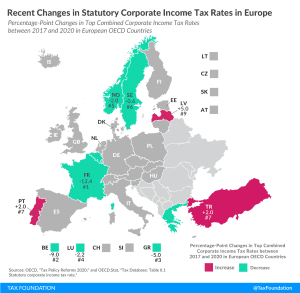

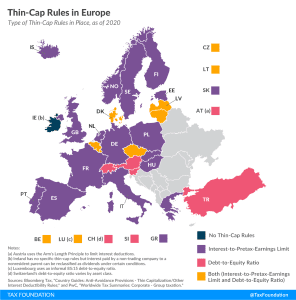

Recent Changes in Statutory Corporate Income Tax Rates in Europe

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read