Businesses Pay and Remit 87 Percent of All Taxes Collected in Europe

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

Policymakers may consider a broader, more comprehensive property tax reform that creates a uniform system with effective levy limits to prevent unauthorized increases in property tax revenues and, in most cases, property tax bills.

4 min read

New leadership at the FDA will have the opportunity to revisit decisions that have shifted consumption to illicit products and discouraged harm reduction—policies that, however well intended, have come at a significant cost in lives.

7 min read

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

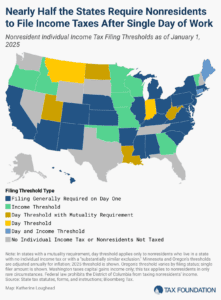

One area of the tax code in which extreme complexity and low compliance go hand-in-hand—and where reform is desperately needed—is in states’ nonresident individual income tax filing and withholding laws.

7 min read

The flat tax trend is gaining momentum nationwide, and Missouri lawmakers are right to identify income tax rate reductions as particularly pro-growth.

4 min read

The better we understand taxes, the better we can manage our finances, but it starts with familiarizing ourselves with basic tax concepts like how tax brackets work.

3 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

Could tariffs, a form of government finance heavily relied upon in the 18th and 19th centuries, function as a major source of revenue for a modern, developed economy in the 21st century?

16 min read

North Dakota’s financial position provides it with a rare capacity to deliver meaningful property tax relief. However, policymakers must balance immediate relief with fiscal sustainability and ensure that local governments remain adequately funded in the years ahead.

5 min read