Tax Burden on Labor in Europe, 2025

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

To make the taxation of labor more efficient, policymakers should understand their country’s tax wedge and how their tax burden funds government services.

5 min read

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, followed by social insurance taxes (including payroll taxes for Social Security and Medicare), consumption taxes, property taxes, and corporate income taxes.

4 min read

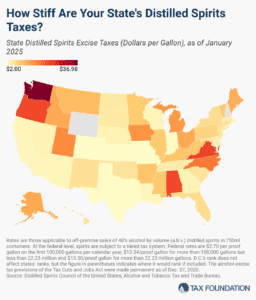

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read

Developed countries raise tax revenue through individual income taxes, corporate income taxes, social insurance taxes, taxes on goods and services, and property taxes—the combination of which determines how distortionary or neutral a tax system is.

4 min read

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

5 min read

According to the latest economic data from the US Census Bureau, the average per capita state and local tax burden is $7,109. However, collections vary widely by state, reflecting differences in tax rates and bases, natural resource endowments, the scale and scope of taxable economic activity in each state, and residents’ political preferences.

5 min read

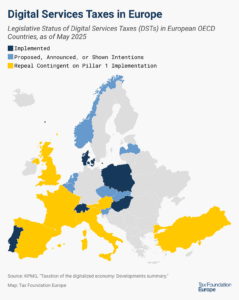

Currently, about half of all European OECD countries have either announced, proposed, or implemented a digital services tax. Because these taxes mainly impact US companies and are thus perceived as discriminatory, the US responded with retaliatory tariff threats.

5 min read

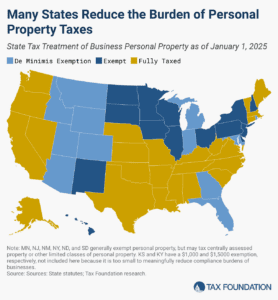

Does your state have a small business exemption for machinery and equipment?

4 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

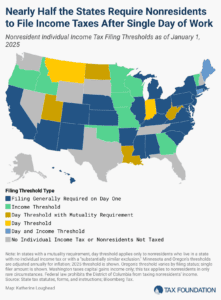

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read