The Tax Code Should Not Be a Game of Hide-and-Seek

Lawmakers should push against efforts to lift the SALT cap, and they should keep an eye toward bringing additional transparency to the tax system.

Lawmakers should push against efforts to lift the SALT cap, and they should keep an eye toward bringing additional transparency to the tax system.

A tax preference originally designed to level the playing field now has the opposite effect, creating preferences for one class of financial institutions even though the distinctions between credit unions and banks are increasingly blurred.

6 min read

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

The Institute for Policy Studies (IPS) only succeeds in demonstrating that America has more millionaires than it used to, not that high-tax states are doing well in attracting or retaining them.

7 min read

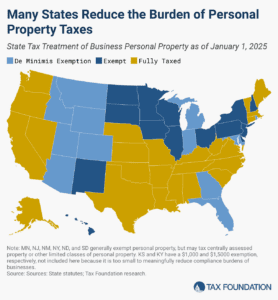

Does your state have a small business exemption for machinery and equipment?

4 min read

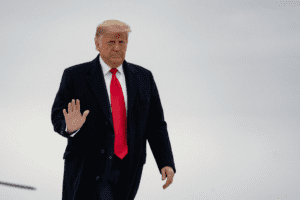

President Trump has repeatedly floated the idea of entirely replacing the federal income tax with new tariffs. Recently, he has said that when tariff revenues come in, he will use them to replace or substantially cut income taxes for people making under $200,000.

8 min read

Raising the top income tax rate would raise several hundred billion dollars but would offset most of the pro-growth effects of making the TCJA’s individual tax provisions permanent by reducing incentives to work and invest.

5 min read

By implementing a more sophisticated and nuanced trigger system for its tax reduction goals, North Carolina can sustain its trajectory toward lower tax rates, reinforce its reputation as a business-friendly state, and ensure long-term fiscal stability in an ever-changing economic landscape.

4 min read

Hemp, intoxicating or otherwise, is a growing market that needs to be addressed with tax policy. A well-designed tax will generate tax revenues for states while improving public health by shifting consumers away from illicit markets.

5 min read

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read