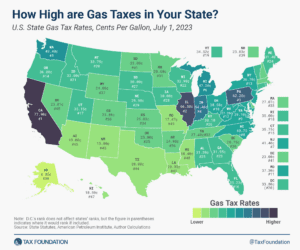

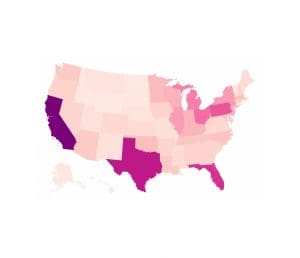

How High are Gas Taxes in Your State?

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

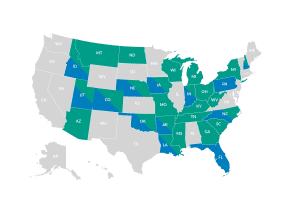

2 min readHow does Idaho’s tax code compare? Idaho has a flat 5.8 percent individual income tax rate. Idaho has a 5.8 percent corporate income tax rate. Idaho also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.03 percent. Idaho has a 0.47 percent effective property tax rate on owner-occupied housing value.

Idaho does not have an estate tax or inheritance tax. Idaho has a 33 cents per gallon gas tax rate and a $0.57 cigarette excise tax rate. The State of Idaho collects $4,541 in state and local tax collections per capita. Idaho has $3,135 in state and local debt per capita and has an 89 percent funded ratio of public pension plans. Overall, Idaho’s tax system ranks 16th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Idaho is no exception. The first step towards understanding Idaho’s tax code is knowing the basics. How does Idaho collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read

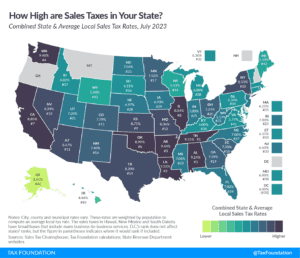

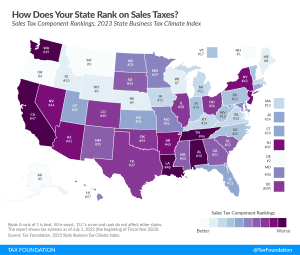

Compare the latest 2023 sales tax rates as of July 1st. Sales tax rate differentials can induce consumers to shop across borders or buy products online.

8 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

15 min read

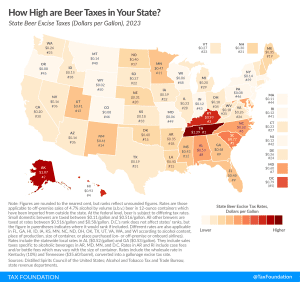

Taxes are the single most expensive ingredient in beer, costing more than the labor and raw materials combined.

3 min read

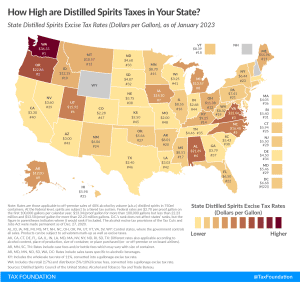

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

4 min read

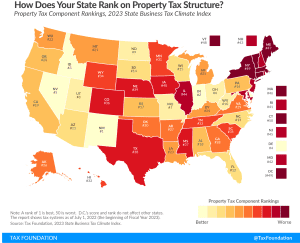

States are in a better position to attract business investment when they maintain competitive real property tax rates and avoid harmful taxes on tangible personal property, intangible property, wealth, and asset transfers.

3 min read

In the United States, tobacco is taxed at both the federal and state and sometimes even local levels. These layers of taxes often result in very high levels of taxation—the highest of any consumer item. The retail price of cigarettes, for instance, is more than 40 percent taxes on average. In some states, like Minnesota and New York, more than 50 percent of the price paid by consumers comes from taxes.

2 min read

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

5 min read