Taxes and the American Revolution

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

The increased senior deduction with the phaseout would deliver a larger tax cut to lower-middle- and middle-income taxpayers compared to exempting all Social Security benefits from income taxation and would not weaken the trust funds as much. But given the temporary nature of the policy, it would increase the deficit-impact of the reconciliation bills without boosting long-run economic growth.

3 min read

Lawmakers are right to be concerned about deficits and economic growth. The best path to address those concerns is to ensure OBBB provides permanent full expensing of capital investment, avoids inefficient tax cuts, and offsets remaining revenue losses by closing tax loopholes and reducing spending.

8 min read

Expanding and updating the US tax treaty network—both by forging new agreements and modernizing existing ones—is vital to maintaining the country’s competitiveness in a rapidly evolving global tax landscape.

4 min read

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our preliminary analysis of the Senate Finance tax plan finds the major tax provisions would increase long-run GDP by 1.1 percent and reduce federal tax revenue by $4.7 trillion over the next decade.

9 min read

If Michiganders are interested in increasing the state’s spending on education or other priorities—and believe that current revenues are insufficient to support such an increase—there are several ways to do so without significantly affecting residents’ incentives to live and work in Michigan.

4 min read

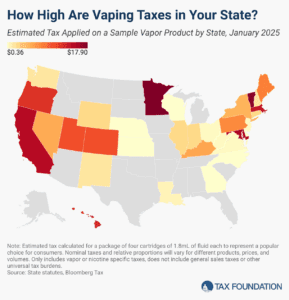

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

The Senate draft overall makes more changes to international tax policy than the House draft. On net the changes are positive.

8 min read