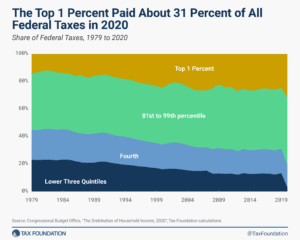

Sustainably Reforming Social Security and Medicare Will Need More than Just Tax Hikes

Creative options including changes in Social Security benefits growth for higher earners and reforms to how Medicare compensates for health services should be on the table, along with broad-based and well-structured tax reforms.

6 min read