Key Findings

- Recently, a group of Republican lawmakers known as the “Big Six” released a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform framework that proposed a number of individual and business tax changes.

- In addition to reducing the corporate tax rate to 20 percent and pass-through maximum tax rate to 25 percent, the Framework proposes allowing businesses immediate full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of all assets (except for buildings and other structures) for at least five years.

- Limiting expensing to certain types of capital investments and making it temporary would greatly reduce the 10-year budget impact. However, there is a downside: it would greatly limit the economic benefit of expensing.

- We estimate that a five-year, limited expensing provision would only temporarily boost output, by at most 0.78 percent after five years. By the end of a decade, GDP would be only 0.18 percent higher than it otherwise would be, and the remaining gains would be lost soon after.

- Temporary expensing may encourage businesses to shift future investments forward to take advantage of the larger deductions, but would not raise the level of investment permanently.

- Instead of making expensing temporary, lawmakers could pursue other ways to speed cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. on a permanent basis, with permanent economic gains, without drastically reducing revenue.

- One option to reduce the cost of expensing is called “depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. indexing” or “neutral cost recovery,” which we estimate could reduce the cost of expensing by 90 percent in the first decade while providing similar economic benefits.

Introduction

Since June 2016, a centerpiece of Republican business tax reform proposals has been the idea to allow companies to fully deduct the cost of new investments, usually called “full expensing.” If enacted on a permanent basis, this proposal would encourage additional investment, boost productivity, and lead to higher output and incomes. The “Big Six,” a group of GOP congressional leaders and the Trump administration’s top economic advisers, recently released a tax reform framework that proposes to enact full expensing for all assets except for buildings and other structures. However, the framework did not specify that the policy would be enacted on a permanent basis, saying that it would be in place “for at least five years.”

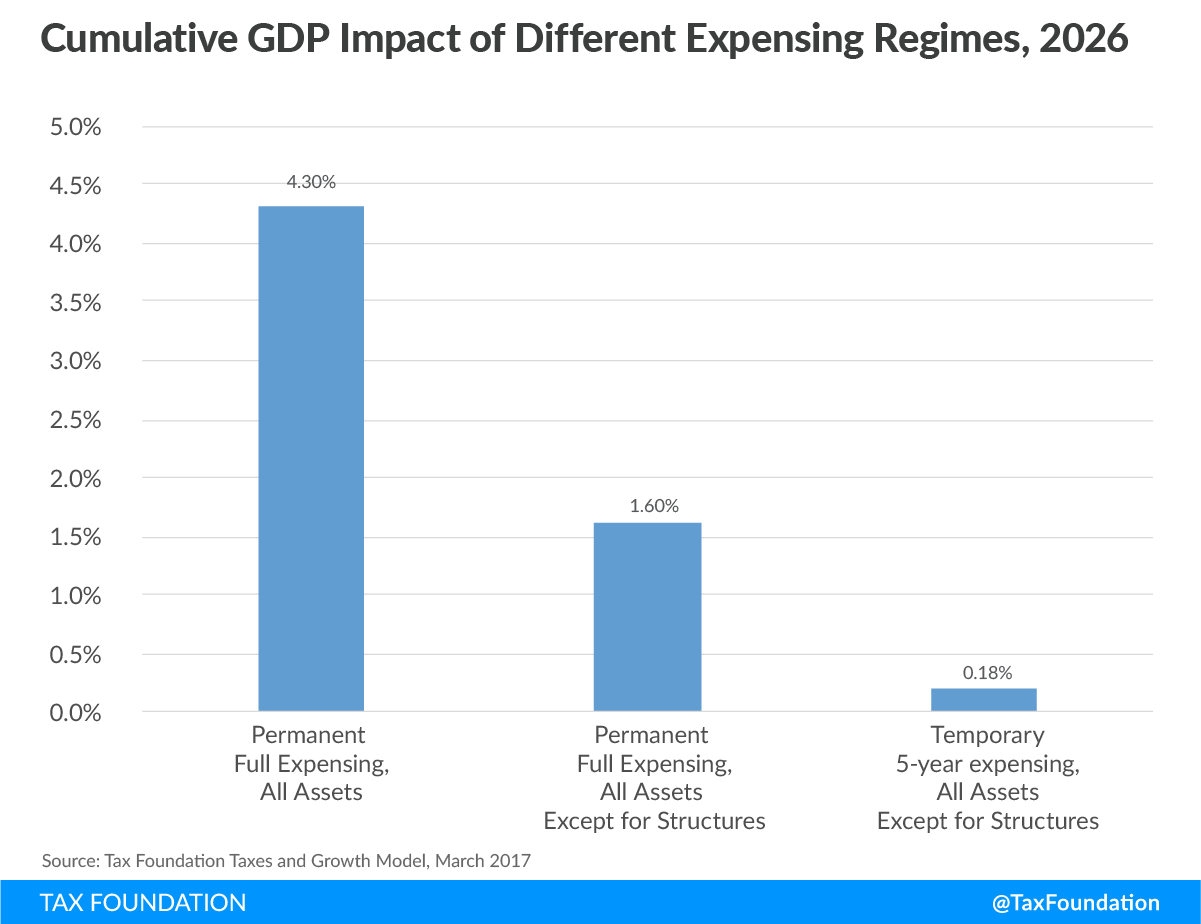

A temporary and limited expensing regime, such as the one described in the Big Six framework, would not reduce revenue nearly as much as permanent expensing of all assets. However, it would provide limited economic benefits. We estimate that a temporary, limited expensing provision would increase GDP by at most 0.78 percent after five years, fading to only 0.18 percent by the end of the budget window, with the remaining gains lost soon thereafter. By contrast, permanent full expensing of all capital investments would permanently boost GDP by as much as 4.3 percent.

Given the limited economic benefit of temporary expensing, we propose alternative policies that could provide similar economic benefit for permanent expensing, but would reduce federal revenue much less over the next decade.

Overview of Proposal

In June 2016, GOP leadership in the House of Representatives released their “Blueprint” for tax reform. A centerpiece of the proposal’s business tax reform was full expensing of capital investments. Under this proposal, companies would be allowed to fully deduct the cost of all investments in productive capital (machines, factories, buildings, inventories) in the year they were purchased. By contrast, current law requires companies to depreciate, or write off, the value of those assets over years or decades.

More recently, the Big Six released a new tax reform framework. This framework proposes to enact full expensing, but would limit it in two important ways: 1) Instead of allowing companies to write off all assets immediately, it would exclude any buildings and other structures from the provision. Machines, equipment, and intellectual property would be expensed, but residential and commercial buildings, factories, and other structures would continue to be depreciated; and 2) This limited expensing regime would only be available for at least five years, after which the proposal would either expire or would have to be extended by lawmakers.

The Budgetary Impact of the Bix Six’s Temporary Expensing Proposal

The Big Six may have chosen to make their expensing provision limited and temporary due to revenue concerns. Enacting full expensing for all assets on a permanent basis reduces revenue a lot during the first ten years of the policy. Temporary expensing for only certain assets looks significantly less expensive over a 10-year budget window than permanent expensing for all capital investments.

Full expensing would greatly increase the value of deductions businesses would take, and greatly reduce business taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , which would reduce business tax collections. This would be especially true in the first few years after enacting expensing, because companies would be taking full deductions for new investments plus depreciation deductions for old investments they made prior to the enactment of full expensing.[1] Later, after old investments have been fully depreciated, the cost of allowing businesses to expense each year’s outlays immediately is rather small, reflecting only a modest timing shift versus depreciation, as investment rises over time.

We estimated that if enacted, full expensing of all capital investments would reduce federal revenue by $2.4 trillion over the next decade. When accounting for the economic growth of the proposal, full expensing of all capital investments would reduce federal revenue by $1.4 trillion over the next decade (Table 1).

However, it is worth noting that the cost of full expensing depends a great deal on what the business tax rate is. The Framework proposes significantly cutting the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate from 35 percent to 20 percent, and cutting the maximum tax rate on pass-through businesses from 39.6 percent to 25 percent. Against these lower business tax rates, full expensing would reduce federal revenue by $1.5 trillion over the next decade on a static basis and $1 trillion on a dynamic basis.

Removing structures from expensing reduces the near-term cost of expensing by a great deal. According to the Tax Foundation’s Taxes and Growth Model (TAG), enacting expensing of all investments except structures would reduce federal revenue by $1.3 trillion over the next decade on a static, or conventional, basis against a 35 percent corporate tax rate. On a dynamic basis, permanent full expensing costs $886 billion over the same period. Against a 20 percent corporate rate and a 25 percent top pass-through rate (the rates under consideration), permanent expensing for nonstructures would reduce federal revenue by $766 billion over the next decade ($520 billion on a dynamic basis).

Limiting this expensing provision to five years would reduce revenue by much less over the next decade. We estimate that five-year temporary expensing (excluding structures) reduces federal revenues by $528 billion on a static basis and $379 billion on a dynamic basis. Against the lower business tax rates in the Framework, this expensing provision would reduce revenue by $308 billion ($270 billion dynamic) over the next decade.

| Source: Tax Foundation Taxes and Growth Model, March 2017 | |||

| Permanent Full Expensing, All Assets | Permanent Full Expensing, All Assets Except for Structures | Temporary 5-year Expensing, All Assets Except for Structures | |

|---|---|---|---|

| Against a 35% Corporate Tax Rate | |||

| 10-Year Change in Static Revenue (billions of dollars) | -$2,372 | -$1,305 | -$528 |

| 10-Year Change in Dynamic Revenue (billions of dollars) | -$1,426 | -$886 | -$359 |

| Against Framework Tax Rates (25% Pass-through rate and 20% Corporate Rate) | |||

| 10-Year Change in Static Revenue (billions of dollars) | -$1,495 | -$766 | -$308 |

| 10-Year Change in Dynamic Revenue (billions of dollars) | -$1,091 | -$560 | -$270 |

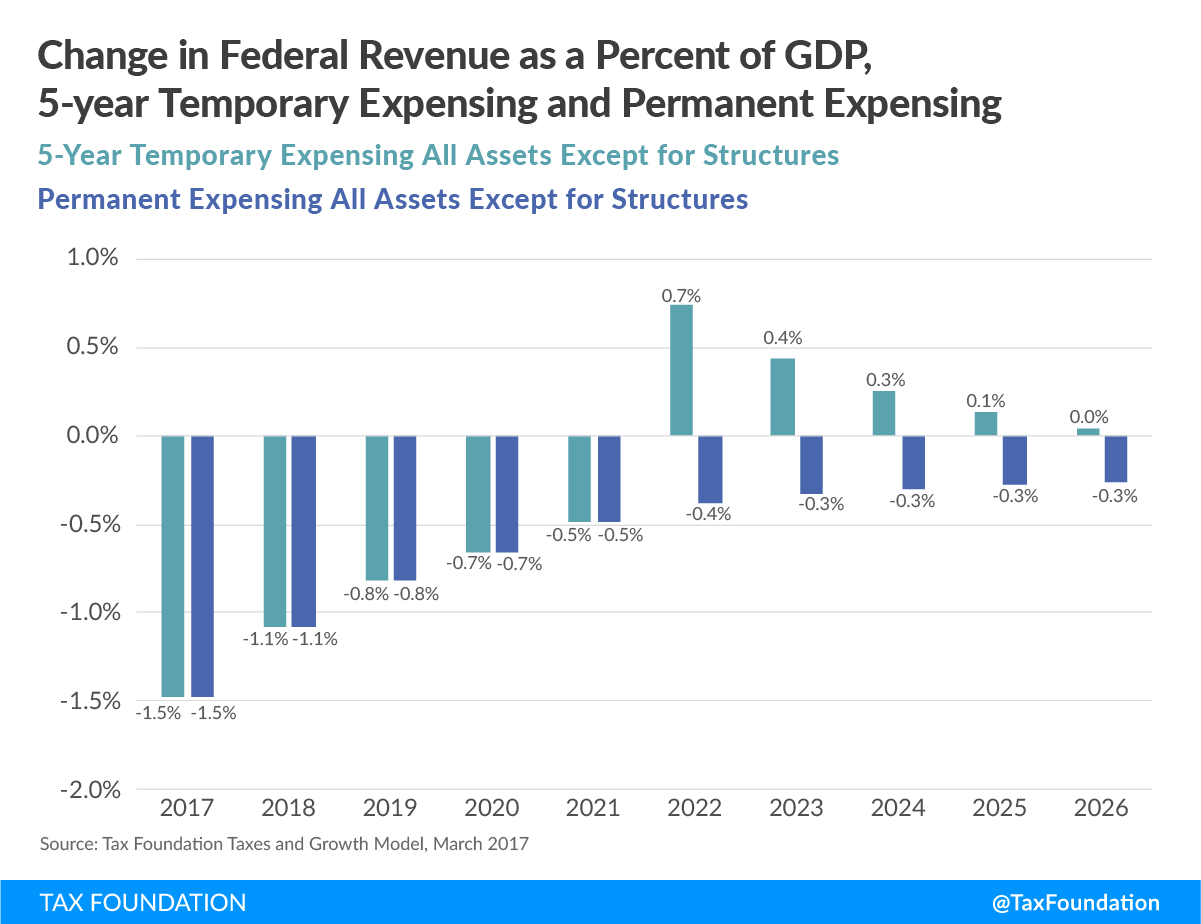

As mentioned above, much of the cost of full expensing in the first decade is transitional, as businesses take larger upfront deductions for a few years. Under five-year temporary expensing, the federal government would still lose just as much revenue in the first five years as under permanent expensing (Chart 1). However, once expensing expires, the federal government would end up raising revenue relative to the baseline later in the decade. This is because slowing depreciation back down would frontload tax payments on new investments, bringing in revenue for the federal government. However, just as the costs of enacting expensing are temporary, this surge of revenue from ending expensing would be temporary and would decline significantly by the tenth year.

The Economic Impact of Temporary Expensing

Limiting expensing to certain types of capital investments and making it temporary greatly reduces the 10-year budget impact. However, there is a downside: it would greatly limit the economic benefit of expensing.

Under standard cost of capital analysis, full expensing reduces the cost of new investment by exempting the normal return on investment from the business tax base. Some capital projects that do not net a sufficient after-tax rate of return under the current code to be justifiable would become economically viable under full and immediate cost recovery. Investment and economic growth would increase for about a decade as companies put new projects into service, building the capital stock. Eventually, the capital stock would hit a new equilibrium level, and investment and economic growth rates would return to their long-run averages, but from a permanently higher base.

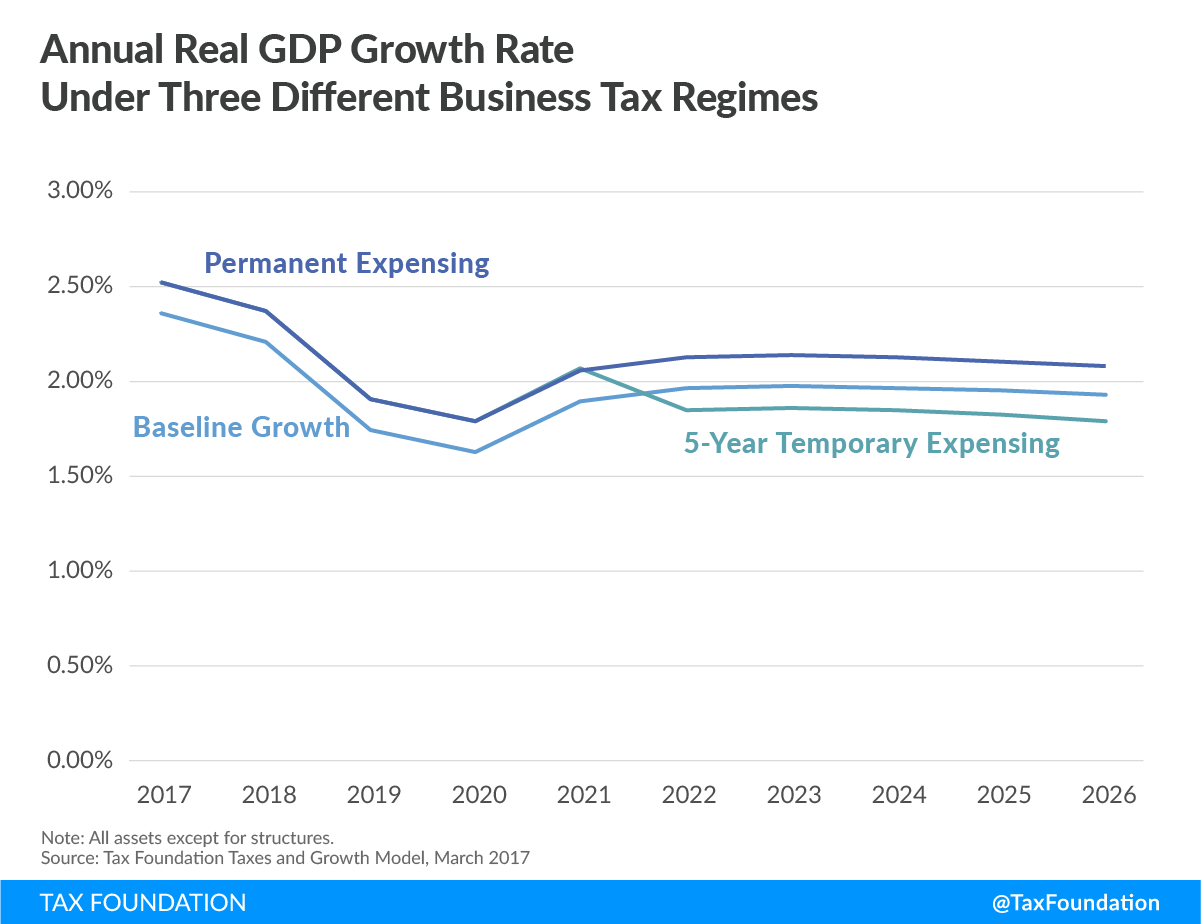

The Taxes and Growth model estimates that if full expensing of all capital investments were enacted, the long-run size of the economy would be 4.3 percent larger. This means that the economy would grow about 0.4 percent faster each year over the next decade as the capital stock adjusted to the significantly lower cost of capital.

Limiting expensing by excluding buildings reduces its economic benefit. Buildings and structures account for roughly two-thirds of the U.S. capital stock. The Taxes and Growth model finds that if the expensing provision the Big Six are considering, excluding buildings, were made permanent, investment would increase by a smaller amount. We estimate that such a policy adds about 0.16 percentage points to GDP growth per year over a decade, eventually resulting in a GDP that is 1.6 percent larger than the baseline scenario after 10 years.

Five-year temporary expensing looks similar at first: it initially produces more investment and economic growth as the capital stock adjusts to a new higher level. In the first five years, GDP would experience similar growth as it would with permanent full expensing (an additional 0.16 percentage points of annual growth) as companies place new capital into service. The change in the level of GDP would peak in the fifth year, at 0.78 percent above baseline.[2]

When this expensing provision expires in the sixth year, however, the GDP growth rate would actually be slower than it would have been in the absence of this expensing provision, gradually scaling back the gains in GDP. Investment projects that were once profitable under expensing would no longer be economically viable after the return to current law depreciation schedules. Investment would slump for several years as companies stop replacing these capital projects and allow the capital stock to return to its original level. By the tenth year, GDP would only be 0.18 percent higher than it otherwise would have been without five-year expensing, with the remaining gains disappearing soon thereafter (Chart 3).

Businesses May Also Shift Investments Over Time

The above analysis only accounts for the macroeconomic impact of temporary expensing: how companies would increase and decrease real investment in response to the change in the cost of capital. It is also important to note that a temporary expensing proposal will create an incentive for companies to shift investments they would have made in the future to the present to benefit from the faster write-offs. Economic literature shows that this has happened in the past when lawmakers passed temporary expensing provisions.

If companies were to shift their investment behavior by pulling forward future projects they would have done anyway, the economic effects would be slightly amplified in the early years. Economic growth rates in the first five years may accelerate slightly faster than our TAG model predicts, but may also drop even more in the second five years.

An Alternative for Making Expensing Budget-Friendly

Instead of making expensing temporary, lawmakers could pursue other ways to speed cost recovery without drastically reducing revenue. One option would be to enact “depreciation indexing,” also known as “neutral cost recovery.” Under depreciation indexing, the federal government would keep current law depreciation schedules. However, annual depreciation allowances would be adjusted by an interest rate to offset both the effect of inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and the time value of money. For companies, depreciation indexing means that they would get the full present value of their deduction, as if they expensed the asset all at once. For the federal government, this has the effect of slowly phasing in the cost of full expensing over time.[3]

We estimate that depreciation indexing would provide roughly the same economic benefit as expensing in the long run, but we estimate it would cost roughly 90 percent less than full expensing over the budget window.[4]

Another option would be to shift current law cost recovery in the direction of expensing by shortening asset lives, especially for buildings. Structures are subject to the least beneficial cost recovery allowances in the tax code. Buildings normally have 39-year asset lives for tax purposes. Lawmakers could improve cost recovery by shortening building asset lives to 30 or 25 years immediately, then gradually reduce asset lives a year at a time thereafter. Alternatively, lawmakers could offer buildings and structures a reduced, 50 percent bonus depreciation. This is less than full expensing, but better than current law depreciation.

Conclusion

The “Big Six” put forth a Framework for fundamental tax reform. The Framework proposed enacting 10 percent expensing for certain assets, but only for five years, at least. We find that this proposal would reduce federal revenue much less than permanent expensing, but only boost economic growth for a few years. In total, temporary expensing for only certain capital assets would only boost the level of GDP by 0.78 percent after five years, and only by 0.18 percent by the end of the decade, without any boost to long-term GDP. Permanent expensing for all assets would boost GDP by 4.3 percent after 10 years, and keep it high permanently. If lawmakers are concerned about the budget impact of permanent expensing, “depreciation indexing,” or other gradual changes to deprecation, could be a permanent alternative.

[1] Kyle Pomerleau and Scott Greenberg, “Full Expensing Costs Less Than You’d Think,” Tax Foundation, June 13, 2017. https://taxfoundation.org/full-expensing-costs-less-than-youd-think/.

[2] For an overview of the methodology see Alan Cole, “Why Temporary Corporate Income Tax Cuts Won’t Generate Much Growth,” Tax Foundation, June 12, 2017.https://taxfoundation.org/temporary-tax-cuts-corporate/.

[3] For more information on “neutral cost recovery,” or depreciation indexing, see Kyle Pomerleau, “How to Reduce the Up-front Cost of Full Expensing,” Tax Foundation, June 19, 2017. https://taxfoundation.org/reduce-front-cost-full-expensing/; and Stephen J. Entin, “The Neutral Cost Recovery System: A Pro-Growth Solution for Capital Cost Recovery,” Tax Foundation, Oct. 29, 2013. https://taxfoundation.org/neutral-cost-recovery-system-pro-growth-solution-capital-cost-recovery/.

[4] It is important to note, however that depreciation indexing’s cost would grow outside of the budget window. In the long run, depreciation indexing and full expensing have the same annual cost. See: Kyle Pomerleau, “How to Reduce the Up-front Cost of Full Expensing,” Tax Foundation.

Share this article