Michigan Governor Gretchen Whitmer (D) this week released her fiscal year (FY) 2020 budget bill, central to which is a 45-cent gas tax increase and a new entity-level taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on unincorporated businesses.

Currently, Michigan’s fuel excise tax is 26.3 cents per gallon (cpg). Under the governor’s proposal, a 45-cent increase would occur in three 15-cent increments over a one-year period: the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. would reach 41.3 cpg in October 2019, 56.3 cpg in April 2020, and 71.3 cpg in October 2020.

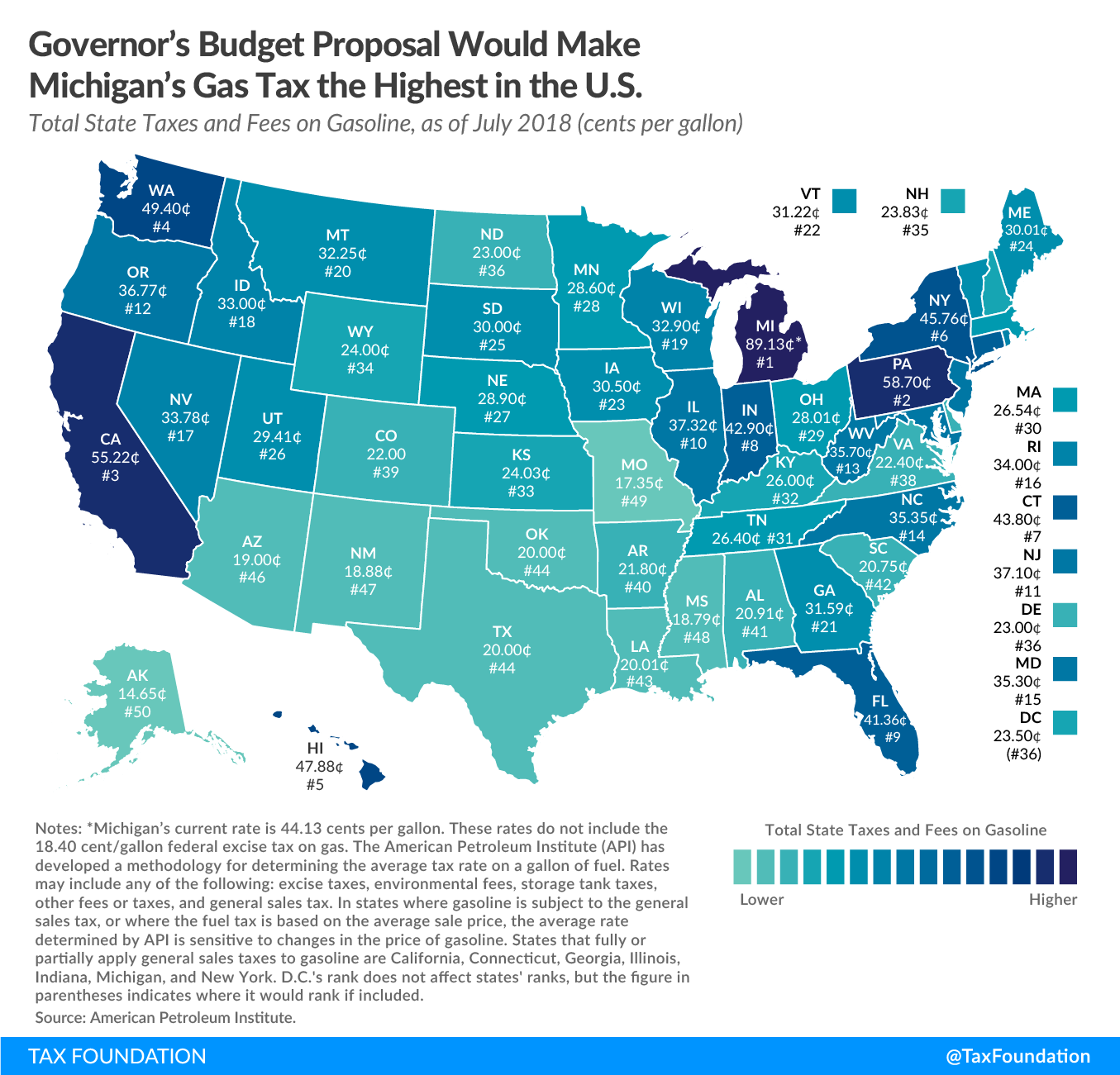

While the proposed excise tax increase alone would make Michigan’s gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. the highest in the nation, it’s important to keep in mind that per-gallon excise taxes are not the only taxes states collect on gasoline. In fact, Michigan is among the few states that applies its sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. to purchases of fuel, bringing the total state tax on a gallon of gas to an average of 44.13 cpg, the sixth-highest in the nation. As such, a 45-cent increase would bring Michigan’s total average gas tax to 89.13 cpg, by far the highest in the nation, and over 30 cents higher than in Pennsylvania, which currently has the highest gas tax (58.7 cpg). The result: Michiganders would be paying double the state taxes they currently pay at the pump.

To offset the gas tax increase for lower-income residents, this proposal would incrementally double the Earned Income Tax Credit (EITC) from 6 percent to 12 percent of the federal credit amount, starting with a 4 percent increase in FY 2020 and an additional 2 percent increase in FY 2021.

In addition, the governor’s budget would create a new entity-level tax on pass-through businesses, including sole proprietorships, partnerships, limited liability companies (LLCs), and S corporations. Currently, the income of unincorporated businesses is taxed at Michigan’s flat 4.25 percent individual income tax rate. That’s because, with limited exceptions, pass-through businesses are taxed under federal and state individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. codes. It’s in their very name: business income passes through to owners’ individual income tax returns.

However, under the governor’s proposal, pass-throughs would be subject to an entity-level tax at a higher rate of 6 percent. Business income would still technically flow through to owners’ individual income tax returns, but owners would receive an offsetting credit so only non-business income would be taxed at the lower 4.25 percent rate.

The governor’s proposal cites “tax parity” as the justification for the tax increase on pass-through businesses, since traditional C corporations are subject to a 6 percent income tax. It’s important to keep in mind, though, that parity of rate does not equate to parity of tax burden. Strict comparisons cannot be made between corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates and individual income tax rates, in part because corporations are taxed at the entity level and again when profits are distributed, and because differences exist between individual and corporate income tax bases. If parity truly becomes an issue that prevents businesses from incorporating when they otherwise would, there are better solutions than raising tax rates on small businesses and forcing them to pay taxes at the entity level.

Another reason for the tax increase on pass-throughs is as an offset to “pay for” the creation of a new income tax exemption for pension income. Currently, Michigan properly treats most retirement income, including pension income, like other forms of income for tax purposes, but the governor’s proposal would carve pension income out of the income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . The governor’s proposal characterizes this move as a repeal of the “pension tax,” but that term is misleading because pension income is not subject to a special tax; it is treated like other forms of income and taxed at the state’s 4.25 percent rate. Exempting pension income would in fact create a disparity in the tax treatment of retirement income. A more neutral approach is simply to tax all income, whether personal income, pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. income, or retirement income, at the state’s competitive, flat rate.

Share this article