The TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act didn’t end the debate on tax reform – it’s shifted the discussion to state capitols across the country, and Maine Governor Paul LePage (R) is joining the conversation. Governor LePage has put forth a comprehensive tax bill that cuts taxes by $111 million over the next two years and conforms Maine’s code to many of the recent federal tax code changes.

The bill, LD 1655, makes substantial changes to both the individual and corporate income sections of the tax code. The bill eliminates the personal exemption in Maine (it was previously tied to the federal amount, which is now $0), but creates a new 0 percent tax bracket, effectively exempting the first $4,150 (or $8,300 for joint filers) in income from taxation. The bill recouples Maine’s standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. to the federal level, raising the amount to $12,000 for single filers and $24,000 for joint filers. It also raises the estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. level to the new federal amount, $11.2 million, and creates new child and dependent tax credits.

On the corporate side, the bill will conform Maine to the federal treatment of bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. , net operating losses, and the interest deduction. Maine will conform to the new full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. of short-lived assets rules, allowing businesses to immediately deduct 100 percent of the value of newly purchased assets. This change is incredibly important and one of the most pro-growth elements in tax reform. Coupling to full expensing will incentivize investment in Maine and encourage the growth of Maine’s economy.

The bill also couples to the federal NOL treatment, so firms in Maine will no longer be allowed to carry back losses, but can carry them forward indefinitely, subject to a cap of 80 percent of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. . LD 1655 couples to the federal interest deduction changes as well, limiting the deductibility of net interest expenses to 30 percent of earnings.

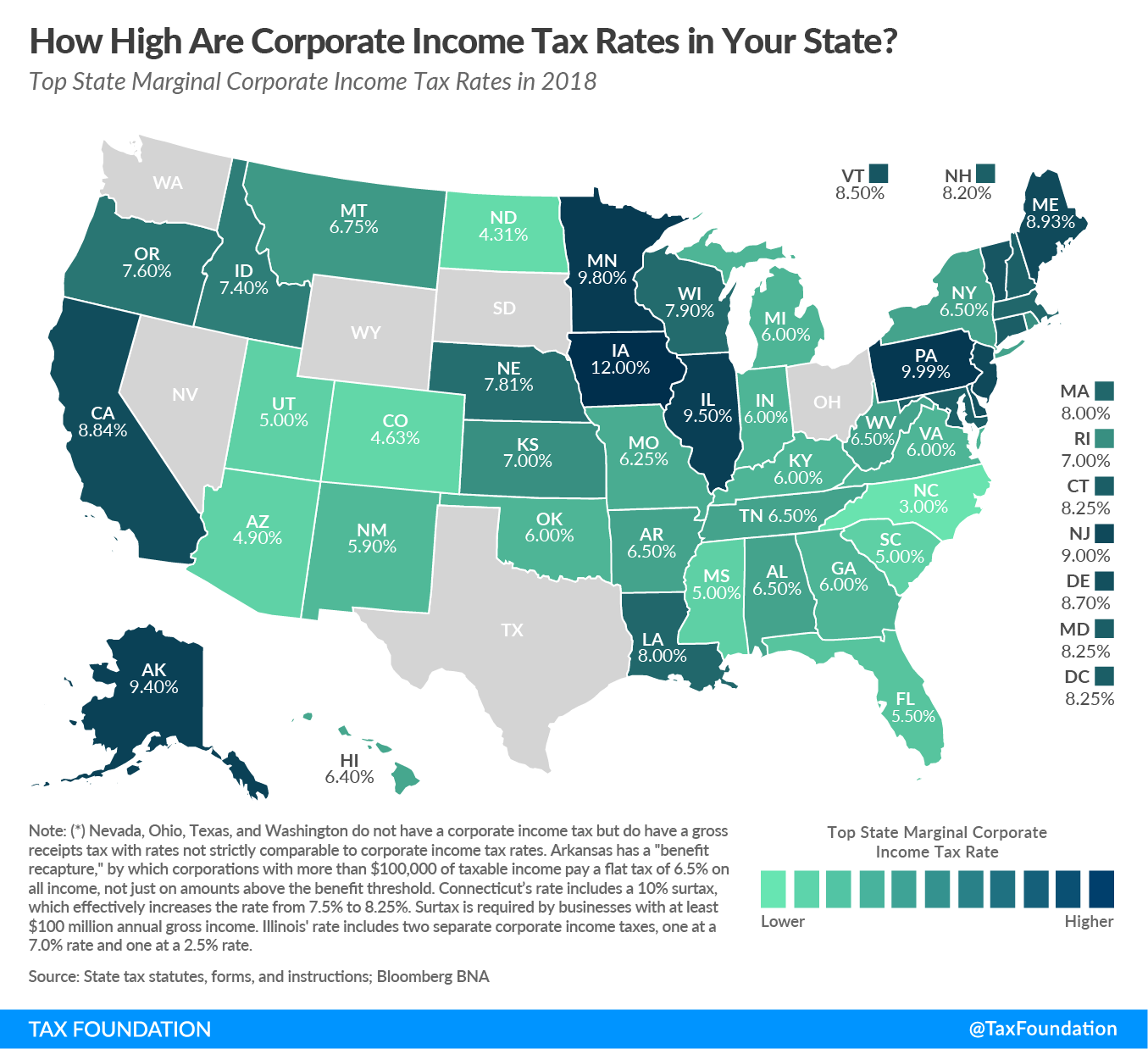

These changes are all proposed together in part to help offset the front-loaded cost of full expensing. To mitigate any small increase in corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. liability, the legislation also includes a modest cut to the corporate income tax rate, from its current 8.93 percent to 8.33 percent. Maine has one of the highest corporate tax rates in the country, and this provision is a step in the right direction for the state.

What legislators should consider, however, is their treatment of revenue from deemed repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. . Maine estimates that it will receive approximately $31 million in one-time revenue from deemed repatriation. Ideally, any revenue from deemed repatriation should be considered one-time money, not funds with which to finance ongoing budget or tax code changes. Good options for any Subpart F income include depositing it into rainy-day funds or pension funds, or financing one-time expenditures. Oregon legislators recently set a good example by passing legislation that would direct that revenue into their pension fund.

Conformity is important, and states conform to the federal tax code in part to reduce complexity for taxpayers. Like my colleague Jared Walczak noted,

“Doing so allows state administrators and taxpayers alike to rely on federal statutes, rulings, and interpretations, which are generally more detailed and extensive than what any individual state could produce. It provides consistency of definitions for those filing in multiple states, and reduces duplication of effort in filing federal and state taxes. It permits substantial reliance on federal audits and enforcement, along with federal taxpayer data. It helps to curtail tax arbitrage and reduce double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. . For the filer, it can make things easier by allowing the filer to copy lines directly from their federal tax forms.”

Overall, this plan advances Maine toward a more sound, simple, and competitive tax code by adopting broader bases and lower rates. Lawmakers should consider some of the funding sources like repatriated income, but would deserve credit for adopting some enormously pro-growth provisions.

Share this article