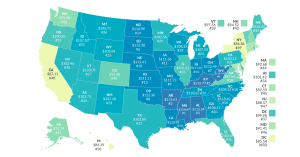

Real Value of $100 by State, 2019

Adjusting incomes for price level can substantially change our perceptions of which states are truly rich or poor. Your dollar goes much further in states like Missouri or Ohio than in states like New York or California. What is the relative value of $100 in your state?

4 min read