From Gallons to Miles: Rethinking Road Taxes

Buckle up as we navigate the twists and turns of infrastructure and road funding. As electric vehicles gain traction, traditional gas taxes are running out of fuel to support our infrastructure budget.

Buckle up as we navigate the twists and turns of infrastructure and road funding. As electric vehicles gain traction, traditional gas taxes are running out of fuel to support our infrastructure budget.

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

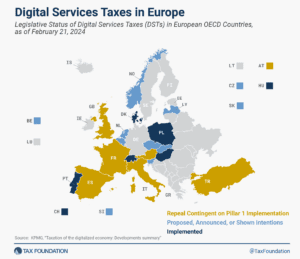

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

Though the TCJA’s expiration poses a threat to the U.S. economy and people’s pocketbooks, it gives lawmakers an opportunity to rewrite the tax code. But if Congress is to build on the successes, and learn from the failures, of the TCJA, it must understand the reform’s effects.

Two bills in Georgia will lower the flat individual income tax rate and align the corporate income tax rate with the individual income tax rate.

4 min read

The outcome of the digital tax debate will likely shape domestic and international taxation for decades to come. Designing these policies based on sound principles will be essential in ensuring they can withstand challenges arising in the rapidly changing economic and technological environment of the 21st century.

58 min read

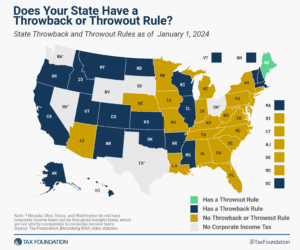

States have generally tried to encourage capital investment. Throwback and throwout rules are an unfortunate example of penalizing it.

4 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

Trump’s protectionist measures and the continuation of most of them under the Biden administration already form the matrix of American trade policy after the 2024 elections.