Opening Day for baseball was scheduled for March 26, an annual sports holiday celebrated across the country as it represents a clean slate for millions of fans. This time, March 26 came and went with no opening day games—the coronavirus pandemic has postponed all major sports leagues in an effort to limit the spread of the outbreak. This is not just bad news for sports fans and sports journalists and the athletes and the teams—it is bad news for several states’ excise tax collections.

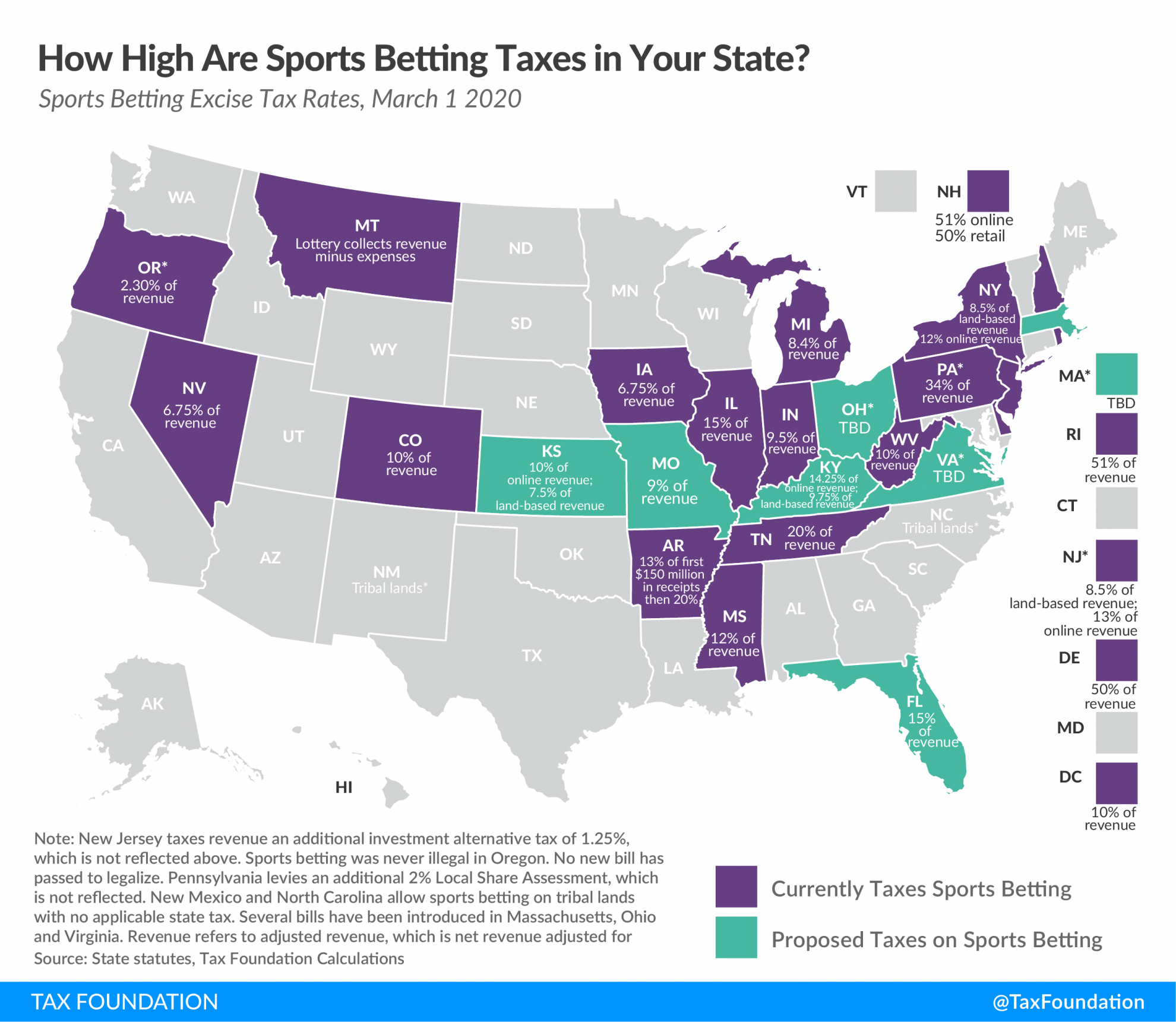

Since the Supreme Court’s 2018 decision in Murphy v. National Collegiate Athletic Association overturned the federal ban on sports betting, several states have legalized betting and introduced excise taxes on the revenues. Sports betting is now legal in 20 states and the District of Columbia. Of those 21 jurisdictions, 14 have established active sports betting enterprises. With almost all sports postponed globally, sports betting is practically nonexistent and as such, states will not be receiving any sports betting excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue.

In the U.S., major sports leagues have postponed games and events with a few exceptions: horse racing remains open for business, but the tracks are closed to the general public. UFC (mixed martial arts) is planning to move ahead with fights without spectators. In Europe, all soccer leagues except the Belarussian league have stopped games. Major sporting events such as the European Soccer Championship and the Olympics have been postponed—possibly to 2021.

These cancellations have prompted television stations to show reruns of old sporting events, and while this might satisfy some sports fans, it certainly does not offer any betting opportunities.

All states with statewide sports betting levy an excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on the adjusted revenue (revenue after winnings are paid out). This revenue is sometimes appropriated for specific government programs (see table below).

However, it generally is ill-advised to earmark revenue from an excise tax to unrelated spending priorities due to the narrow design of excise taxes. As excise taxes are often designed to capture the cost of externalities arising from the activity being taxed, appropriations should reflect that logic. In the case of sports betting, an obvious related priority would be programs that fund gambling addiction treatment and prevention.

Appropriating revenues to general spending priorities can be problematic because high excise taxes applied to small tax bases are volatile, making it difficult to sufficiently fund designated priorities from year to year. The extreme case triggered by the coronavirus pandemic serves as a reminder of why revenue for government spending priorities should be raised with the broadest possible bases and low rates.

| State | Tax Rate | Projected Revenue FY2020 | Appropriations |

|---|---|---|---|

| Arkansas | 13% of first $150 million in receipts, then 20% | Not published | General Fund |

| Colorado | 10% of revenue | $6.5 million | Colorado Water Plan |

| Delaware | 50% of revenue | Not published | General Fund |

| District of Columbia | 10% of revenue | $26 million | Gambling addiction, Neighborhood Safety, and childcare programs |

| Illinois | 15% of revenue | Up to $200 million | Capital Projects Fund (improvements to roads, bridges, mass transit, schools, universities) |

| Indiana | 9.5% of revenue | $8.9 million | General Fund, cities and counties, gambling addiction services |

| Iowa | 6.75% of revenue | $630,000-$1.8 million | Deposited in separate Sports Wagering Fund |

| Michigan | 8.4% of revenue | $15.8 million | 30% to the city housing the casino, to be used for local purposes as described in the bill; 55% to the state to be deposited into the Sports Betting Fund, described below; 5% to the State School Aid Fund; 5% to the Michigan Transportation Fund; and 5% to the Michigan Agriculture Equine Industry Development Fund. |

| Mississippi | 12% of revenue | $5 million | General Fund, but $3 million distributed to a separate state highway fund |

| Montana | Lottery collects revenue minus expenses | $3.8 million | First $12.4 million goes to the General Fund; excess directed to STEM scholarship fund |

| Nevada | 6.75% of revenue | Not published | General Fund |

| New Hampshire | 51% online; 50% retail | $1.5 million-$7.5 million (FY2021) | Education Trust Fund, gambling addiction services |

| New Jersey (a) | 8.5% of land-based revenue; 13% of online revenue | $12 million-$17 million | Casino Revenue Fund, General Fund, Atlantic City Marketing/Promotion, compulsive gambling |

| New Mexico | Tribal Lands | N/A | N/A |

| New York | 10% of revenue | Not published | Special Fund |

| North Carolina | Tribal Lands | N/A | N/A |

| Oregon (b) | 2.3% | N/A | N/A |

| Pennsylvania (c) | 34% of revenue | $28 million | General Fund |

| Rhode Island | 51% of revenue | $30 million | General Fund |

| Tennessee | 20% of revenue | $2.975 million | Education, General Fund, and substance abuse prevention |

| West Virginia | 10% of revenue | $5 million | First $15 million to the Lottery Fund (dedicated to education, seniors, and tourism); additional revenue directed to the Public Employees Insurance Agency, and Financial Stability Fund |

|

Source: State statutes, bill fiscal notes, budget documents, Tax Foundation calculations. (a) New Jersey taxes revenue an additional investment alternative tax of 1.25 percent, which is not reflected in these figures. Revenue refers to adjusted revenue, which is net revenue adjusted for winnings. Projections may include license fees, when separate numbers are not available. Illinois projection includes 10 license fees, each costing $20 million and no tax revenue. |

|||

Among the appropriations listed above, there are several spending priorities like education, water projects, childcare, and road projects with no obvious connection to sports betting. In the current economic crisis, these programs stand to lose funding as the revenue from sports betting dries up. That will either result in programs being suspended or funding moving from the general fund to cover the deficit—an undesirable consequence at a time when states will raise less revenue than projected due to social distancing, shelter-in-place-orders, and quarantines.

While many states overestimated their original revenue forecast for sports betting taxes, none would have bet on collecting basically nothing in revenue for a prolonged period. Notwithstanding the extreme consequences of a pandemic, lessons about excise taxes can still be learned. Taxes on wagers is not a long-term solution to fix budget woes. States should rely on broad-based, low-rate taxes instead. Policymakers in states poised to legalize sports betting should keep this in mind when designing tax regimes.

Share this article