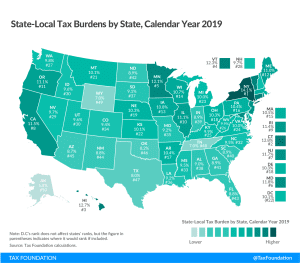

Reviewing Benefits of the State and Local Tax Deduction by County in 2018

It is important to understand how the SALT deduction’s benefits have changed since the SALT cap was put into place in 2018 before repealing the cap or making the deduction more generous. Doing so would disproportionately benefit higher earners, making the tax code more regressive.

6 min read