State Tax Reform and Relief Enacted in 2022

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min readHow does Idaho’s tax code compare? Idaho has a flat 5.8 percent individual income tax rate. Idaho has a 5.8 percent corporate income tax rate. Idaho also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.03 percent. Idaho has a 0.47 percent effective property tax rate on owner-occupied housing value.

Idaho does not have an estate tax or inheritance tax. Idaho has a 33 cents per gallon gas tax rate and a $0.57 cigarette excise tax rate. The State of Idaho collects $4,541 in state and local tax collections per capita. Idaho has $3,135 in state and local debt per capita and has an 89 percent funded ratio of public pension plans. Overall, Idaho’s tax system ranks 16th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Idaho is no exception. The first step towards understanding Idaho’s tax code is knowing the basics. How does Idaho collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min read

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

4 min read

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

The Kansas experience is so infamous that “what about Kansas?” is almost guaranteed to be a question—sometimes as a retort, but often a genuine expression of concern—any time any state explores tax relief. But what about the other two dozen states that have cut their income taxes since then?

6 min read

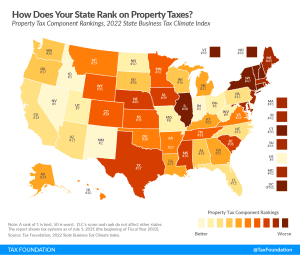

Which states have the highest property taxes in 2022? See how your state compares in property taxes across the United States

3 min read

The sales tax is too important a part of states’ revenue toolkits to be permitted further erosion, making sales tax modernization a vital project of the 2020s.

17 min read

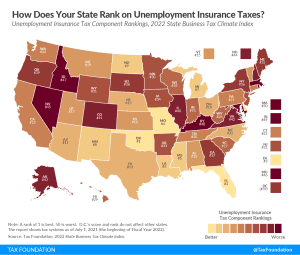

Ranking unemployment insurance tax codes on the 2022 State Business Tax Climate Index. Learn more about state unemployment insurance tax code and systems.

4 min read

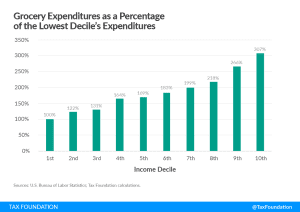

Exempting groceries from the sales tax base reduces economic efficiency without achieving its objective of enhancing tax progressivity.

19 min read

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read