All Related Articles

Tax Foundation Response to UN Request for Public Input on a Framework Convention on International Tax Cooperation

The global economy needs policymakers who are invested in seeing growth recover and avoiding unnecessary barriers to cross-border trade and investment. The challenges countries face will become even more difficult to solve in a stagnant global economy.

Property and Transfer Tax: If It Moves, Stop Taxing It.

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

The Shortcomings of Nebraska’s EPIC Option

31 min read

Caitlin Clark Pays Income Taxes on NIL. It’s Time to Tax the NCAA, too.

If student athletes are taxed on their earnings, it’s time the NCAA should be taxed on theirs.

Summary of the Latest Federal Income Tax Data, 2024 Update

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

Unpacking the Impact of TCJA, IRA, and CHIPS on the U.S. Economy

We’re examining the differences between the broad incentives provided by the Tax Cuts and Jobs Act and the targeted approach of the Inflation Reduction Act and the CHIPS and Science Act.

Taxes and Migration: New Evidence from Academic Research

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

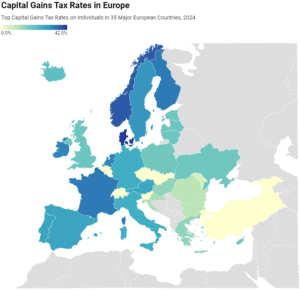

Capital Gains Tax Rates in Europe, 2024

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read