This study was published in collaboration with the Badger Institute of Wisconsin. The Badger Institute is a nonpartisan, not-for-profit institute established in 1987 working to engage and energize Wisconsinites on key public policy issues critical to the state’s future, growth, and prosperity.

Key Findings:

- On June 21, 2018, the U.S. Supreme Court handed down a landmark decision in South Dakota v. WayfairSouth Dakota v. Wayfair was a 2018 U.S. Supreme Court decision eliminating the requirement that a seller have physical presence in the taxing state to be able to collect and remit sales taxes to that state. It expanded states’ abilities to collect sales taxes from e-commerce and other remote transactions. , Inc., expanding states’ authority to require out-of-state businesses (primarily online retailers) to collect and remit sales taxes on transactions involving in-state residents.

- In its decision, the Supreme Court overturned longstanding legal precedent that previously limited states’ online sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. collection authority to sellers with property or employees (“physical presence”) in a given state.

- The Wisconsin Department of Revenue has announced plans to issue a remote sales taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rule that complies with Wayfair and to begin remote sales tax collection effective October 1, 2018.

- Expanded remote sales tax collection is expected to bring in $90 million in additional sales and use tax revenue for Wisconsin in 2018-2019, followed by $120 million annually in subsequent years. In addition, remote sellers will be required, where applicable, to collect local sales taxes and the Southeast Wisconsin Professional Baseball Park District sales tax. Expanded online collection of these taxes is expected to generate a total of $7.7 million in local revenue in 2018-2019 and $10.3 million in 2019-2020.

- In 2013, the Wisconsin legislature enacted a law requiring the state to reduce state individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rates across the board in proportion to any new revenue generated from expanded online sales tax collection.

- As the state prepares to authorize expanded online sales tax collection in compliance with Wayfair, Wisconsin lawmakers have the opportunity to expand upon the 2013 law and dedicate any new revenue toward permanent, comprehensive tax reform.

- Academic research consistently finds that broad-based, low-rate systems contribute to better economic outcomes; legislators should view this new revenue landscape as an opportunity.

- Wisconsin’s tax code is ripe for reform, and dedicating Wayfair revenue toward this purpose could help the state better compete with its neighbors, become more attractive to prospective residents and businesses, and enhance long-term economic growth.

Introduction

On June 21, 2018, the U.S. Supreme Court handed down a landmark decision in South Dakota v. Wayfair, Inc., expanding the ability of states to require out-of-state retailers to collect and remit state sales taxes on transactions involving in-state residents. The Wisconsin Department of Revenue (DOR) has announced that expanded remote sales tax collection will begin October 1, 2018, after the Department takes administrative steps necessary to ensure compliance with Wayfair. This expanded sales tax collection authority is expected to bring in approximately $90 million in additional revenue for Wisconsin in 2018-2019 and $120 million annually in subsequent years. This projection can reasonably be expected to increase as e-commerce continues to gain prominence in the national and global economies.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeCompared to many other states across the country, Wisconsin is much better prepared to adhere to the Supreme Court’s standards for constitutional collection of sales taxes on remote transactions, so Wisconsin taxpayers can reasonably expect to start seeing expanded online sales tax collection in the allotted time frame. Further, Wisconsin policymakers have already grappled with how to use any new revenue from expanded online sales tax collection authority. In 2013, when the potential for congressional action on online sales taxes seemed likely, Wisconsin policymakers enacted a law requiring the state to apply any potential new revenue to reducing state individual income tax rates.

Today, legislators have the opportunity to revisit and expand upon that contingent legislation in the current policy landscape. Wisconsin is now ripe for tax reform, and revenue from expanded remote sales tax collection should be applied towards its highest valued use: permanent, comprehensive tax reform that broadens tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. s and lowers rates.

South Dakota v. Wayfair: A Recap

In its recent Wayfair decision, the U.S. Supreme Court ruled 5-4 in favor of South Dakota.[1] The question in this case was the constitutionality of a state law requiring collection of South Dakota sales tax by out-of-state vendors for purchases shipped into the state. In its decision, the Supreme Court overturned longstanding legal precedent that previously limited states’ online sales tax collection authority to sellers with property or employees (“physical presence”) in a given state. As a result, the Wayfair decision opened the way for other states to begin similar tax collection on out-of-state sales.[2]

However, this ruling does not give states carte blanche in constructing and enforcing these collections. It’s important to note that the Court cited several structural components of South Dakota’s tax statute that were designed to prevent the law from creating an undue burden on interstate commerce. From the Court’s majority opinion:

South Dakota’s tax system includes several features that appear designed to prevent discrimination against or undue burdens upon interstate commerce. First, the Act applies a safe harbor to those who transact only limited business in South Dakota. Second, the Act ensures that no obligation to remit the sales tax may be applied retroactively….Third, South Dakota is one of more than 20 States that have adopted the Streamlined Sales and Use Tax Agreement. This system standardizes taxes to reduce administrative and compliance costs: It requires a single, state level tax administration, uniform definitions of products and services, simplified tax rate structures, and other uniform rules. It also provides sellers access to sales tax administration software paid for by the State. Sellers who choose to use such software are immune from auditA tax audit is when the Internal Revenue Service (IRS) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. liability.[3]

The favorable mention of these features signals how the Supreme Court could be expected to evaluate the constitutionality of another state’s remote sales tax law if challenged; states would be wise to follow suit, and Wisconsin has signaled its intention to do so.

With regard to the Supreme Court’s exposition of what is now being called the Wayfair “checklist,”[4] Wisconsin is far better prepared than many states to expand its online sales tax collection. For starters, like South Dakota, Wisconsin has adopted the Streamlined Sales and Use Tax Agreement and is a member of the Streamlined Sales Tax Project (SSTP), satisfying a substantial component of the Wayfair checklist by only requiring sellers to file with the state when registering to collect Wisconsin’s state and local sales taxes. Similarly, the definitions of products and services are consistent at the state and local levels, meaning if a product or service is taxable at the state level, it is also taxable at the local level for those localities which choose to levy a local sales tax. In addition, Wisconsin’s general sales tax has a limited number of rates, as compared to some states that apply a wide range of rates depending on the product or service being purchased. Finally, the state has a central electronic registration system run through the SSTP, which is available to remote sellers who register to collect the state’s sales tax.

With respect to the safe harbor component (how much business an out-of-state vendor must conduct before subject to Wisconsin sales taxes), the DOR has announced plans to modify its sales and use tax regulations to “enforce sales tax laws on remote sellers… consistent with Wayfair,” citing South Dakota’s $100,000 in sales or 200 transactions threshold.[5] Finally, Wisconsin has no plans to enforce any of these rules retroactively, and so will be prepared to proceed with remote sales tax collection as planned starting October 1, 2018.[6]

Expanded remote sales tax collection is expected to bring in $90 million in additional sales and use tax revenue for Wisconsin in 2018-2019, followed by $120 million annually in subsequent years. In addition, expanded remote collection of local sales taxes and the Southeast Wisconsin Professional Baseball Park District sales tax is expected to generate a total of $7.7 million in local revenue in 2018-2019 and $10.3 million in 2019-2020.[7] For context, Wisconsin’s total state sales and use tax collections amounted to approximately $5 billion in 2015-2016.[8]

Wisconsin Should Dedicate New Revenue Toward Its Highest Value Use

After the DOR finalizes the safe harbor regulatory change needed to begin collecting sales taxes from remote sellers, Wisconsin legislators will have the opportunity to solidify plans for how to use the new revenue.

In 2013, Wisconsin legislators demonstrated admirable foresight by including a provision in the state budget that specifies how any new revenue should be used in the event that a change in federal law results in expanded online sales tax collection authority for the state. Specifically, the provision directs the DOR, 12 months after expanded collection begins, to determine how much additional revenue has been collected and lower individual income tax rates across the board by the same amount for the following year.[9] The law is unclear as to whether such rate reductions are to be permanent or whether they would revert to their original rates, adjusted for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. , after the first year of expanded online sales tax collection. Accordingly, Wisconsin’s Legislative Fiscal Bureau suggested that additional legislation might be necessary to clarify this directive.[10]

As expanded online sales tax collection authority can be expected to result in a sustainable new stream of revenue for years to come, legislators have a unique opportunity to make permanent, pro-growth changes to the state’s individual income tax structure while simultaneously restructuring some of the more economically detrimental portions of the state’s tax code.

Between now and a year after collections begin, Wisconsin can build upon or modify the plans set forth in the 2013 budget. Specifically, the state could use the new sales tax revenue as an opportunity to enact additional tax code reforms that promote long-term economic growth.

The academic literature on taxes and growth consistently finds that both tax rates and tax structure contribute to economic outcomes. For example, Jens Arnold et al. of the Organisation for Economic Co-operation and Development (OECD) found in an extensive panel review that corporate income taxes are most harmful to growth, followed by personal income taxes, then consumption taxes, and finally property taxes.[11]

The economic literature finds graduated-rate income taxes to be particularly unproductive. The Arnold et al. study concluded that reductions in top marginal rates would be beneficial to long-term growth, and Mullen and Williams (1994) find that higher marginal tax rates reduce gross state product growth.[12] This finding even adjusts for the overall tax burden of a state, lending credence to the precept of broad bases and low rates.

Wisconsin’s Tax Code is Ripe for Reform

The Wayfair decision comes at an opportune time for Wisconsin, as strategic reforms to the state’s tax code have the potential to strengthen the state’s economy and improve its competitiveness among its regional neighbors.

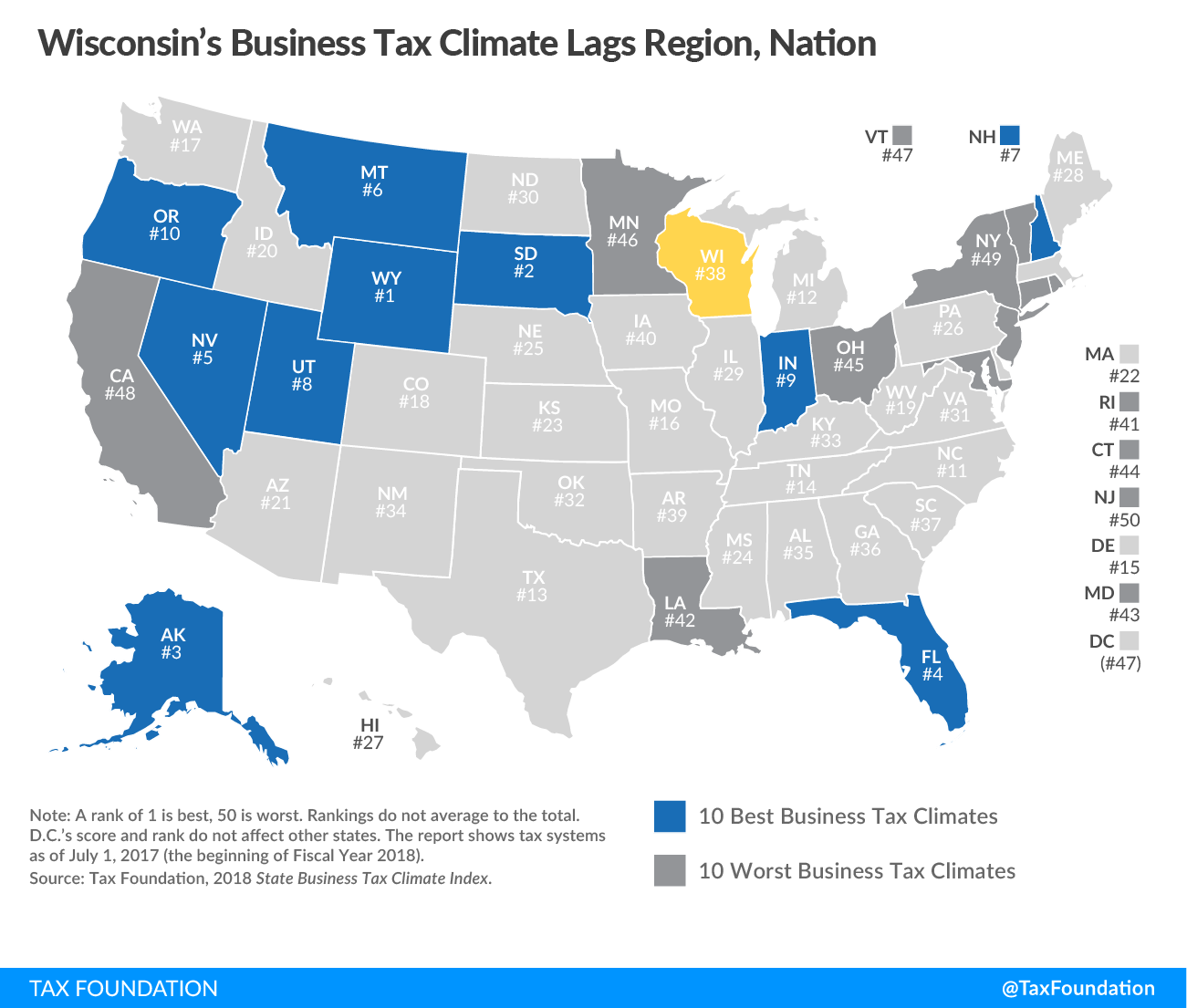

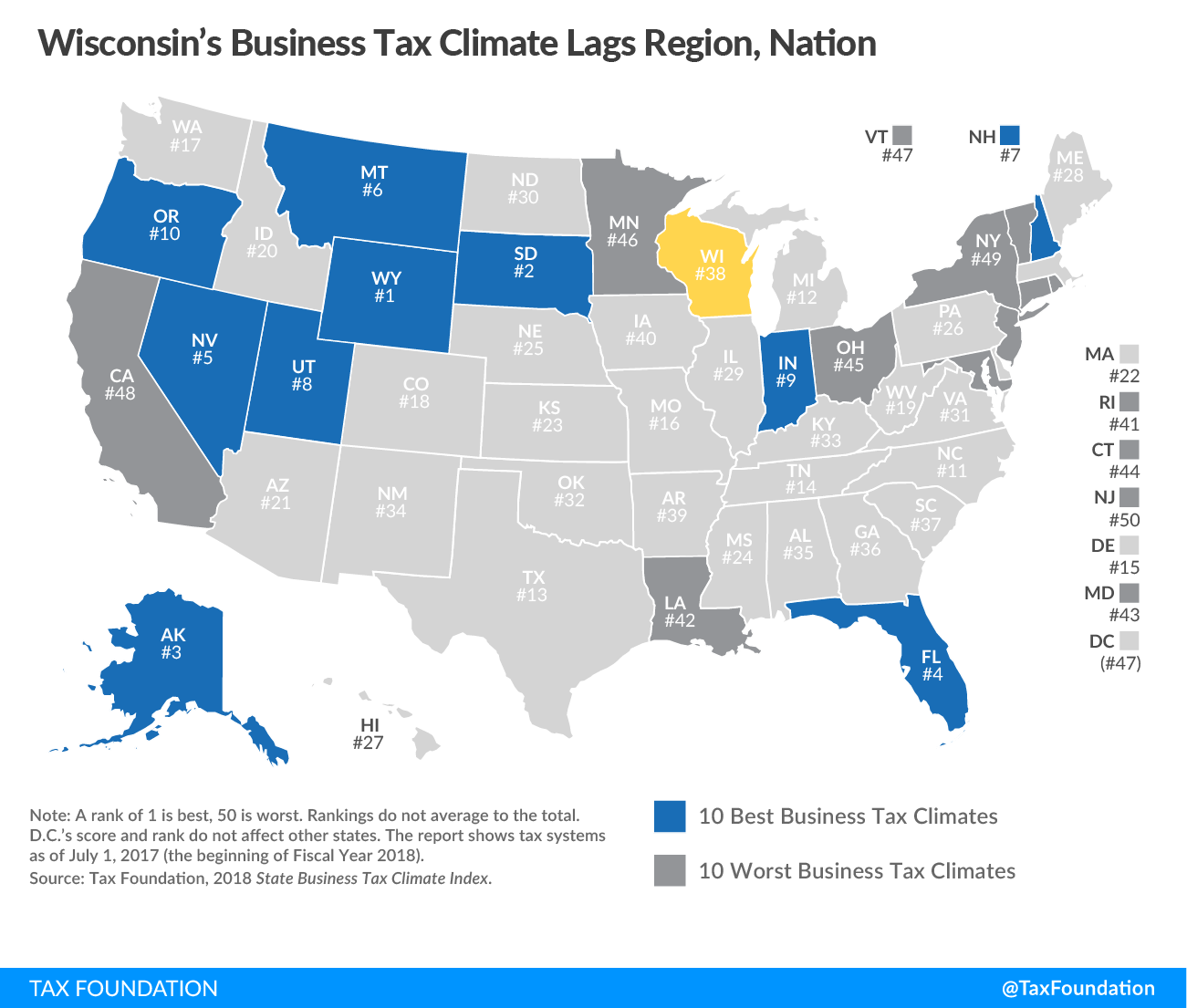

Each year, the Tax Foundation produces the State Business Tax Climate Index to enable business leaders, state policymakers, and taxpayers to gauge how these structural elements compare. The Index examines more than 100 variables in individual income tax, corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , sales tax, unemployment insurance tax, and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. categories to reduce these many complex considerations into a ranking. The map below shows each state’s 2018 Index rank; states with the 10 best and 10 worst ranks are denoted in blue and gray, respectively.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIn the most recent edition of the report, Wisconsin’s overall tax structure ranks 38th among states, leaving much to be desired.[13] The most poorly ranked element of the state’s tax system is the individual income tax, which ranks 43rd in the country, chiefly due to its relatively high top marginal rate of 7.65 percent. Another component that contributes to Wisconsin’s poor Index ranking is the top statutory corporate income tax rate of 7.9 percent, which ranks lower than some of the state’s neighbors but remains among the highest nationally. In contrast, Wisconsin’s sales tax ranks among the top 10 states due in part to its moderate rate and relative ease of administration. That ranking could be improved even further by broadening the sales tax base.

The table below shows Wisconsin’s overall Index rank, as well as its rank in each of the five individual components.

| Component | Rank |

|---|---|

|

Note: States without a tax are ranked equally as 1. Source: Tax Foundation |

|

| Overall | 38 |

| Corporate | 29 |

| Individual | 43 |

| Sales | 7 |

| Property | 26 |

| Unemployment Insurance | 40 |

Permanent, comprehensive tax reform presents an opportunity to improve these shortcomings so the state can generate a stable source of revenue to fund government services while improving economic competitiveness for years to come. Expanded online sales tax collection, when combined with other measures to simplify the tax code and broaden the tax base, affords a unique opportunity for the state to reduce tax rates while improving overall tax structure. For example, if expanded remote collection of the state sales and use tax brings in approximately $120 million each year as anticipated, that would be enough new revenue to reduce the state’s corporate income tax rate by approximately 1 percent.[14] Combined with base-broadening reforms, the potential for lowering top marginal rates could be even more impactful.

At the end of 2018, the Badger Institute and the Tax Foundation will publish a series of economically advantageous tax reform options for policymakers to consider. These proposals will be designed to help the state achieve its goal of providing individual income tax relief to taxpayers while setting the state on a path to a stronger fiscal future.

Conclusion

The landmark Wayfair decision comes at an opportune time for Wisconsin. Due to its alignment with the Supreme Court’s “checklist,” the state is well positioned to start collecting sales taxes from online transactions involving sellers in other states. With an overall tax mix that is poorly balanced and anticompetitive, this new revenue stream will make it easier to accomplish substantive, long-term reforms that benefit all Wisconsinites.

Meaningful structural changes to the state’s individual income tax, corporate income tax, and other parts of its tax code would make Wisconsin more attractive to businesses and families while improving its competitive standing among its neighbors and enhancing its role as a key player in the national economy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeNotes

[1] South Dakota v. Wayfair, Inc., 585 U.S. ___ (2018).

[2] Syllabus to Wayfair, 585 U.S. ___ at 4.

[3] Wayfair, 585 U.S. ___ at 23.

[4] See Joseph Bishop-Henchman, “Testimony: Post-Wayfair Options for Congress,” Tax Foundation, July 24, 2018, https://taxfoundation.org/post-wayfair-options-congress/; and “Supreme Court’s Wayfair Decision Offers Blueprint for States,” Center for State and Local Finance, Georgia State University, July 16, 2018, https://cslf.gsu.edu/2018/07/16/supreme-court-wayfair-dakota-nexus/.

[5] Wisconsin State Legislature, “Wisconsin Legislature: SS 079-18,” July 5, 2018, 2, https://docs.legis.wisconsin.gov/code/register/2018/751A2/register/ss/ss_079_18/ss_079_18.

[6] Id. at 3.

[7] Id.

[8] U.S. Census Bureau, “2015 State and Local Government Finances,” http://www.census.gov/govs/local/.

[9] 2013 Wisconsin Act 20, Section 1460d. 73.03 (71)(a).

[10] Wisconsin Legislative Fiscal Bureau, “South Dakota v. Wayfair, Inc. – Sales and Use Tax Collections on Remote Sales,” July 2, 2018, http://docs.legis.wisconsin.gov/misc/lfb/misc/165_south_dakota_v_wayfair_inc_sales_and_use_tax_collections_on_remote_sales_7_2_18.pdf.

[11] Jens Matthias Arnold, Bert Brys, Christopher Heady, Åsa Johannsson, Cyrille Schwellnus, and Laura Vartia, “Tax Policy for Economic Recovery and Growth,” The Economic Journal 121:550 (February 2011).

[12] John K. Mullen and Martin Williams, “Marginal Tax RateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. s and State Economic Growth,” Regional Science and Urban Economics 24:6 (December 1994).

[13] Jared Walczak, Scott Drenkard, and Joseph Bishop-Henchman, 2018 State Business Tax Climate Index, Tax Foundation, October 17, 2017, https://taxfoundation.org/state-business-tax-climate-index-2018/.

[14] Tax Foundation calculations; corporate tax collections for Wisconsin totaled $920.9 million in state fiscal year 2017.

Share