Table of Contents

- Key Findings

- Introduction

- Evaluating the Federal R&D Tax Credit

- Effectiveness of the R&D Tax Credit

- — Does the R&D Credit Increase R&D Spending?

- — Does Increased R&D Spending Reflect Real Investment or Reclassification of Expenses?

- — Does Increased R&D Investment Drive Useful Innovation?

- — Administration, Compliance, and Lobbying

- — The R&D Tax Credit and Firm Location

- How to Reform the R&D Tax Credit

- Cost Recovery and R&D Expenses

- Economic, Revenue, and Distributional Effects of Canceling R&D Amortization

- Conclusion

- Appendix: Calculating the R&D Tax Credit

Key Findings

- Investment in research and development (R&D) is central for driving long-term technological change and innovation. The R&D tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. and immediate expensing for R&D spending are two important ways the federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code provides incentives for R&D investment.

- The economic literature on the R&D tax credit suggests that it increases R&D spending, although the magnitude of that increase and how much of that new research translates to new innovation is more ambiguous.

- The R&D tax credit is complicated for firms to claim and smaller firms sometimes have a hard time accessing the credit. Simplifying the credit and ensuring it can be broadly accessible would make the U.S. more attractive for R&D investment. Making the R&D credit more generous is unlikely to be an effective tool for greater R&D investment unless paired with a more competitive business tax system.

- Providing an immediate and full deduction for R&D costs is neutral tax treatment and helps incentivize firms to invest in R&D. However, under current law, firms will be required to amortize R&D costs over five years beginning in 2022, which would make the U.S. an outlier internationally and reduce our international competitiveness in R&D.

- According to the Tax Foundation General Equilibrium Model, canceling R&D amortization would raise long-term GDP by about 0.1 percent, raise wages by nearly 0.1 percent, and create about 19,500 jobs.

Introduction

Technological innovation is the main driver of long-term economic growth and increases in living standards.[1] It is difficult to have ongoing technological innovation without investing in research and development (R&D).

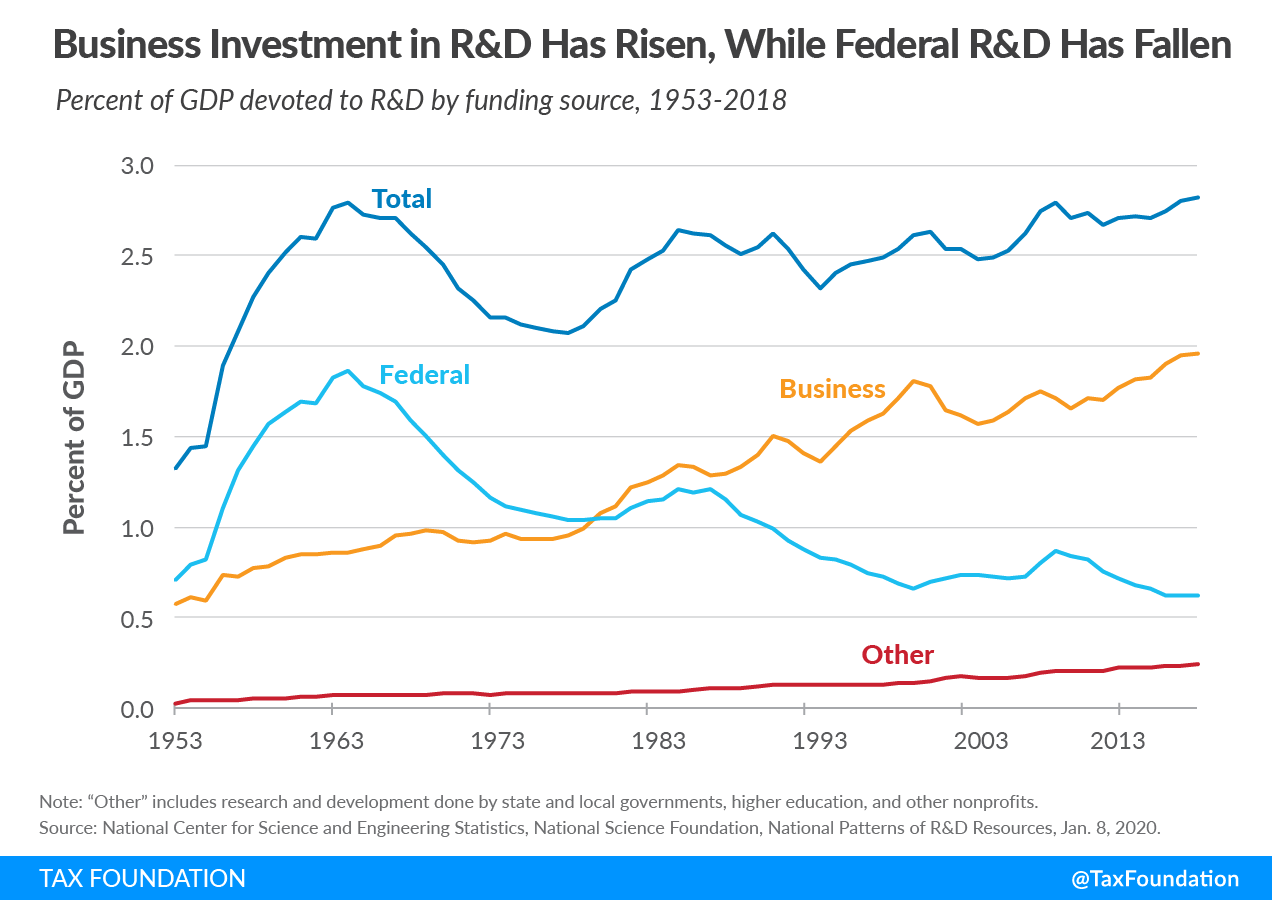

Over time, the composition of U.S. research spending has changed. Since around 1980, private sector R&D investment as a share of Gross Domestic Product (GDP) has grown consistently, while public sector R&D has declined—more than two-thirds of all U.S. R&D investment is now done by business.

Public and private R&D are important to generating future innovation. However, according to the Congressional Budget Office (CBO), public R&D investments have about three-fourths the long-term impact on economic output that private R&D investment does.[2] Moreover, the social benefits of private sector R&D to others in the economy are much greater than the private benefits to the firm making the investments.[3] As such, private R&D investment is often underprovided by the market.

If social returns are greater than private returns, that means private investment has positive externalities, which may merit a subsidy. However, just because the theoretical justification for a subsidy exists does not mean one can be administered effectively to produce efficient outcomes.

With those motivations in mind, the federal government provides incentives for additional private investment in R&D through the tax code via the R&D tax credit as well as by allowing a full and immediate deduction (expensing) for R&D investment. However, under current law, the tax treatment of R&D is scheduled to change at the end of 2021, requiring R&D expenses to be amortized over five years.

In this paper, we examine the federal tax treatment of R&D investment, with a focus on the R&D tax credit and cost recovery for R&D expenses. We review the evidence for the R&D tax credit’s effectiveness and the credit’s complexity, while recommending ways to improve the credit if it is retained in the tax code.

We also provide economic, distributional, and revenue estimates of preserving a full and immediate deduction for R&D expenses, rather than moving to a five-year amortization requirement.

With renewed interest in greater R&D spending at the federal level and increasing international competition for innovative activity, it is important to get the tax treatment of R&D right to avoid undermining America’s innovative edge.

Evaluating the Federal R&D Tax Credit

The R&D tax credit provides an incentive to invest in R&D by allowing companies to claim credits for spending on qualified research expenditures (QREs). According to the Joint Committee on Taxation’s (JCT) most recent tax expenditureTax expenditures are departures from a “normal” tax code that lower the tax burden of individuals or businesses through an exemption, deduction, credit, or preferential rate. However, defining which tax expenditures grant special benefits to certain groups of people or types of economic activity is not always straightforward. report, the R&D tax credit will reduce tax revenue by about $11.8 billion in 2020—$10.6 billion for corporations and $1.2 billion for individuals.[4]

The R&D tax credit was first established in 1981, in the Economic Recovery Tax Act (ERTA). The initial credit equaled 25 percent of a corporation’s research spending in excess of its average research spending in the preceding three years, or alternatively, 50 percent of its current-year spending.[5] The R&D tax credit originally expired at the end of 1985 and was updated as part of the Tax Reform Act of 1986.[6] The credit was classified as a Section 38 general business credit, subjecting it to a yearly cap, while lowering the credit’s statutory rate to 20 percent.

The R&D tax credit now has four separate elements: the regular credit, the alternative simplified credit, the energy research credit, and the basic (or university) research credit. In any year, taxpayers can take the energy research credit and the basic research credit, along with either the regular credit or the alternative simplified credit.[7]

| Type | Base | Policy goal | |

|---|---|---|---|

| Regular Credit | Incremental | 20 percent of QREs above a base amount | Private R&D |

| Alternative Simplified Credit | Incremental | 14 percent of QREs above half of average QREs over the previous 3 years | Private R&D |

| Energy Research Credit | Flat | 20 percent of QREs | Energy R&D |

| University Research Credit | Incremental | 20 percent of QREs above a base amount | Collaboration between the university system and the private sector |

|

Source: Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress,” Congressional Research Service, Mar. 3, 2015, https://www.fas.org/sgp/crs/misc/RL31181.pdf. |

|||

The regular R&D credit equals 20 percent of a firm’s QREs above a certain baseline level. Companies defined as “established firms” are firms with gross receipts and QREs in at least three of the tax years from 1984 to 1988. “Startup firms” are companies that had their first year with QREs and gross receipts after 1988, or firms that had fewer than three years of both QREs and gross receipts between 1984 and 1988. The choice of 1984 to 1988 was originally a transitional policy and has not been updated.

The alternative simplified credit (ASC) equals 14 percent of a firm’s QREs above half of its average QREs over the past three years, i.e., a moving average. If the firm has no QREs over the previous three years, the credit is 6 percent of QREs for the current year.

The difference between the regular credit and the ASC is that the regular credit has a fixed base, while the ASC has a moving average base.

While the ASC has simplicity advantages over the regular credit, it provides smaller marginal incentives to invest. This is due to smaller credit rates and the moving average aspects, as an increase in spending each year increases the base amount of R&D excluded from eligibility for the credit in future years.[8]

The energy research credit equals 20 percent of a firm’s QREs on payments to nonprofit organizations for the purpose of conducting energy research in the public interest. It can also be claimed on payments to colleges, universities, federal labs, and small firms, provided the taxpayer does not hold a majority stake in the firm performing the research.[9] The university basic research credit equals 20 percent of QREs above a base amount. “Basic research” is defined as “any original investigation for the advancement of scientific knowledge not having a specific commercial objective.”

In addition to restrictions shared with the regular credit, the university basic research credit can only be claimed on payments to educational institutions, nonprofit scientific research organizations (excluding private foundations), and some grant-making organizations.[10] In any given year, taxpayers can take both the energy research credit and the university basic research credit, as well as one of either the regular credit or the alternative simplified credit.

Except for the energy research credit, most aspects of the R&D tax credit are incremental, incentivizing R&D beyond a certain level. This feature is designed to avoid giving tax breaks to firms for existing R&D activity. Of OECD countries with R&D tax credits, 13 calculate their credit based on the total amount of R&D spending in a year, while five use an incremental R&D credit system—the U.S., Spain, Portugal, Mexico, and the Czech Republic.[11]

Another aspect of the U.S. R&D credit benefits small businesses that are unlikely to have taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. to offset with a credit. This benefit was originally provided through the Protecting Americans from Tax Hikes (PATH) Act in 2015 and allows businesses with less than five years of revenues and less than $5 million in current year revenues to use the R&D tax credit to offset up to $250,000 in payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. liability.[12]

The R&D tax credit applies to several QREs. It includes wages paid to workers engaged in qualified research activities, supplies (including any depreciable or non-depreciable property other than land), contracts for third parties (limited to 65 percent of the cost incurred), and basic research payments to qualified educational institutions or other scientific research organizations (limited to 75 percent of the cost incurred).[13]

Spending must meet several criteria to qualify for the credit. Taxpayers must show that research spending is based in hard sciences like engineering, computer science, chemistry, and so on, and is related to the development of a new or improved component. Taxpayers must also prove the project’s goal is to “resolve technological uncertainty” and establish a process to eliminate technological uncertainty.[14] Additional qualifications apply to software development.

Several types of research are excluded: social science research, research conducted outside the U.S., research conducted after commercial production has begun, research on management functions or techniques, and market research, among others.[15]

Under current law, companies can expense R&D costs, but there is a trade-off between expensing for R&D and the R&D tax credit.[16] Taxpayers must choose between either reducing the value of the expensing deduction for research expenses by the amount of credit claimed or reducing the credit by the statutory corporate tax rate, which are generally equivalent.[17]

The Tax Cuts and Jobs Act of 2017 (TCJA) reduced the corporate tax rate from 35 percent to 21 percent, so it indirectly increased the value of the R&D tax credit. Before the TCJA, companies effectively had to reduce the regular credit from 20 percent of QRE spending to 13 percent of QRE spending or reduce the alternative simplified credit from 14 percent to 9.1 percent.[18] However, with a 21 percent corporate tax rate, firms now either reduce the regular credit from 20 percent to 15.8 percent, or the alternative simplified credit from 14 percent to 11.06 percent.[19]

| Pre-Tax Cuts and Jobs Act | Post-Tax Cuts and Jobs Act | |

|---|---|---|

| Corporate Tax Rate | 35% | 21% |

| R&D Tax Credit | $200,000 | $200,000 |

| Add back value of expensing deduction ($200,000 times 35% versus 21%) | $70,000 | $42,000 |

| Net R&D Tax Credit | $130,000 | $158,000 |

|

Source: Richard Ray and Nicholas C. Lynch, “Qualifying Expenses for the Expanded Research and Development Tax Credit: A Closer Look at the TCJA Impact,” The CPA Journal, November 2019, https://www.cpajournal.com/2019/11/18/qualifying-expenses-for-the-expanded-research-and-development-credit/. |

||

Effectiveness of the R&D Tax Credit

The R&D credit’s goal is to stimulate innovation that encourages greater economic growth and living standards. However, it’s difficult to connect the R&D tax credit directly with a subsequent innovation—just because a company that developed a vaccine, for example, took the R&D tax credit on some of its related research spending does not mean the R&D credit was the deciding factor in undertaking that investment.

Many studies examine the degree to which the R&D credit increases R&D spending, but there is less evidence regarding the effect the R&D credit has on innovation.

Does the R&D Credit Increase R&D Spending?

Evidence generally indicates that R&D tax credits stimulate additional research spending. Initially, the impact of the R&D tax credit on new investment was believed to be relatively small. The Government Accountability Office (GAO) released a report examining the initial impact of the tax credit on R&D in 1989 and found that it had a modest impact. The report estimated that the credit cost $7 billion in forgone tax revenue and stimulated between $1 billion and $2.5 billion in new research spending—or $1 in tax subsidy created between 15 and 36 cents of R&D spending.

A literature review published in 1989 found slightly stronger effects on research spending, estimating between 35 and 93 cents of new research spending generated from $1 of forgone tax revenue.[21] An analysis of the literature in 2000 found that $1 of R&D tax credit generates about $1 of new investment in R&D.[22]

An analysis comparing R&D spending before and after the Omnibus Budget Reconciliation Act of 1989 tweaked several rules associated with the R&D tax credit found that $1 of tax credit stimulated $2.08 in new R&D spending.[23]

Recent research finds larger effects.[24] A paper from the Journal of Public Economics in 2016 examined the first 10 years of the R&D tax credit’s existence in the United States and found that for a 10 percent reduction in the user cost of R&D spending, the research intensity (or the ratio between research and sales) of a firm increased by 11 percent.[25]

A 2017 paper in the Review of Economics and Statistics found that in the long run, $1 of R&D tax credit would lead to about $4 of R&D spending, suggesting firms slowly adjust long-term research plans.[26]

One explanation for recent findings that firms are more responsive to the R&D tax credit is that changes in the policy over time have made it more effective. It is also possible that firms now better understand the credit’s structure than when it was first introduced, resulting in more utilization.[27] A survey of businesses following the PATH Act’s passage in 2015 suggested that reforms to the credit passed in that legislation would increase spending, but there is little further research on that issue.[28]

Regarding industry effects, a meta-analysis of firm-level studies of the effects of the tax credit found it stimulated additional investment in certain industries like the service sector and other traditionally low-tech sectors under an incremental system.[29] One study found a conflicting result—that the sensitivity of R&D spending in industries such as transportation and manufacturing is higher than in low R&D sectors like retail.[30] There is also evidence that firms with higher-growth trajectories increase investment in R&D more in response to the credit than firms with lower growth trajectories.[31]

Does Increased R&D Spending Reflect Real Investment or Reclassification of Expenses?

Evidence suggests that a significant portion of increased R&D spending may be driven by reclassification of existing activity as QREs.

Problems with the definition of QREs have lessened the effectiveness of the credit historically.[32] There is a trade-off in determining what expenses should qualify for the credit, in that a narrow definition of qualified research spending could target the program’s benefits to the kind of major innovation it is intended to support, while a broad definition of research would ease compliance and administration.

More recently, a paper published in the Journal of Accounting and Public Policy in 2019 using data from 1994 to 2012 found that creative categorization of some corporate spending as qualified R&D expenses can be an effective tax avoidance technique for companies to use.[33]

One factor that could overestimate the R&D tax credit’s impact on new research investment is that some portion of the credit might be captured by scientists themselves. In other words, the credit increases spending, but a large portion of the increase goes to higher wages for researchers. A paper from economist Austan Goolsbee, former chair of the Council of Economic Advisers, found that this may lead to an overestimate of the R&D credit’s impact on research by between 30 and 50 percent.[34] However, a 2013 National Tax Journal paper found no evidence that wage inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. had led to distortions of past estimates of R&D subsidies’ benefits.[35]

Does Increased R&D Investment Drive Useful Innovation?

Evidence from the United Kingdom’s R&D tax credit from 2006 to 2011 indicates the R&D credit caused R&D investment to increase, along with patents, even after adjusting for patent quality.[36] Additionally, the R&D investment created positive spillovers by increasing innovation among technologically related firms, even if other firms did not directly benefit from the credit. A 2018 paper on the U.S. R&D credit found projects that benefited from the credit had lower pretax profitability, but more volatile returns, suggesting innovation effects.

However, a paper from the Centre for European Economic Research found lowering tax rates generally on corporate income stimulated productive, higher-quality projects, while R&D tax credits did not generate more innovative investment.[38] This suggests reduced marginal tax rates may be a better tool for increasing innovation than tax credits.

For example, Estonia does not have an R&D tax credit (or any other tax policy mechanism) designed to increase research spending. Instead, Estonia has broadly neutral corporate taxation, allowing the full deductibility of investment and only taxes profits when they are distributed to shareholders. Partly thanks to this neutral, pro-investment approach, Estonia has been one of the most economically successful former Soviet Bloc countries.[39]

The fact that the R&D credit tends to help high-growth firms invest and grow even more suggests it’s an effective tool for generating major technological improvements with positive spillovers. However, if low-tech industries increase their R&D more than high-tech ones do, that suggests the additional innovations are marginal improvements and have smaller spillover benefits.

Administration, Compliance, and Lobbying

In 2007, the IRS designated research claims as a “Tier 1” compliance issue.[40] A report from the Office of Information and Regulatory Affairs (OIRA) in 2018 found that Form 6765 (used for the credit for increasing research activities) created 285,281 hours of compliance burden.[41] As of May 2019, the Bureau of Labor Statistics (BLS) estimated the average hourly salary of lawyers is $59.11, and we can use that to estimate the rough cost of complying with the provision.[42] A cost of $59.11 per hour for 285,281 hours equals a compliance cost of the credit of almost $16.9 million. Substantial, but insignificant compared to the credit’s annual payout of roughly $11 billion.[43] However, this ignores additional out-of-pocket expenses associated with complying with the R&D tax credit.[44]

Other methods of calculating tax compliance costs could produce a higher estimate.[45] The economist Youssef Benzarti developed a method of calculating tax compliance costs using revealed preferences. Taxpayers often forgo tax strategies that would reduce their tax burden because of the compliance costs associated with those strategies.[46]

A major issue with the tax credit is that firms that could gain from the credit choose not to use it, suggesting that the revealed preferences method would produce a much higher cost estimate.[47] A report by Pamela Sommers, a professional services senior manager with Thompson Reuters, argues it is “not uncommon for a company to leave 10% to 30% of its credit unclaimed due to the expense and difficulty of effectively documenting it.”[48]

Some have expressed concerns that the R&D credit encourages lobbying for special rules benefiting specific interest groups, adding complexity to the code. Prior to being made permanent in 2015, the credit was temporary and had to be renewed regularly, and lobbyists had plenty of opportunities to push for changes advantageous to their clients.[49] Big business may have an incentive to lobby for more complex rules, since compliance costs are more burdensome for smaller companies that do not have sophisticated tax departments.[50]

Small businesses have historically benefited less from the tax credit.[51] A Small Business Administration (SBA) study from 2013 found of the $6.9 billion allocated to the tax credit for increasing research activities, only $0.2 billion went to small businesses, or just under 3 percent of the total. Meanwhile, of the $5.4 billion in benefits of expensing for R&D, small businesses received $0.5 billion, or about 9.2 percent of the total.

Interestingly, some studies have also shown that small businesses are more responsive to R&D incentives than larger ones, even though they receive a small portion of the benefits, perhaps because of logistical constraints big businesses face to greatly increase R&D spending.[52],[53]

As mentioned, the PATH Act of 2015 made the R&D tax credit more accessible to small businesses.[54] A relatively small survey of businesses indicated that the PATH Act’s changes would lead to increased R&D spending for firms of all sizes; however, it’s not clear yet how many small firms benefited from this policy change.[55] Evidence from Canada found that small firms, especially ones with no current tax liability, increased their R&D investment 17 percent in response to changes to their R&D credit, allowing companies to claim the credit as a refund.[56]

The R&D Tax Credit and Firm Location

R&D tax credits might cause a multinational enterprise (MNE) to move its research to one jurisdiction, thus increasing research in that region, but not internationally.[57] For example, evidence from state-level R&D tax credits indicate they result in increased research spending in a particular state, but mostly by shifting R&D spending across state lines rather than inducing an overall increase.[58][59]

However, according to the evidence cited previously, the federal credit incentivizes smaller firms to increase R&D spending, and these firms aren’t capable of shifting R&D across national borders, indicating at least much of the measured effect for MNEs represents additions to R&D rather than international shifting. Furthermore, to the degree the federal credit does cause shifting of R&D operations into the U.S., at least some of the spillover benefits associated with the R&D would accrue to the U.S. economy.[60]

How to Reform the R&D Tax Credit

While effectively incentivizing R&D spending, the R&D tax credit has plenty of flaws. Its complexity may limit the ability of firms, particularly smaller firms, to access its benefits. The difficulties inherent in defining “qualified research” are not only costly to comply with and administer, but also incentivize companies to reclassify expenses as related to R&D. Nonetheless, the high social return to R&D suggests the program is worthwhile but could be improved.[61],[62],[63]

One proposal would be to replace the definition of research expenditures eligible for the R&D tax credit with the definition of research expenditures eligible for expensing, eliminating the need for balancing two separate accounting rules. As another option, the GAO has recommended eliminating the regular credit and replacing it with a modified alternative simplified credit.[64]

Another proposal from U.S. Senators Todd Young (R-IN) and Maggie Hassan (D-NH), the American Innovation and Jobs Act, would expand the credit’s benefits for startup companies by raising the maximum amount of payroll tax liability that can be offset by the R&D credit from $250,000 to $500,000 and increasing to $750,000 over the next decade.[65]

The proposal would also expand eligibility for the startup refundability portion of the credit, by raising the gross receipts threshold for eligibility from $5 million to $15 million and allowing companies to claim the startup portion of the credit for eight years after they start generating $25,000 in revenue, as opposed to five years under current law. This approach is promising for expanding the program’s benefits to more small businesses.

Cost RecoveryCost recovery refers to how the tax system permits businesses to recover the cost of investments through depreciation or amortization. Depreciation and amortization deductions affect taxable income, effective tax rates, and investment decisions. and R&D Expenses

In addition to the R&D tax credit, the ability to fully recover the cost of R&D expenses is an important aspect of the tax code for firms engaging in innovation. Under current law, firms can choose to fully deduct R&D costs from their taxable income in the year in which they are incurred.

This tax treatment ensures that firms are paying the proper amount of tax on their net income, as delaying the deduction for R&D costs would overstate profits due to inflation and the value of having cash sooner rather than later (the time value of money).[66] Ideally, all business expenses, including expenses related to investment, would be immediately deductible.

Starting in 2022, R&D expenses must be amortized over five years, rather than immediately expensed. This change is required under the TCJA and will create a headwind against new R&D investment. Research conducted outside of the U.S. must be amortized over 15 years. Firms amortizing R&D expenses must track their deductions over several years, increasing the complexity of the tax code.

Requiring R&D expenses to be amortized is highly unusual tax treatment from historical and international perspectives. The shift to amortization would mark the first time R&D expenses were not immediately deductible in the U.S. since 1954.[67] Across the OECD, countries allow either immediate expensing for R&D costs or provide even more generous treatment by providing “super-deductions” worth more than 100 percent of the value of the R&D investment.[68]

Evidence suggests that requiring R&D to be amortized would harm R&D investment. Research examining the effects of R&D expensing in the United Kingdom suggests that permitting firms to expense R&D costs produces additional R&D investment.[69]

Canceling R&D amortization has several benefits, as it makes the tax code simpler to comply with, ensures that the U.S. remains an economically attractive location for R&D investment, and does not have a large long-run revenue cost.

For policymakers seeking to encourage greater R&D investment in the U.S., canceling R&D amortization should be at the top of the priority list.

Economic, Revenue, and Distributional Effects of Canceling R&D Amortization

By allowing a full and immediate deduction for R&D expenses, firms would engage in greater investment that leads to long-run economic growth. Using the Tax Foundation General Equilibrium Model, we find the policy would boost long-run GDP by 0.1 percent, the capital stock by 0.2 percent, wages by 0.1 percent, and would lead to about 19,500 additional full-time equivalent jobs.

| Gross Domestic Product (GDP) | +0.1% |

| Gross National Product (GNP) | +0.1% |

| Capital Stock | +0.2% |

| Wage Rate | +0.1% |

| Full-Time Equivalent Jobs | +19,500 |

|

Source: Tax Foundation General Equilibrium Model, March 2021. |

|

The economic effect of canceling R&D amortization is smaller than the economic boost from broader full-expensing provisions because intellectual property is a smaller share of the overall capital stock.[70] However, intellectual property has been one of the stronger categories of capital investment over the past 20 years and canceling amortization can ensure it remains a strong contributor to investment in the future.[71]

We find that canceling R&D amortization would reduce federal revenue by about $131.3 billion from 2022 to 2031 on a conventional basis. About 75 percent of the cost is experienced over the first four years of the budget window, before reaching a steady-state cost of about $5 billion to $6 billion per year in the last half of the budget window.

When accounting for increased economic growth, canceling R&D amortization costs about $108 billion from 2022 to 2031. This is because increased economic output produces additional revenue from higher corporate and individual income as well as payrolls, offsetting part of the net cost of the tax change.

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | Total | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Conventional | -$38.6 | -$27.5 | -$18.8 | -$13.5 | -$7.4 | -$4.5 | -$4.9 | -$5.1 | -$5.3 | -$5.6 | -$131.3 |

| Dynamic | -$38.4 | -$27.1 | -$18.2 | -$12.8 | -$6.6 | -$1.5 | -$1.3 | -$1.0 | -$0.7 | -$0.4 | -$108.0 |

|

Source: Tax Foundation General Equilibrium Model, March 2021. |

|||||||||||

The cost of canceling amortization is frontloaded, as existing R&D investments and new investments are fully expensed. However, the cost declines over time as firms have fully realized their deductions and begin to pay income tax. That is, permanent R&D expensing would be mostly a timing shift for federal revenue, as the long-run cost is much lower than the initial cost.[72]

The shape of the revenue impact of canceling R&D amortization should also inform decisions about whether to merely delay the shift to amortization. By making full expensing for R&D costs a temporary provision (or, even worse, an ongoing “tax extender”), the upfront revenue costs would dominate and obscure the declining pattern of revenue costs under permanent expensing.

Furthermore, temporary tax policy does not produce long-run economic benefits because firms do not have certainty over whether the provision will be in effect in the future. Instead, temporary policy can lead firms to change the timing of investment to take advantage of the temporary tax change.[73] From both a revenue and economic perspective, it would be better to make the cancellation permanent, capturing both the benefit of long-run growth and the lower long-run revenue cost.

Distributionally, canceling R&D amortization would increase after-tax incomes across all income levels. Using the Tax Foundation General Equilibrium Model, we find that after-tax incomes would increase by about 0.35 percent in 2022.

By 2031, after-tax incomes are higher, but by a smaller margin than in 2022. That is because by 2031, the revenue cost of the change is lower as firms are only deducting new investments, resulting in a smaller tax cut relative to 2022.

In the long run, after-tax incomes rise by about 0.12 percent overall, 0.11 percent for the bottom 20 percent of earners, and 0.2 percent for the top 1 percent of earners.

| Income Quintile | Conventional, 2022 | Conventional, 2031 | Dynamic, Long-Run |

|---|---|---|---|

| 0% to 20% | +0.18% | +0.02% | +0.11% |

| 20% to 40% | +0.13% | +0.01% | +0.11% |

| 40% to 60% | +0.15% | +0.01% | +0.11% |

| 60% to 80% | +0.15% | +0.01% | +0.10% |

| 80% to 100% | +0.50% | +0.05% | +0.14% |

| 80% to 90% | +0.17% | +0.01% | +0.10% |

| 90% to 95% | +0.23% | +0.02% | +0.11% |

| 95% to 99% | +0.42% | +0.04% | +0.13% |

| 99% to 100% | +1.12% | +0.10% | +0.20% |

| TOTAL | +0.35% | +0.03% | +0.12% |

|

Source: Tax Foundation General Equilibrium Model, March 2021. |

|||

Canceling the upcoming amortization of R&D expenses would pair well with reforming the R&D tax credit. It should also be considered in the context of increased R&D spending by the federal government, as allowing amortization to take effect would undermine the very goal of that spending.

Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. for R&D costs could be one of several tax changes that could contribute to research in sustainable energy, climate change mitigation, and retrofitting of our aging capital stock.[74] It would also be an important policy change to keep the U.S. competitive amongst the OECD and with China, which provides a “super-deduction” for eligible investments in R&D.[75]

Conclusion

Building a more innovative ecosystem within the United States will continue to be a pressing matter for policymakers over the coming years. As part of this effort, it is important to ensure the tax system does not become a headwind to R&D activity by making it difficult to navigate the R&D tax credit or delaying cost recovery for R&D expenses.

Simplifying the R&D credit, making it more accessible for smaller firms, and ensuring full cost recovery for R&D expenses by canceling the upcoming R&D amortization are three things policymakers should consider when trying to improve the tax code for R&D.

In addition to improving R&D-specific tax provisions, policymakers should also make the broader tax system pro-growth and competitive, an approach that Estonia and Sweden have pursued with success.[76] This will ensure that economic growth can be maximized across industries and activities, including for firms engaging in innovation within the U.S.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeAppendix

Calculating the R&D tax credit

Below are two examples of how an established firm and a startup firm would calculate their R&D tax credit values under the regular and the alternative simplified credit.[77]

First, consider an established firm with $100 million in gross receipts in 1984 and a growing number of gross receipts and QREs between 1984 and 2021.

| Year | Gross Receipts (millions) | QREs (millions) |

|---|---|---|

| 1984 | $100 | $5 |

| 1985 | $150 | $8 |

| 1986 | $250 | $12 |

| 1987 | $400 | $15 |

| 1988 | $450 | $16 |

| 1989 | $400 | $18 |

| 1990 | $450 | $18 |

| 2015 | $915 | $45 |

| 2016 | $1,005 | $50 |

| 2017 | $1,215 | $53 |

| 2018 | $1,465 | $60 |

| 2019 | $1,650 | $85 |

| 2020 | $1,825 | $95 |

| 2021 | $1,900 | $100 |

|

Source: Author calculations. |

||

Table 7 shows an example of the established firm taking the regular R&D credit in 2021.

| A. Total Gross Receipts from 1984-1988 (From Table 6) | $1,350 million |

| B. Total QREs from 1984-1988 (From Table 8) | $56 million |

| C. Divide QREs by Total Gross Receipts to get fixed base percentage (B/A) | 4 percent |

| D. Average Gross Receipts from previous 4 years (2017-2020) (From Table 6) | $1,539 million |

| E. Multiply average gross receipts by the fixed base percentage to get base amount for 2021 (D * C) | $62 million |

| F. QREs in 2021 (From Table 6) | $100 million |

| G. Reduce Research Expenses in 2021 by higher of base amount or 50 percent of 2021 QREs (F – E) | $38 million |

| H. Multiply by 20 percent to get R&D credit value (G* 0.20) | $7.6 million |

|

Sources: Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress,” Congressional Research Service, Mar. 3, 2015, https://www.fas.org/sgp/crs/misc/RL31181.pdf; Tax Foundation calculations. |

|

Table 8 shows how the established firm would calculate the R&D credit if the firm elected to take the alternative simplified credit in 2021.

| Current Year Research Expenses | $100 million |

| Calculate average QREs in three previous years (2018-2020) | $83 million |

| Divide by 2 (B/2) | $41.5 million |

| Subtract this amount from current year research expenses (A-C) | $58.5 million |

| Multiply by 0.14 to get R&D credit value (D * 14%) | $8.2 million |

|

Sources: Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress, Congressional Research Service, Mar. 3, 2015, https://www.fas.org/sgp/crs/misc/RL31181.pdf; Tax Foundation calculations. |

|

Now, consider a new firm, founded in 2013. Table 9 shows the startup’s gross receipts and QREs from 2013 to 2021.

| Year | Gross Receipts (millions) | QREs (millions) |

|---|---|---|

| 2013 | $30 | $35 |

| 2014 | $42 | $40 |

| 2015 | $55 | $45 |

| 2016 | $60 | $55 |

| 2017 | $210 | $65 |

| 2018 | $305 | $73 |

| 2019 | $400 | $82 |

| 2020 | $475 | $90 |

| 2021 | $600 | $105 |

|

Source: Author calculations. |

||

Table 10 shows the firm’s R&D credit calculation if it elected to take the regular R&D tax credit in 2021.

| A. Compute fixed-base percentage using the formula (for 2021, sum QREs for previous four years and divide by the sum of gross receipts for the previous four years, then multiply by 2/3) | 14.9 percent |

| B. Calculate average annual receipts of past 4 years, 2017-2020 (From Table 9) | $374.5 million |

| C. Multiply by fixed-base percentage to get the base amount (A * B) | $52 million |

| D. Subtract the larger of the base amount or 50 percent of current-year QREs from current year QREs | $52.5 million |

| E. Multiply this amount by 20 percent to calculate the regular R&D credit value (E * 0.20) | $10.5 million |

|

Sources: Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress,” Congressional Research Service, Mar. 3, 2015, https://www.fas.org/sgp/crs/misc/RL31181.pdf; see also Daniel Karnis, “How the R&D Credit is Calculated,” Journal of Accountancy (Mar. 1, 2010), https://www.journalofaccountancy.com/news/2010/mar/rdcredit.html. |

|

Table 11 shows how the new firm would calculate the R&D credit if the firm elected to take the alternative simplified credit in 2021.

| A. Calculate average QREs for three previous years (2018-2020) (From Table 9) | $82 million |

| B. Divide average QREs by 2 (A / 2) | $41 million |

| C. Subtract this amount from QREs from current year (2021) (B – 2021 QREs in Table 11) | $64 million |

| D. Multiply the excess QRE amount by 14 percent to get alternative R&D credit value (C * 0.14) | $9 million |

|

Source: Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress,” Congressional Research Service, Mar. 3, 2015, https://www.fas.org/sgp/crs/misc/RL31181.pdf. |

|

/research/all/federal/research-and-development-tax/

[1] Robert M. Solow, “Perspectives on Growth Theory,” Journal of Economic Perspectives 8:1 (Winter 1994), www.https://www.pubs.aeaweb.org/doi/pdfplus/10.1257/jep.8.1.45; see also Paul M. Romer, “Endogenous Technological Change,” Journal of Political Economy 98:5 (October 1990), www.jstor.org/stable/2937632.

[2] Sheila Campbell and Chad Shirley, “Estimating the Long-Term Effects of Federal R&D Spending: CBO’s Current Approach and Research Needs,” Congressional Budget Office, June 21, 2018, https://www.cbo.gov/publication/54089.

[3] William D. Nordhaus, “Schumpeterian Profits in the American Economy: Theory and Measurement,” National Bureau of Economic Research, Working Paper No. 10433, April 2004, https://www.nber.org/papers/w10433.pdf.

[4] Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022,” Oct. 4, 2018, https://www.jct.gov/publications.html?id=5148&func=startdown.

[5] Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress,” Congressional Research Service, June 18, 2016, https://www.everycrsreport.com/files/20160618_RL31181_ac919b4772ff5f454f8cedd2dd7aa8b290950a41.pdf.

[6] Ibid.

[7] Ibid.

[8] Government Accountability Office, “The Research Tax Credit’s Design and Administration Can Be Improved,” Nov. 6, 2009, https://www.gao.gov/products/gao-10-136.

[9] Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress.”

[10] Ibid.

[11] Daniel Bunn, “Tax Subsidies for R&D Spending and Patent Boxes in OECD Countries,” Tax Foundation, Mar. 17, 2021, https://www.taxfoundation.org/rd-tax-credit-rd-tax-subsidies-oecd/.

[12] Internal Revenue Service, “Qualified Small Business Payroll Tax Credit for Increasing Research Activities,” https://www.irs.gov/businesses/small-businesses-self-employed/qualified-small-business-payroll-tax-credit-for-increasing-research-activities.

[13] Yair Holtzman, “U.S. Research and Development Tax Credit,” The CPA Journal, October 2017, https://www.cpajournal.com/2017/10/30/u-s-research-development-tax-credit/.

[14] Ibid.

[15] Ibid.

[16] Robert Bellafiore, “Amortizing Research and Development Expenses Under the Tax Cuts and Jobs Act,” Tax Foundation, Feb. 5, 2019, https://www.taxfoundation.org/research-development-expensing-tcja/.

[17] Office of Tax Analysts, “Research and Experimentation (R&E) Credit,” U.S. Department of Treasury, Oct. 12, 2016, https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/RE-Credit.pdf.

[18] Ibid.

[19] Richard Ray and Nicholas C. Lynch, “Qualifying Expenses for the Expanded Research and Development Tax Credit: A Closer Look at the TCJA Impact,” The CPA Journal, November 2019, https://www.cpajournal.com/2019/11/18/qualifying-expenses-for-the-expanded-research-and-development-credit/.

[20] Jennie S. Stathis, “The Research and Development Tax Credit Has Stimulated Some Additional Research Spending,” Government Accountability Office, Sept. 5, 1989, http://archive.gao.gov/d26t7/139607.pdf.

[21] Joseph J. Cordes, “Tax Incentives and R&D Spending: A Review of the Evidence,” Research Policy 18:3 (June 1989), https://www.sciencedirect.com/science/article/pii/0048733389900012.

[22] Bronwyn Hall and John Van Reneen, “How Effective Are Fiscal Incentives For R&D? A Review of the Evidence,” Research Policy 29:4-5 (April 2000), https://www.sciencedirect.com/science/article/pii/S0048733399000852.

[23] Sanjay Gupta, Yuhchang Hwang, and Andrew Schmidt, “Structural Change in the Research and Experimentation Tax Credit: Success or Failure,” National Tax Journal 64:2 (June 2011), http://www.ntanet.org/NTJ/64/2/ntj-v64n02p285-322-structural-change-research-experimentation.pdf?v=%CE%B1.

[24] Andrew C. Chang, “Tax Policy Endogeneity: Evidence from R&D Tax Credits,” Economics of Innovation and New Technology, 27:8 (Jan. 12, 2018), https://www.tandfonline.com/doi/abs/10.1080/10438599.2017.1415001?journalCode=gein20.

[25] Nirupama Rao, “Do Tax Credits Stimulate R&D Spending? The Effect of the R&D Tax Credit in its First Decade,” Journal of Public Economics 140 (August 2016), https://www.wagner.nyu.edu/files/faculty/publications/do-tax-credits-stimulate-r-d-spending.pdf.

[26] Russell Thomson, “The Effectiveness of R&D Tax Credits,” The Review of Economics and Statistics 99:3 (July 1, 2017), https://www.mitpressjournals.org/doi/abs/10.1162/REST_a_00559?journalCode=rest&. The same paper found that in the short run, a 10 percent change in the tax price of investment in R&D leads to a 5 percent change in R&D expenditures. The difference between the short-run and long-run elasticity of R&D spending is explained by adjustment costs: firms take time to change long-term research plans.

[27] Joint Committee on Taxation, “Tax Incentives for Research, Experimentation, and Innovation,” Sept. 16, 2011, https://www.jct.gov/publications.html?func=startdown&id=4358.

[28] Yair Holtzman, “The U.S. Research and Development Credit.”

[29] Fulvio Castellacci and Christine Mee Lie, “Do the Effects of R&D Tax Credits Vary Across Industries? A Meta-Regression Analysis,” Research Policy 44:4 (May 2015), https://www.sciencedirect.com/science/article/pii/S0048733315000128.

[30] Nirupama Rao, “Do Tax Credits Stimulate R&D Spending.”

[31] C.W. Swenson, “Some Tests of the Incentive Effects of the Research and Experimentation Tax Credit,” Journal of Public Economics 49:2 (November 1992), https://www.sciencedirect.com/science/article/pii/004727279290020G.

[32] Evan Wamsbey, “The Definition of Qualified Research under the Section 41 Research and Development Tax Credit: Its Impact on the Credit’s Effectiveness,” Virginia Law Review 87:1, March 2001, https://www.jstor.org/stable/1073897.

[33] Stacie K. Laplante, Hollis A. Skaife, Laura A. Swenson, and Daniel D. Wangerin, “Limits of Tax Regulation: Evidence from Strategic R&D Classification and the R&D Tax Credit,” Journal of Accounting and Public Policy 38:2 (March-April 2019), https://www.sciencedirect.com/science/article/pii/S0278425419300651.

[34] Austan Goolsbee, “Does Government R&D Policy Mainly Benefit Scientists and Engineers,” American Economic Review 88:2 (May 1998), https://www.nber.org/papers/w6532.

[35] Russell Thomson and Paul Jensen, “The Effects of Government Subsidies on Business R&D Employment: Evidence From OECD Countries,” National Tax Journal 66:2 (June 2013), https://www.ntanet.org/NTJ/66/2/ntj-v66n02p281-310-effects-government-subsidies-business-rd.pdf?v=%CE%B1.

[36] Antoine Dechezleprêtre, Elias Einiö, Ralf Martin, Kieu-Trang Nguyen, and John Van Reneen, “Do Tax Incentives for Research Increase Firm Innovation? An RD Design for R&D,” National Bureau of Economic Research, Working Paper No. 22405, July 2016, https://www.nber.org/papers/w22405.pdf.

[37] Wei-Chuan Kao, “Innovation Quality of Firms with the Research and Development Tax Credit,” Review of Quantitative Finance and Accounting 51 (2018), https://link.springer.com/article/10.1007/s11156-017-0661-x.

[38] Christof Ernst, Katharina Richter, and Nadine Riedel, “Corporate Taxation and the Quality of Research and Development,” Centre for European Economic Research Discussion Paper No. 13-010 (2013), http://www.ftp.zew.de/pub/zew-docs/dp/dp13010.pdf.

[39] Mart Laar, “The Estonian Economic Miracle,” The Heritage Foundation, Aug. 7, 2007, https://www.heritage.org/report/the-estonian-economic-miracle,

[40] Nirupama Rao, “Ending the R&D Tax Credit Stalemate,” Penn Wharton Public Policy Initiative Book 34, April 2015, https://www.repository.upenn.edu/cgi/viewcontent.cgi?article=1027&context=pennwhartonppi.

[41] Office of Information and Regulatory Affairs, “Credit for Increasing Research Activities,” Information Collection Review, Apr. 30, 2018, https://www.reginfo.gov/public/do/PRAViewICR?ref_nbr=201712-1545-005.

[42] U.S. Bureau of Labor Statistics, “Occupational Employment and Wage Statistics: May 2019 Occupation Profiles,” https://www.bls.gov/oes/2019/may/oes_stru.htm. .

[43] Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022,” Oct. 4, 2018, https://www.jct.gov/publications.html?id=5148&func=startdown.

[44] Erica York and Alex Muresianu, “Reviewing Different Methods of Calculating Tax Compliance Costs,” Tax Foundation, Aug. 21, 2018, https://www.taxfoundation.org/different-methods-calculating-tax-compliance-costs/.

[45] Ibid.

[46] Youssef Benzarti, “How Taxing is Tax Filing: Using Revealed Preferences to Estimate Compliance Costs,” National Bureau of Economic Research, Working Paper No. 23903, October 2017, https://www.nber.org/papers/w23903.

[47] Nirupama Rao, “Ending the R&D Tax Credit Stalemate.”

[48] Pamela Sommers, “The Ripple Effects of an R&D Tax Credit Study’s Real Costs,” Thomson Reuters, accessed Apr. 10, 2021, https://www.silo.tips/download/the-ripple-effect-of-an-rd-tax-credit-study-s-real-costs.

[49] Harry Gural, Frank Clemente, Tam Doan, and Erin Weiler, “Corporate Lobbying on Tax Extenders and the GE Loophole,” Americans for Tax Fairness, March 2014, https://www.americansfortaxfairness.org/files/Corporate-Lobbying-on-Tax-Extenders-and-the-GE-Loophole.pdf.

[50] Rosemary Marcuss, George Contos, John Guyton, Patrick Langetieg, Allen Lerman, Susan Nelson, Brenda Schafer, and Melissa Vigil, “Income Taxes and Compliance Costs: How Are They Related,” National Tax Journal 66:4 (December 2013), http://www.ntanet.org/NTJ/66/4/ntj-v66n04p833-854-income-taxes-compliance-costs.pdf?v=%CE%B1.

[51] John O’Hare, Mary Schmitt, and Judy Xanthopoulos, “Measuring the Benefit of Federal Tax Expenditures Used by Small Business,” Small Business Administration, Office of Advocacy, November 2013, https://www.novoco.com/sites/default/files/atoms/files/measuring_tax_expenditures_111113.pdf; see also Garrett Watson, “Tax Expenditures Taken by Small Businesses in the Federal Tax Code,” Tax Foundation, Aug. 5, 2019, https://www.taxfoundation.org/small-business-tax-expenditures/,

[52] Nirupama Rao, “Do Tax Credits Stimulate R&D Spending.”

[53] Fulvio Castellacci and Christine Mee Lie, “Do the Effects of R&D Tax Credits Vary Across Industries? A Meta-Regression Analysis.”

[54] Center for American Entrepreneurship, “Restore the Research and Development Credit to the Most Favorable in the World,” Center for American Entrepreneurship, Policy Agenda, https://www.startupsusa.org/issues/innovation/.

[55] Yair Holtzman, “U.S. Research and Development Tax Credit.”

[56] Ajay Agrawal, Carlos Rosell, and Timothy Simcoe, “Tax Credits and Small Firm R&D Spending,” American Economic Journal: Economic Policy 12:2 (May 2020), https://www.aeaweb.org/articles?id=10.1257/pol.20140467.

[57] Bodo Knoll, Nadine Riedel, Thomas Schwab, Maximilian Todtenhaupt, and Johannes Voget, “Cross-Border Effects of R&D Tax Incentives,” SSRN Electronic Journal, Oct. 11, 2019, https://www.papers.ssrn.com/sol3/papers.cfm?abstract_id=3484384.

[58] Yonghong Wu, “The Effects of State R&D Tax Credits in Stimulating Private R&D Expenditure: A Cross-State Empirical Analysis,” Journal of Policy Analysis and Management 24:4 (Sept. 1, 2005), https://www.onlinelibrary.wiley.com/doi/abs/10.1002/pam.20138.

[59] Daniel J. Wilson, “Beggar Thy Neighbor? The In-State, Out-of-State, and Aggregate Effects of R&D Tax Credits,” The Review of Economics and Statistics 91:2 (May 2009), https://www.mitpressjournals.org/doi/abs/10.1162/rest.91.2.431.

[60] Rob Atkinson, “On Tax Incentives,” American Compass, June 8, 2020, https://www.americancompass.org/essays/on-tax-incentives/.

[61] Joe Kennedy and Robert D. Atkinson, “Why Expanding the R&D Tax Credit Is Key to Successful Corporate Tax Reform,” Information Technology and Innovation Foundation, July 2017, http://www2.itif.org/2017-rd-tax-credit.pdf.

[62] Jose Trejos, “If Retained, R&D Tax Credit Should Be Reformed,” Tax Foundation, July 20, 2017, https://www.taxfoundation.org/rd-tax-credit-reform/.

[63] Jason J. Fichtner, “Can a Research and Development Tax Credit Be Designed for Economic Efficiency,” Mercatus Center, July 14, 2015, https://www.mercatus.org/publications/government-spending/can-research-and-development-tax-credit-be-properly-designed.

[64] Government Accountability Office, “The Research Tax Credit’s Design and Administration Can Be Improved.”

[65] Office of Senator Tom Young, “Senators Young, Hassan Introduce American Innovation and Jobs Act,” Oct. 20, 2020, https://www.young.senate.gov/newsroom/press-releases/senators-young-hassan-introduce-american-innovation-and-jobs-act-.

[66] Erica York, “DepreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. Requires Businesses to Pay Tax on Income That Doesn’t Exist,” Tax Foundation, May 21, 2019, https://www.taxfoundation.org/depreciation-business-capital-investment/.

[67] Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress.”

[68] Daniel Bunn, “Tax Subsidies for R&D Spending and Patent Boxes in OECD Countries.”

[69] Dennis R. Oswald, Ana Vidolovska Simpson, and Paul Zarowin, “Capitalization vs Expensing and the Behavior of R&D Expenditures,” SSRN Electronic Journal, Feb. 17, 2019, https://www.papers.ssrn.com/sol3/papers.cfm?abstract_id=2733838.

[70] Erica York, “Details and Analysis of The CREATE JOBS Act,” Tax Foundation, July 30, 2020, https://www.taxfoundation.org/details-analysis-create-jobs-act/.

[71] François Gourio, “Has Business Fixed Investment Really Been Unusually Low?” Chicago Fed Letter, No. 418, Federal Reserve Bank of Chicago, 2019, https://www.chicagofed.org/publications/chicago-fed-letter/2019/418

[72] Kyle Pomerleau and Scott Greenberg, “Full Expensing Costs Less Than You’d Think,” Tax Foundation, June 13, 2017, https://www.taxfoundation.org/full-expensing-costs-less-than-youd-think/.

[73] Erica York, “Navigating the 2020 Tax Extenders in the Pandemic Economy,” Tax Foundation, Dec. 1, 2020, https://www.taxfoundation.org/expiring-tax-provisions-2020-tax-extenders/.

[74] See Alex Muresianu, “How Expensing for Capital Investment Can Accelerate the Transition to a Cleaner Economy,” Tax Foundation, Jan 12. 2021, https://www.taxfoundation.org/energy-efficiency-climate-change-tax-policy/.

[75] KPMG, “R&D Expenses Super Deduction rate to be increased to 75% for all enterprises,” China Tax Alert, Issue 17, July 2018, https://www.home.kpmg/cn/en/home/insights/2018/07/china-tax-alert-17.html.

[76] Daniel Bunn, “Tax Subsidies for R&D Spending and Patent Boxes in OECD Countries.”

[77] Examples are adapted from Gary Guenther, “Research Tax Credit: Current Law and Policy Issues for the 114th Congress.”

Share this article