Key Findings

- A temporary cut to the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate is substantially less effective at generating economic growth than a permanent cut.

- A ten-year reduction in the U.S. corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate to 15 percent would boost investment and growth over the first seven years of the policy, but then reduce growth.

- The specter of a future tax increase makes investment under a temporary low rate less enticing, especially for long-lived assets.

- A temporary corporate income tax cut is most likely to result in higher payouts to shareholders of corporations; a permanent corporate income tax cut has a much better chance to result in increased wages as well.

Introduction

In recent months, Republicans in the federal government and in Congress have been considering tax reform ideas. One issue that lawmakers are considering is the difference between temporary and permanent changes in tax policy. While most would prefer to make permanent policy changes, there are procedural limits in the U.S. Senate on permanent policy changes that increase the budget deficit.[1]

Because of these procedural limitations, some lawmakers have taken to considering the merits of a temporary tax cut plan as well, which would sunset after ten years, much like the tax cuts enacted by President George W. Bush in 2001 and 2003.

There are many trade-offs involved in this kind of decision. This report will cover one of them: a question posed by Office of Management and Budget (OMB) Director Mick Mulvaney to The Wall Street Journal.[2]

“If it’s a temporary proposal, will businesses and even individuals change their behavior in order to get you the economic growth?” asked White House budget chief Mick Mulvaney in an interview last week. “That’s what we’re going through right now.”

Mulvaney’s question—whether an individual or firm would change behavior in response to a tax policy provision, knowing that the provision was only temporary—is relevant to all kinds of tax policy; however, this question is most incisive when it concerns cuts to the corporate income tax rate, as the administration has proposed.

This report will show that, by the economic framework typically used to evaluate business taxes and investment decisions, a temporary cut to the corporate income tax rate is substantially less effective than a permanent one.

Corporate Income Taxes and Investment Behavior

Business income taxes are often criticized for being a drag on economic growth; this has been a common theme in President Donald Trump’s policy message, and especially in promoting his plan to reduce the corporate income tax rate from 35 percent to 15 percent.

There is backing for this position in academic economic theory. For example, the framework developed by Robert Hall and Dale Jorgenson (1967) shows that business taxes raise the marginal cost of investment under most circumstances.[3] Variations on this framework are used by many tax policy analysts today, including those at Tax Foundation, Tax Policy Center, and the Joint Committee on Taxation. Raising the cost of investment would likely reduce investment, wages, and economic growth.

These tools of analysis were developed primarily to calculate the cost of investment under a constant tax code, though, not one that changes during the life of the asset. Therefore, they are not immediately helpful in analyzing a proposal to temporarily reduce the corporate income tax rate to 15 percent.

The appendix of this report expands on the framework created by Hall and Jorgenson, deriving the expressions for understanding investment behavior under a regime where tax rates can change during the life of an asset.

This derivation was then used to calculate the cost of capital on real-life U.S. investment, and those results were then integrated with the Tax Foundation’s Taxes and Growth Model in order to project the kind of growth one might see under a ten-year reduction in the corporate income tax rate to 15 percent, and how that would compare to a permanent reduction.[4]

For purposes of this analysis, shareholders and firms were assumed to have discount rates in the range of 3 to 4 percent; these rates are somewhat higher than the risk-free discount rates one might see on government bonds, reflecting a risk premium on corporate capital.

The Economic Effects of Temporary and Permanent Corporate Income Tax Cuts

A permanent corporate rate reduction reduces the cost of capital and makes new investments worthwhile that otherwise would not have been. Under the Taxes and Growth model, a permanent cut to 15 percent boosts investment substantially, which allows a sustained period of higher growth. Such a policy adds about 0.39 percentage points to GDP growth per year over a decade, eventually resulting in a GDP that is 3.9 percent larger than the baseline scenario after ten years. This additional 3.9 percent level adjustment to GDP remains for as long as the policy stays in effect; more investments are profitable, and therefore, the nation is richer.

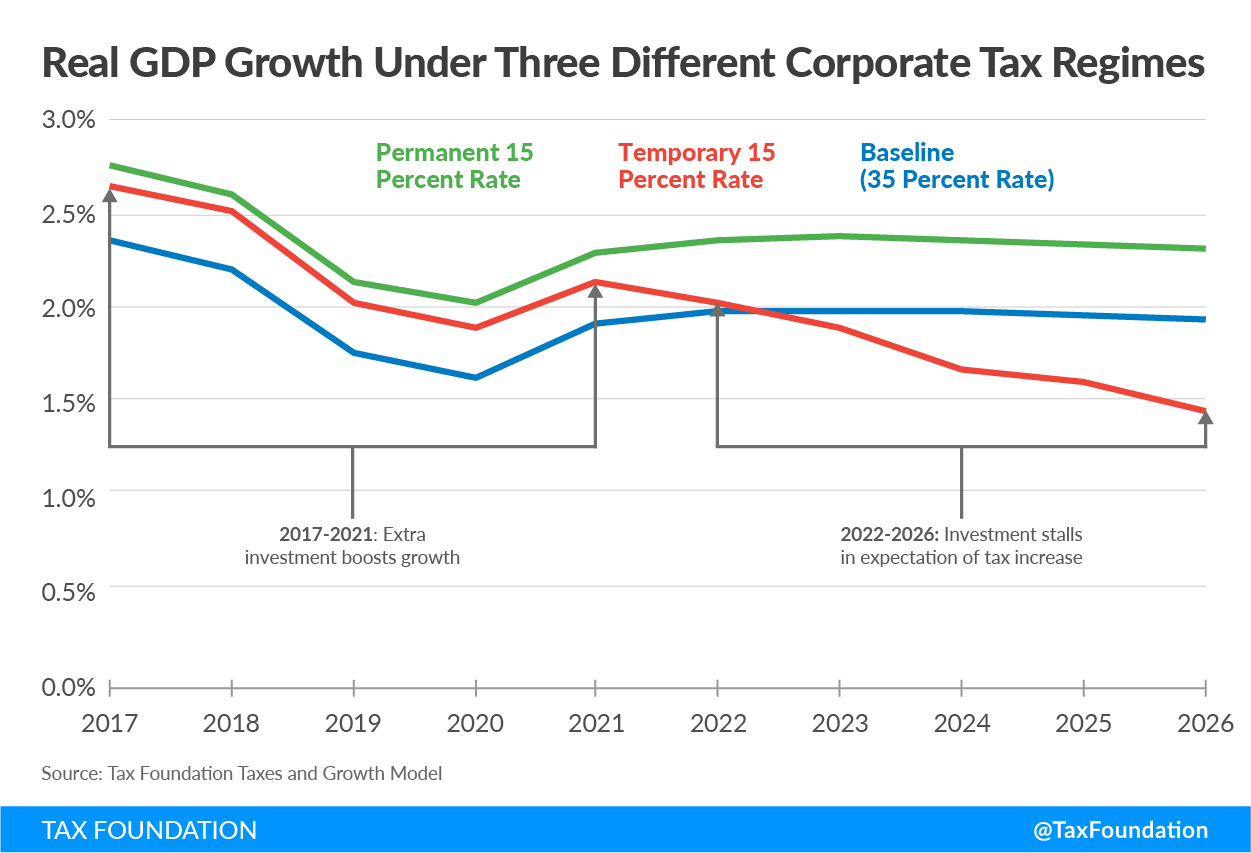

A temporary corporate rate reduction looks similar at first: it initially produces more investment and growth. However, the effect is never as strong as for the permanent cut. Worse, the improvements to growth slow. The increase in GDP peaks in the sixth year, with a grand total of 1.37 percent added to GDP over all six years. Then, growth from the seventh year on is actually slower than it would have been with no tax cut at all. By the end of the tenth year and the sunset of the policy, GDP is only 0.14 percent larger than it would have been without the tax cut. The results are shown below:

| Source: Tax Foundation Taxes and Growth Model | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Baseline (35 Percent Rate) | 2.36% | 2.21% | 1.74% | 1.63% | 1.90% | 1.96% | 1.98% | 1.97% | 1.95% | 1.93% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Permanent 15 Percent Rate | 2.75% | 2.60% | 2.14% | 2.02% | 2.29% | 2.36% | 2.37% | 2.36% | 2.34% | 2.32% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Temporary 15 Percent Rate | 2.64% | 2.51% | 2.03% | 1.88% | 2.12% | 2.01% | 1.88% | 1.67% | 1.60% | 1.44% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Economic growth is much weaker under a temporary cut because investment is a forward-looking behavior. The specter of a future tax increase makes investment under a low rate less enticing, especially for long-lived assets. Many of the most important business decisions concern large structures, such as factories or wharves or office buildings. These investments generate much of their revenue years or decades after the structures are first constructed. When the revenue comes after a tax cut has expired, the tax cut does the investor no good.

This effect becomes more substantial as the end of a tax cut draws nearer. Even shorter-lived assets, such as equipment, begin to be affected by the looming tax increase. Furthermore, many of the most worthwhile investments were already made in previous years. Rather than continuing to invest at normal rates, businesses should be expected to slow their investment behavior in expectation of a tax increase.

This model includes no Keynesian effects, which might result in larger growth in the first few years of a tax cut. This also includes no adverse economic effects of reduced tax revenue, such as a potential increase in borrowing costs “crowding out” some private investment; this might result in slower growth in the later years of a tax cut. This model also assumes that a return to the original policy is entirely certain under the temporary scenario, and entirely impossible under the permanent scenario; in a real-world political situation, such certainty is unlikely.

The Budgetary Effects of Temporary and Permanent Corporate Income Tax Cuts

Under both a temporary corporate income tax cut and a permanent corporate income tax cut, overall revenues over the next decade would be expected to be lower than they would be at a 35 percent rate. However, the economy grows somewhat larger under both proposals, mitigating the $2.15 trillion revenue loss that the 15 percent rate would incur without accounting for economic growth.

| Source: Tax Foundation Taxes and Growth Model | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10-year Corporate Rate Reduction to 15 Percent | Permanent Corporate Rate Reduction to 15 Percent | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 10-Year Change in Static Revenue (billions of dollars) | -$2,149 | -$2,149 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10-Year Change in Dynamic Revenue (billions of dollars) | -$1,695 | -$973 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The higher economic growth described leads to a larger tax base: not just for corporate income taxes, but also for individual income taxes, payroll taxes, and other revenue-raising provisions. The permanent rate reduction would spur greater economic growth, and therefore, recoup more revenue—though it requires a running commitment to continue the tax cuts in the future, which would be costly outside of the traditional ten-year budget window used for evaluating tax bills.

The Distributional Effects of Temporary and Permanent Corporate Income Tax Cuts

It is far from settled in the economics profession whether a corporate income tax cut would primarily benefit shareholders, workers, or both. Furthermore, temporary corporate income tax cuts could be expected to have different distributional impacts from permanent ones.

Publishing a distributional table for temporary corporate income tax cuts would require making some relatively unfounded assumptions, which Tax Foundation is not prepared to do at this time. However, the general direction of things is clear: permanent corporate tax cuts are more likely to benefit workers than temporary ones, which are more likely to benefit shareholders.

The case for this is relatively clear: a temporary tax cut is more likely to help mostly preexisting capital, as new capital will not have time to be constructed and take advantage of the provision. In contrast, a permanent tax cut is likely to benefit both old and new capital; when new capital is constructed, workers can benefit as well.

In contrast, a temporary tax cut would have less time to create these kinds of second-order benefits. The less time taxpayers have to adjust to a tax change, the more likely it is that the economic incidence of the tax matches the nominal incidence. In all likelihood, a temporary corporate income tax cut would benefit workers much less than a permanent corporate income tax cut would.

Conclusion

There are serious reasons to consider cutting the U.S. corporate income tax. However, many of the best arguments for cutting the corporate income tax apply most strongly to permanent cuts, not temporary ones. A temporary corporate income tax cut is less likely to promote growth and less likely to benefit workers than a permanent corporate income tax cut.

A tax reform effort should hope to boost incomes for all, and a corporate income tax cut could be a means to do it. However, a large but short-lived reduction in corporate income taxes may be largely a windfall for investors, pension funds, and retirement accounts, with precious few broader benefits to the economy at large.

Appendix: Deriving the Service Price of Capital with a Changing Corporate Rate

Introduction

In calculating the response of investment behavior to corporate income taxes, economists have traditionally used expressions for the service price of a marginal investment—that is, the ongoing costs of maintaining the investment net of depreciation, taxes, and financing—and observed how different tax rates or systems affect that expression.

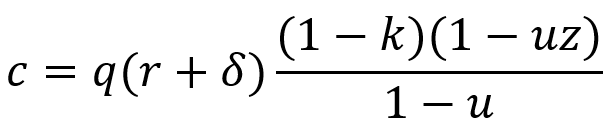

However, the most commonly used service price expressions are designed around a constant corporate income tax rate. For example, the traditional service price expression used in many models, derived by Dale Jorgenson and Robert Hall (1967), is as follows:[5]

where c is the cost of capital services, q is the price of capital goods, r is the discount rate, δ is the real rate of depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. on the asset, k is an investment tax credit, z is the present value of the depreciation deductions on one dollar’s investment, and u is the tax rate.

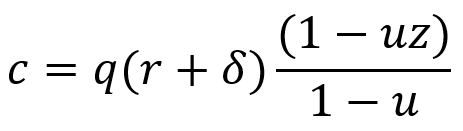

This can be modified for our purposes to exclude k since the investment tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. is no longer part of the code.

Expression 2

This expression works well if there is only one corporate income tax rate for the entire life of the asset. However, given that Congress may be considering a temporary corporate income tax cut in 2017, it is worthwhile to consider how this expression might change if u can be a different value at different points in the life of the asset.

This paper is an expansion of Hall and Jorgenson to reflect the possibility of investment behavior under an expected change in corporate tax rates—for example, an expiring corporate rate cut.

The Present Value of Depreciation Deductions

In order to represent a business tax code that changes year by year, the terms u and z need to be expanded to reflect that there may be different rates at different times. We do this as follows:

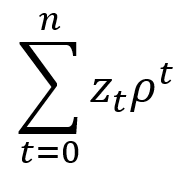

The z in the Hall-Jorgenson formula represents the summation of many deductions taken over the life of the asset, present-discounted. This can be expressed as

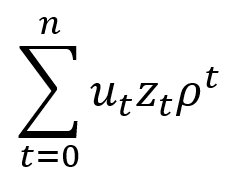

Expression 3

for an asset with an n-year life, where zt is the depreciation deduction taken on the asset in a particular year and ρ is the firm’s discount factor.

In the Hall-Jorgenson expression, this summation of deductions is then multiplied by a single tax rate, u. The reason for multiplying z by u is that a deduction is worth what rate you can count it against. In order to allow for multiple rates, we need to bring u back into the summation and allow for different tax rates in different years. In total, what was represented as uz by Hall and Jorgenson becomes

Expression 4

which allows the zt for any given year t to be counted against the rate ut for that same year. This expression will be used later, but we now turn to the denominator of the fraction in expression 2.

The Present-Discounted Tax Rate on Earnings

The denominator of the fraction in the Hall-Jorgenson expression, (1-u), is relatively simple: it denotes the portion of an asset’s revenues that go untaxed. Under a single tax rate, the formula is trivial: it is simply 1 minus the fraction that is taxed.

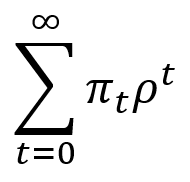

However, if different tax rates apply at different times, we need to expand u, the fraction that is taxed, to treat each year’s earnings separately in a summation. We start with this expression for an asset’s present-discounted earnings:

where πt is the earnings for year t and ρ is the firm’s discount factor.

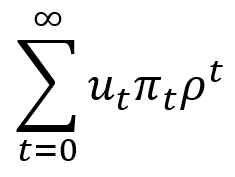

The present value of taxes paid on those earnings is a similar summation to expression 5 but with the tax rate added. The tax rate for a given year t can again be represented as ut, and the total taxes incurred is similar to expression 5 but with the tax rate for each year applying to each year’s profits.

Expression 6

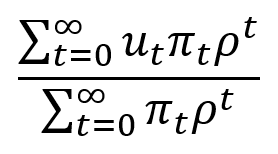

Therefore, the fraction of the asset’s earnings that are paid in taxes, with present-discounting, has expression 6 in the numerator and expression 5 in the denominator:

Expression 7

Deriving the New Service Price Formula

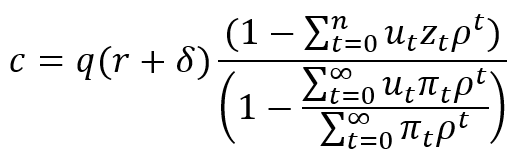

Finally, we can take expression 2 and replace the uz on the top of the fraction with expression 4, and the u on the bottom of the fraction with expression 7. This gives us a modified service price formula:

Expression 8

where c is the cost of capital services, q is the price of capital goods, δ is the real rate of depreciation on the asset, r is the discount rate for investors, t is time, zt is the depreciation deduction for year t on one dollar’s investment, ut is the tax rate for year t, ρ is the firm’s discount factor, and πt is the earnings for year t.

[1] Committee for a Responsible Federal Budget, “Reconciliation 101,” http://www.crfb.org/papers/reconciliation-101

[2] Nick Timiraos and Richard Rubin, “The Big Tax Questions Trump and Republicans Can’t Answer,” The Wall Street Journal, April 27 2017, https://www.wsj.com/articles/the-big-tax-questions-trump-and-republicans-cant-answer-1493328213

[3] Jorgenson, Dale and Robert E. Hall. “Tax Policy and Investment Behavior,” American Economic Review 57, no. 3 (1967): 391-414. http://scholar.harvard.edu/jorgenson/publications/tax-policy-and-investment-behavior

[4] There may be procedural issues in the U.S. Senate with a 10-year corporate income tax cut, due to intertemporal income shifting. However, this report will assume a 10-year corporate income tax cut is possible.

[5] Jorgenson, Dale and Robert E. Hall, “Tax Policy and Investment Behavior,” American Economic Review 57, no. 3 (1967): 391-414. http://scholar.harvard.edu/jorgenson/publications/tax-policy-and-investment-behavior.

Share this article