Tax Subsidies for R&D Spending and Patent Boxes in OECD Countries

Despite the coronavirus pandemic’s immense health and economic challenges, the crisis has also revealed the incredible value of innovation.

32 min read

Despite the coronavirus pandemic’s immense health and economic challenges, the crisis has also revealed the incredible value of innovation.

32 min read

The excise tax family is growing. Over the last decade, several products have become subject to excise taxes or are in the process of becoming so. Given this development, it is more crucial than ever that lawmakers, businesses, and consumers understand the possibilities and, more importantly, limitations of excise tax application.

77 min read

Mississippi has an opportunity to become the 10th state without an individual income tax and to do so with sales tax rates which, while certainly high, are in line with regional competitors. For such a momentous undertaking, however, policymakers should be equipped with reliable revenue projections and a detailed accounting of how much revenue is projected to come from each offsetting change. A change worth doing is worth doing right.

15 min read

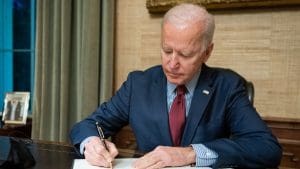

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

46 min read

The Biden campaign and Senate Democrats identified changes to GILTI that would increase the taxes U.S. companies pay on their foreign earnings. Rather than tacking on changes to a system that is currently neither fully territorial nor worldwide, policymakers should evaluate the structure of the current system with a goal of it becoming more, not less, coherent.

51 min read

In addition to its economic impact on Maryland businesses and the likelihood of serious legal challenges, Maryland’s proposed digital advertising tax is incredibly vague on vital definitions, creating uncertainty about where revenue is sourced and when it is subject to the tax.

17 min read

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

We identify 13 of the highest tax reform priorities Nebraska policymakers should consider in their effort to create a more growth-friendly tax code. We also offer a sample comprehensive tax reform plan to show one way policymakers could begin tackling these objectives over the next couple legislative sessions, with further progress to be made in the years ahead.

8 min readJoe Biden has proposed an ambitious agenda that would make the federal fiscal system more progressive, and the huge budget deficits caused by the numerous COVID-19 relief packages could heighten the call for more tax revenues. What is needed are benchmark facts to guide these debates.

13 min read

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read