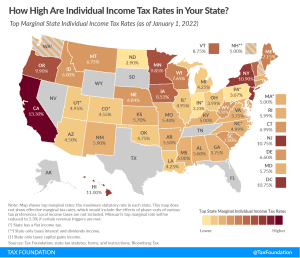

State Individual Income Tax Rates and Brackets, 2022

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min readHow does Wisconsin’s tax code compare? Wisconsin has a graduated state individual income tax, with rates ranging from 3.50 percent to 7.65 percent. Wisconsin has a 7.9 percent corporate income tax rate. Wisconsin also has a 5.00 percent state sales tax rate and an average combined state and local sales tax rate of 5.70 percent. Wisconsin has a 1.38 percent effective property tax rate on owner-occupied housing value.

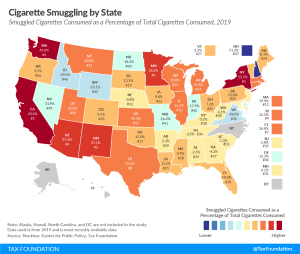

Wisconsin does not have an estate tax or inheritance tax. Wisconsin has a 32.9 cents per gallon gas tax rate and a $2.52 cigarette excise tax rate. The State of Wisconsin collects $5,700 in state and local tax collections per capita. Wisconsin has $8,464 in state and local debt per capita and has a 100 percent funded ratio of public pension plans. Overall, Wisconsin’s tax system ranks 24th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Wisconsin is no exception. The first step towards understanding Wisconsin’s tax code is knowing the basics. How does Wisconsin collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

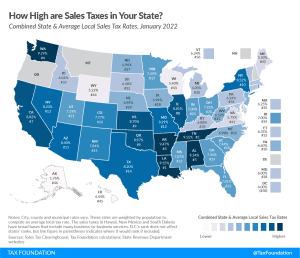

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

12 min read

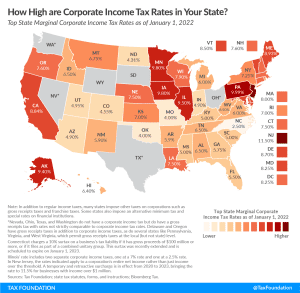

Forty-four states levy a corporate income tax. Rates range from 2.5 percent in North Carolina to 11.5 percent in New Jersey.

8 min read

Well-designed Net Operating Loss (NOL) provisions benefit the economy by smoothing business income, which mitigates entrepreneurial risk and helps firms survive economic downturns.

24 min read

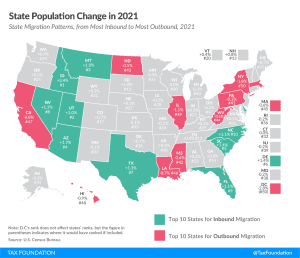

States are unprepared for the ongoing shift to remote and flexible work arrangements, or for the industries and activities of today, to say nothing of tomorrow. In some states, moreover, existing tax provisions exacerbate the impact of high inflation and contribute to the supply chain crisis.

40 min read

The pandemic has accelerated changes in the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

While there are many ways to show how much is collected in taxes by state governments, our State Business Tax Climate Index is designed to show how well states structure their tax systems and provides a road map for improvement.

169 min read

The six counties with the highest median property tax payments all have bills exceeding $10,000—Bergen, Essex, and Union Counties in New Jersey, and Nassau, Rockland, and Westchester counties in New York. All six are near New York City, as is the next highest, Passaic County, New Jersey ($9,881).

3 min read

It is important to understand how the SALT deduction’s benefits have changed since the SALT cap was put into place in 2018 before repealing the cap or making the deduction more generous. Doing so would disproportionately benefit higher earners, making the tax code more regressive.

6 min read