Morgan Stanley, six years after getting bailed out by taxpayers, is now doing research on inequality. The former investment bank released a report last week that attributes growing inequality to many factors, including taxes:

Though taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policies are still largely supportive of lower income groups, they have become less progressive over time.

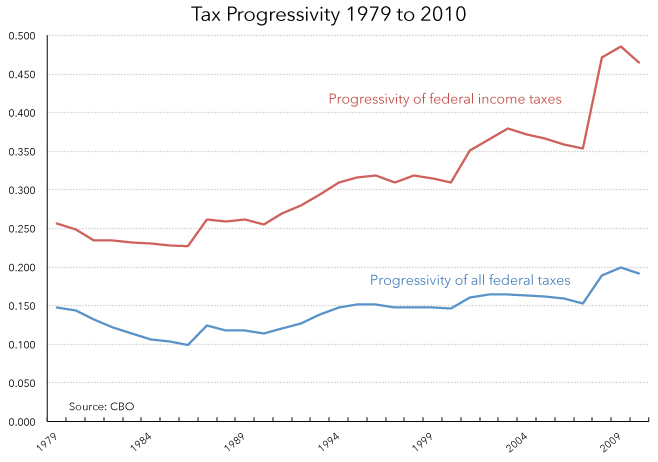

Wrong. The chart below, from CBO data, indicates that progressivity has roughly doubled since the 1980s, both in terms of the federal income tax and federal taxes as a whole. This is mainly due to the introduction and expansion of various tax preferences for low- and middle-income households, particularly the refundable earned income tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. and child credit.

As a result, the CBO finds that the bottom 40 percent of households have negative income tax rates. As the second chart illustrates, effective tax rates for the bottom 80 percent of households have been going down since the 1980s, while effective tax rates for the top 20 percent have stayed roughly the same.

Lastly, comparing across countries indicates the U.S. has one of the most progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. systems in the developed world. For instance, our tax system is more progressive than that found in the U.K., Germany, Sweden, and all of the Scandinavian countries.

For more on inequality, see our recent reports here, here and here.

Follow William McBride on Twitter

Share this article