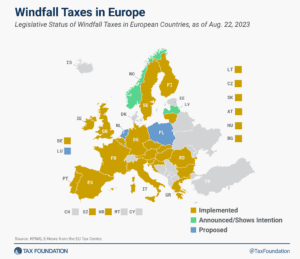

Windfall Profit Taxes in Europe, 2023

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of raising additional revenues without distorting the market. Instead, they would penalize domestic production and punitively target certain industries without a sound tax base.

13 min read