Slovak Republic (42.9 percent), and Japan (39.7 percent). (Table 1, below.)

Denmark raised the least, at 0.1 percent. Australia and New Zealand are the only countries that do not levy specific social insurance taxes on workers to fund government programs.

Individual Income Taxes

Income taxes are levied directly on an individual’s income, beginning with wage income. Many nations, such as the United States, also levy their individual income tax on investment income such as capital gains, dividends, interest, and business income. These taxes are typically levied in a progressive manner, meaning that an individual’s average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. increases as income increases. The country with the highest reliance on individual income taxes in 2014 was Denmark (54.0 percent), followed by Australia (41.0 percent). (Table 1, below.)

Chile (7.3 percent) and the Slovak Republic (9.6 percent) raised the least amount of revenue from individual income taxes.

Corporate Income Taxes

The corporate income tax is a direct taxA direct tax is levied on individuals and organizations and cannot be shifted to another payer. Often with a direct tax, such as the personal income tax, tax rates increase as the taxpayer’s ability to pay increases, resulting in what’s called a progressive tax. on corporate profits. All OECD countries levy a tax on corporate profits. However, many countries differ substantially in how they define taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. and the rate at which they apply the tax. Generally, the corporate income tax raises little revenue compared to other sources. Chile relied the most on its corporate income tax, at 21.3 percent of total tax revenue. Norway (17.1 percent), Mexico (16.9 percent), and Australia (16.8 percent) also relied heavily on their corporate income tax compared to the OECD average of 8.8 percent. (Table 1, below.)

In 2014, Hungary (3.8 percent), Slovenia (3.9 percent), and Finland (4.4 percent) relied the least on the corporate income tax.

Property Taxes

A much smaller source of tax revenue for most OECD countries is the property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. . The property tax is levied on the value of an individual’s or business’ property. In the United States, property taxes are most typically levied on real estate, cars, and other personal property by state and local governments. Other types of property taxes include estate, gift, and inheritance taxes, and net wealth taxes. The United Kingdom relied the most on property taxes in the OECD (12.7 percent), followed by the Canada (11.7 percent), Korea (11.0 percent), and the United States (10.8 percent). (Table 1, below.)

Estonia relied the least on property taxes, raising only 0.9 percent of total revenue. The Czech Republic (1.3 percent), the Slovak Republic (1.4 percent), and Austria (1.4 percent) also relied very little on property taxes.

Conclusion

In general, developed nations lean more on tax revenue from social insurance taxes and consumption taxes. The United States, in contrast, relies more on individual income taxes, while raising relatively little from consumption taxes. This policy difference matters, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

| Source: OECD.StatExtrats, http://stats.oecd.org | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Individual Income Taxes | Corporate Income Taxes | Social Insurance Taxes | Property Taxes | Consumption Taxes | Other | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Australia | 41.0% | 16.8% | 0.0% | 10.1% | 26.9% | 5.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Austria | 23.6% | 5.0% | 34.2% | 1.4% | 27.3% | 8.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Belgium | 28.6% | 7.2% | 31.6% | 7.9% | 23.9% | 0.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Canada | 36.3% | 10.5% | 15.1% | 11.7% | 23.0% | 3.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Chile | 7.3% | 21.3% | 7.2% | 4.2% | 55.3% | 4.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Czech Republic | 10.8% | 10.6% | 43.8% | 1.3% | 32.9% | 0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Denmark | 54.0% | 5.3% | 0.1% | 3.7% | 30.2% | 6.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Estonia | 17.5% | 5.3% | 33.6% | 0.9% | 42.1% | 0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Finland | 30.6% | 4.4% | 28.9% | 3.0% | 32.8% | 0.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| France | 18.7% | 5.1% | 37.4% | 8.5% | 24.1% | 6.1% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Germany | 26.3% | 4.8% | 38.1% | 2.6% | 27.7% | 0.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Greece | 16.4% | 5.3% | 28.7% | 4.0% | 43.4% | 2.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Hungary | 13.9% | 3.8% | 32.7% | 3.4% | 44.0% | 2.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Iceland | 34.9% | 8.6% | 9.5% | 6.4% | 31.0% | 9.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ireland | 32.0% | 8.3% | 17.3% | 7.7% | 33.6% | 1.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Israel | 18.6% | 10.2% | 16.4% | 9.5% | 39.4% | 5.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Italy | 25.9% | 5.0% | 29.8% | 6.6% | 27.0% | 5.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Japan | 18.9% | 12.9% | 39.7% | 8.5% | 19.8% | 0.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Korea | 16.3% | 12.8% | 26.9% | 11.0% | 30.0% | 3.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Latvia | 20.5% | 5.3% | 29.1% | 3.6% | 40.9% | 0.6% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Luxembourg | 23.2% | 11.4% | 28.7% | 7.8% | 28.8% | 0.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Mexico | 19.7% | 16.9% | 20.6% | 2.1% | 35.8% | 4.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands | 18.7% | 6.9% | 39.6% | 3.9% | 29.6% | 1.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Zealand | 38.6% | 13.2% | 0.0% | 6.2% | 38.4% | 3.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Norway | 25.4% | 17.1% | 25.7% | 3.1% | 28.7% | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Poland | 14.3% | 5.4% | 38.1% | 4.4% | 36.1% | 1.8% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portugal | 22.5% | 8.3% | 26.2% | 3.6% | 38.2% | 1.2% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Slovak Republic | 9.6% | 10.6% | 42.9% | 1.4% | 34.2% | 1.3% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Slovenia | 14.0% | 3.9% | 39.4% | 1.7% | 40.4% | 0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Spain | 22.3% | 6.1% | 34.4% | 7.0% | 28.5% | 1.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sweden | 28.6% | 6.3% | 23.2% | 2.5% | 28.4% | 11.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Switzerland | 31.0% | 10.4% | 24.9% | 6.6% | 22.4% | 4.7% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Turkey | 14.7% | 6.4% | 28.5% | 4.9% | 44.1% | 1.4% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United Kingdom | 27.4% | 7.5% | 18.7% | 12.7% | 33.2% | 0.5% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| United States | 39.3% | 8.4% | 24.1% | 10.8% | 17.4% | 0.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| OECD – Average | 24.0% | 8.8% | 26.2% | 5.6% | 32.6% | 3.0% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

[1] Ernst and Young, “2017 Global Oil and Gas TaxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

Guide, Norway,” 2017. http://www.ey.com/gl/en/services/tax/global-oil-and-gas-tax-guide—xmlqs?preview&XmlUrl=/ec1mages/taxguides/GOG-2017/GOG-NO.xml

[2] OECD, “OECD.StatExtracts, OECD 2016.” http://stats.oecd.org/

Share