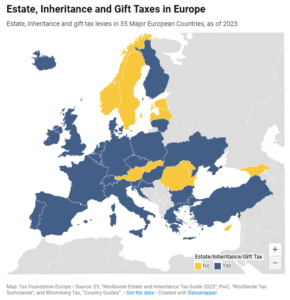

Estate, Inheritance, and Gift Taxes in Europe, 2024

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read