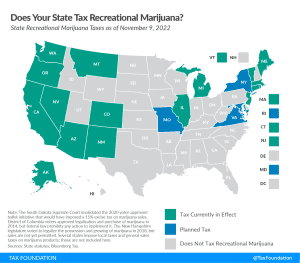

How High Are Taxes on Recreational Marijuana in Your State?

Recreational marijuana taxation is one of the hottest policy issues in the U.S. Currently, 19 states have implemented legislation to legalize and tax recreational marijuana sales.

5 min read