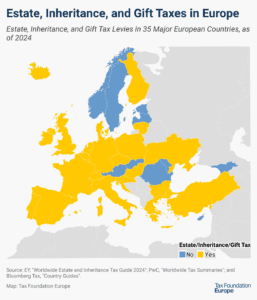

Estate, Inheritance, and Gift Taxes in Europe, 2025

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Lawmakers are right to enact a single-rate individual income tax. However, lawmakers should consider the full effects of the reform, ensuring that relief is not financed by shifting the tax burden to lower-income individuals and families.

4 min read

Among the many other tax proposals being considered in Washington this year, policymakers have proposed separate bills that would impose a carbon tax on cigarettes and implement a state-wide flavor ban on tobacco products.

3 min read

Attempting to defend Trump’s tariffs, the White House points to studies that show they raise prices, cut manufacturing output, and lead to costly retaliation.

Congressional Republicans are looking for ways to pay for extending the tax cuts scheduled to expire at the end of the year. Repealing the green energy tax subsidies expanded or introduced in the Inflation Reduction Act is an appealing option.

Do tariffs really level the playing field, or are they just bad economics? In this emergency episode, we fact-check the Trump administration’s claims that retaliatory tariffs make trade fairer.

Despite characterizing the tariffs as “reciprocal,” the White House didn’t actually measure tariffs, currency manipulation, or trade barrier policies employed by other countries. Instead, it drew its estimates from something else entirely: bilateral trade deficits in goods.

7 min read

What are the biggest tax stories shaping policy today—and what do they mean for you? In our 100th episode, we break down the five biggest tax stories, from the global tax deal to the looming expiration of the Tax Cuts and Jobs Act.

President Trump has announced that new tariffs will go into effect on April 2, following several weeks of threats. These new tariffs are likely to be broader in scope than the limited ones implemented thus far. So who is likely to pay for them?

7 min read

Lawmakers can constrain the growth of property taxes without creating new problems. But the details matter.