How Do Taxes Affect Interstate Migration?

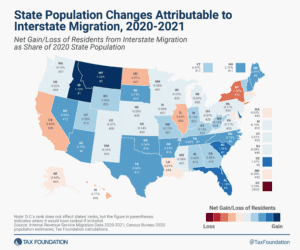

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

7 min readHow does Washington’s tax code compare? Washington does not have a typical individual income tax but does levy a 7.0 percent tax on capital gains income. Washington does not have a corporate income tax but does levy a state gross receipts tax. Washington has a 6.50 percent state sales tax rate and an average combined state and local sales tax rate of 9.38 percent. Washington has a 0.76 percent effective property tax rate on owner-occupied housing value.

Washington has an estate tax. Washington has a 52.8 cents per gallon gas tax rate and a $3.025 cigarette excise tax rate. The State of Washington collects $6,644 in state and local tax collections per capita. Washington has $11,632 in state and local debt per capita and has a 103 percent funded ratio of public pension plans. Overall, Washington’s tax system ranks 35th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Washington is no exception. The first step towards understanding Washington’s tax code is knowing the basics. How does Washington State collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

7 min read

Whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

3 min read

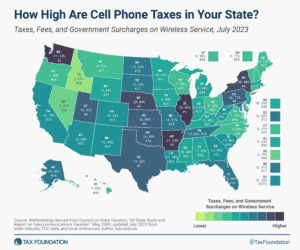

To alleviate the regressive impact on wireless consumers, states should examine their existing communications tax structures and consider policies that transition their tax systems away from narrowly based wireless taxes and toward broad-based tax sources.

18 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

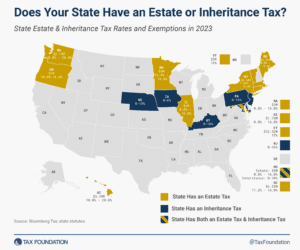

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

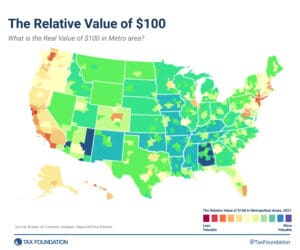

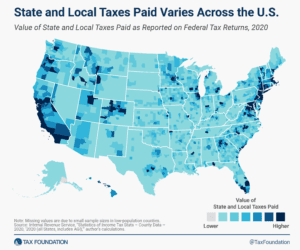

The differences in purchasing power can be large and they have significant implications for the relative impact of economic and tax policies across the United States.

3 min read

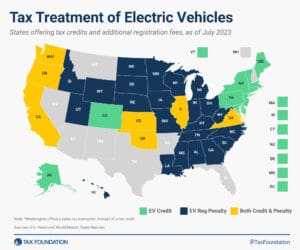

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read