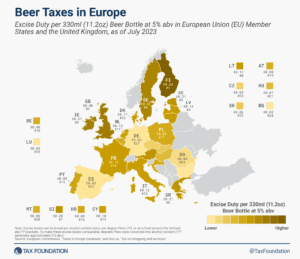

Beer Taxes in Europe, 2023

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

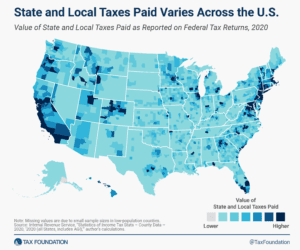

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

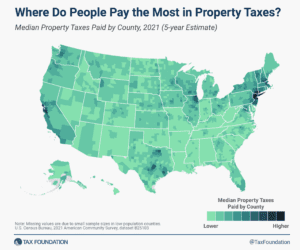

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

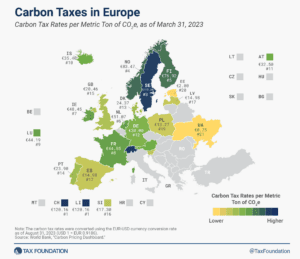

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

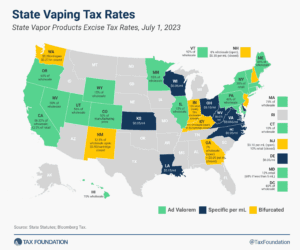

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

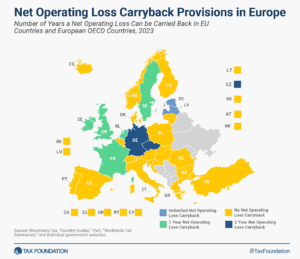

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

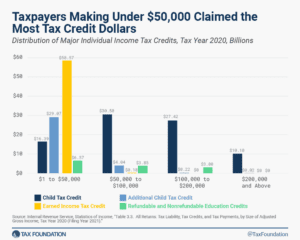

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

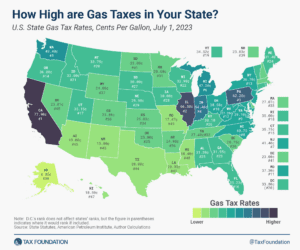

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

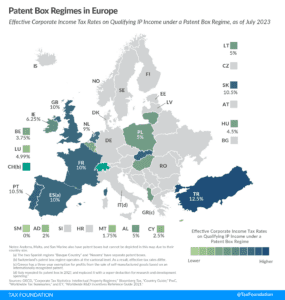

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read