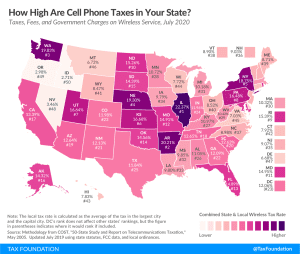

Wireless Tax Burden Remains High Due to Federal Surcharge Increase

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read