New York Lawmaker Floats a Scrooge Tax on Online Shopping

Just in time for the holidays, one lawmaker wants to tax New York City residents $3 for every package they order online, excluding food and medicine

3 min readHow does New York’s tax code compare? New York has a graduated individual income tax, with rates ranging from 4.00 percent to 10.90 percent. There are also jurisdictions that collect local income taxes. New York has a 6.50 percent to 7.25 percent corporate income tax rate. New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent. New York’s tax system ranks 49th overall on our 2023 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and New York is no exception. The first step towards understanding New York’s tax code is knowing the basics. How does New York collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Just in time for the holidays, one lawmaker wants to tax New York City residents $3 for every package they order online, excluding food and medicine

3 min read

Our new study provides a 360-degree assessment of New York’s budget crisis, analyzes proposed revenue options, and offers solutions to raise revenue without driving more taxpayers out of the state or undoing recent positive reforms

106 min read

New York already suffers from significant smuggling of untaxed tobacco products—smuggled cigarettes accounted for 53 percent of cigarettes consumed in the state in 2018—and further increasing tobacco taxes is likely to make matters worse.

3 min read

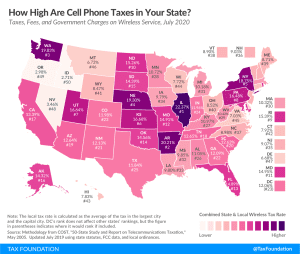

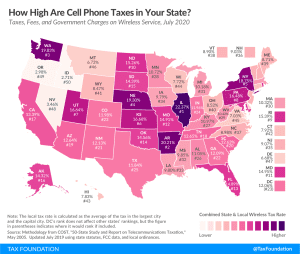

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read

New Jersey’s tax design adds another element to the ongoing experiment with legal recreational marijuana in the states.

3 min read

Zoom Video Communications announced that, come November, the company will start collecting and remitting local utility and communications taxes in California, New York, Maryland, and Virginia.

5 min read

President Joe Biden’s tax plan would yield combined top marginal state and local rates in excess of 60 percent in three states: California, Hawaii, and New Jersey (also New York City).

4 min read

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

Taxes on digital services, digital advertising, and the sale or utilization of consumer data, which were already emerging before the #coronavirus crisis, look increasingly attractive to cash-strapped states and localities.

7 min read