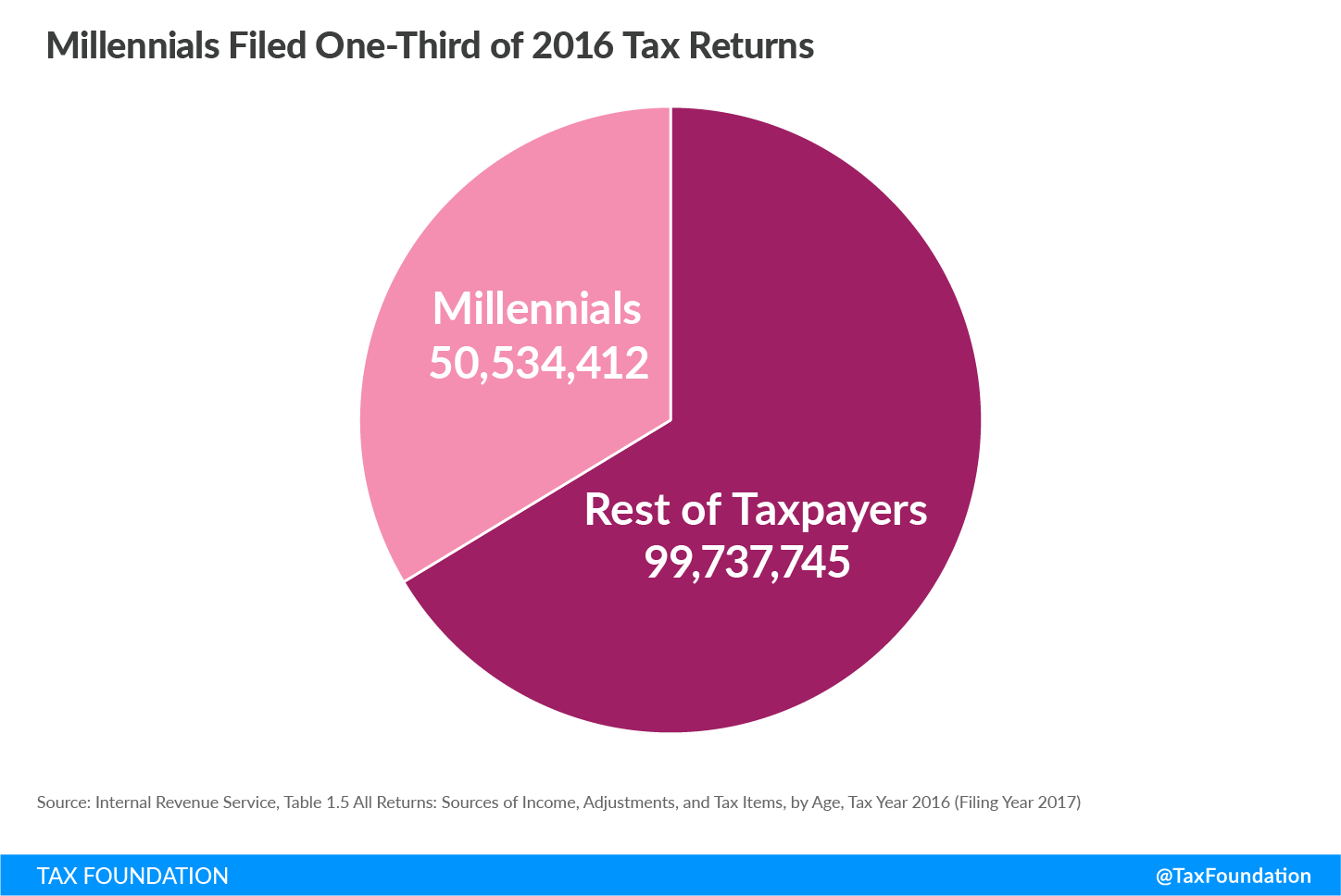

New data released by the Internal Revenue Service (IRS) lets us see how Americans earned their taxable income in 2016. Using this data, we can see which sources of reported income were the largest as well as other taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. -related characteristics by age group. Millennials (defined here as age 18 under age 35 in 2016) filed 50.5 million tax returns in 2016, accounting for one-third of all returns filed that year.

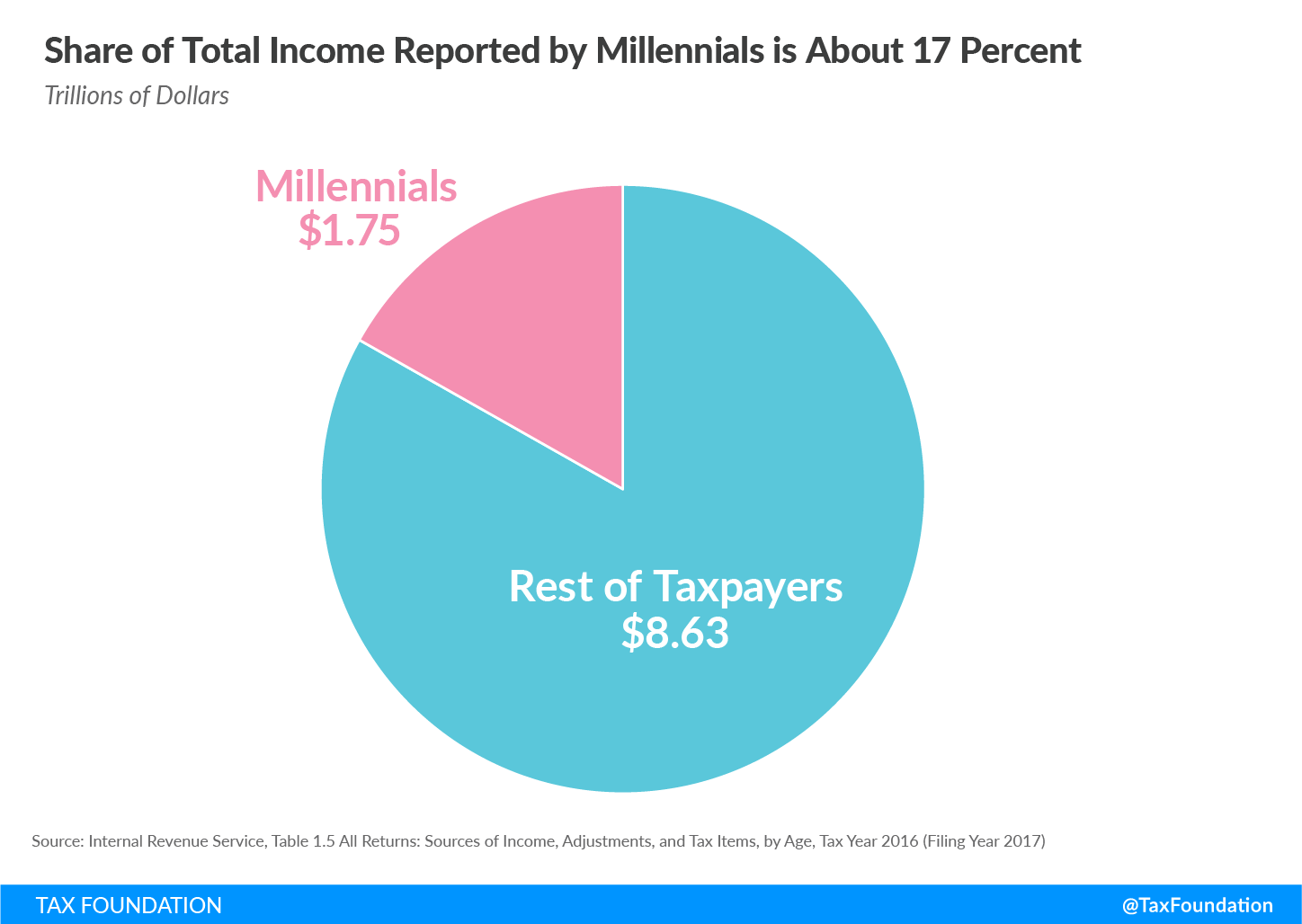

On those 50 million tax returns, millennials reported $1.75 trillion in total income. This makes up about 17 percent of all income reported in 2016, smaller than this age group’s share of tax returns filed (33 percent). This difference, one-third of returns reporting just 17 percent of total income, shows that millennials earn less than other taxpayers, on average.

This makes sense because younger individuals are still working on their education, building their careers, and gaining skills and experience. Income changes with age, generally arcing in an inverted U-like shape over the course of an individual’s life—a large portion of taxpayers who earn low incomes in a particular year will earn higher incomes when they are older.

Wages and salaries made up 93 percent of millennials’ total income, making it their largest source of income, at $1.63 trillion. The next largest income source for millennials in 2016 was business net income at $53.4 billion (13.7 percent of all business net income) followed by partnership and S corporation net income at $31.6 billion (4.2 percent of all partnership and S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). net income).

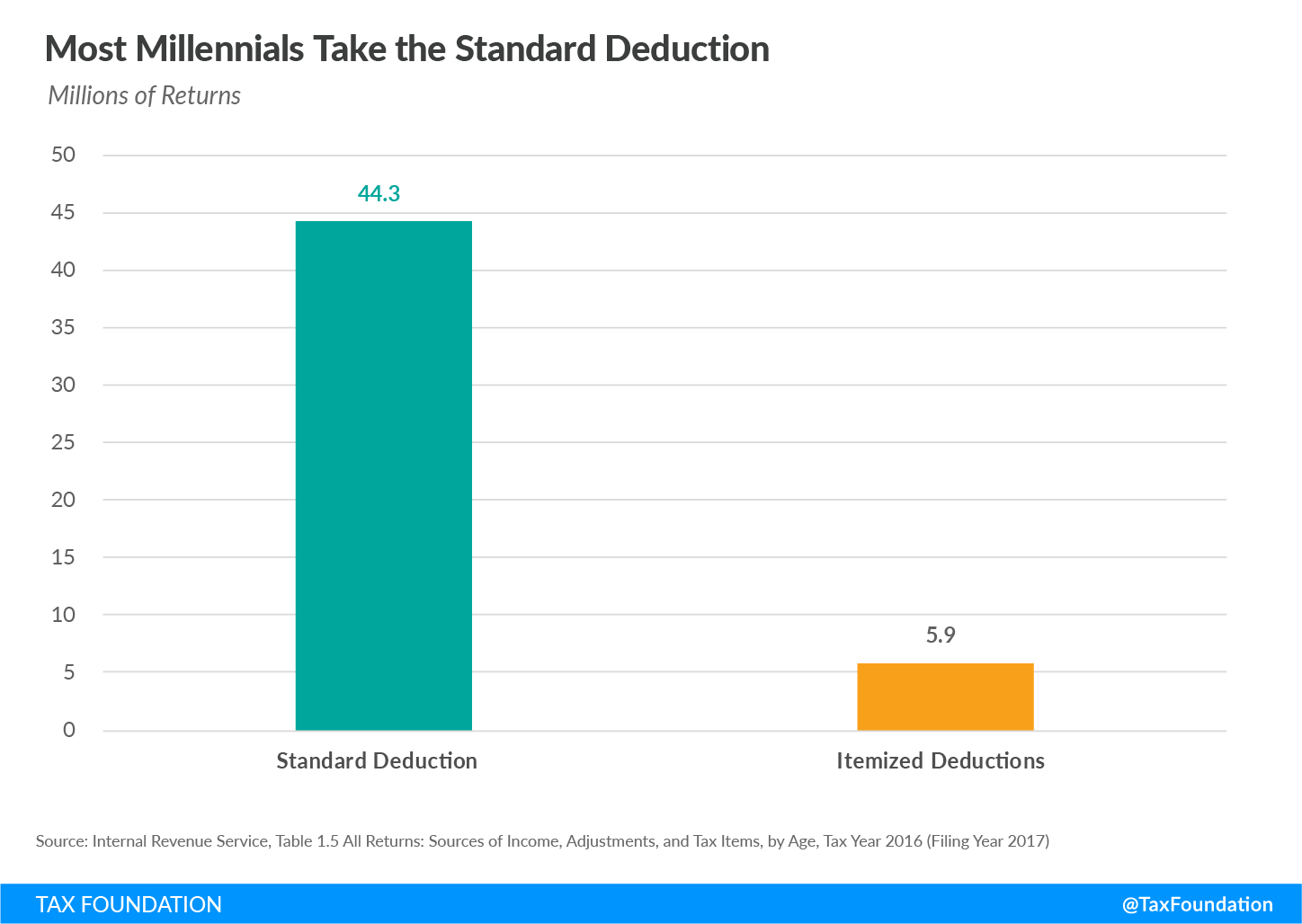

When figuring their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , most millennials, 44.3 million, took the standard deduction. Only 5.9 million returns used itemized deductions. Millennials utilize itemized deductions to a lesser extent than all other taxpayers; about 12 percent of millennials itemize compared to 40 percent of all other taxpayers.

Unfortunately, we will not be able to follow this particular set of taxpayers forward to see how these factors change over time. Some taxpayers would age out of the 18 to 35 group and others age in, and eventually this would result in intergenerational age groups; for example, some millennials and some Gen X in one age group. But the 2016 data provides an interesting glimpse at the sources of reported income and other tax filing stats of the millennial generation.

Share this article