All Content

Boost Semiconductor Manufacturing by Removing Tax Barriers—Not Creating Tax Subsidies

A bipartisan group of Senators introduced a bill to create a permanent 25 percent tax credit for investments in semiconductor manufacturing equipment and construction of related facilities—but their proposal would not address underlying bias against investment that exists in the tax code today.

3 min read

Spain Determined to Cash in on Digital Services Tax

Spain’s digital services tax levies a 3 percent tax on revenues from online ads, deals brokered on digital platforms, and sales of user data by tech companies with at least €750 million (US $893 million) in total annual worldwide revenues and Spanish revenues of €3 million ($3.57 million).

4 min read

States Continue to Bet on Sports

With many state legislative sessions wrapping up for this year, and a new fiscal year about to begin, it’s a good time to examine some of the 2021 legislative trends—and sports betting taxes are among the more prominent.

5 min read

Tax Foundation Comment on Treasury’s State Tax Cuts Limitation Rule

The Tax Foundation recently submitted regulatory comment on the U.S. Treasury’s state tax cuts limitation rule, highlighting three areas of concern and suggesting revisions to the rule.

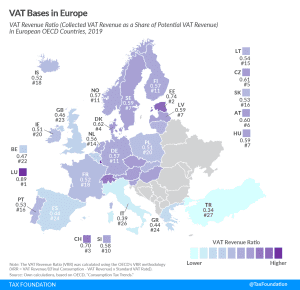

VAT Bases in Europe

As economic activity resumes and the task of accounting for the deficits incurred in navigating the crisis of the past year becomes the focus of fiscal policy deliberations, a greater reliance on VAT could be an important tool in ensuring fiscal stability going forward. Countries should use this as an opportunity to improve VAT systems by re-examining carveouts in the form of exemptions and reduced rates.

2 min read

A Global Minimum Tax and Cross-Border Investment: Risks & Solutions

Leaders around the world are quickly moving to finalize an agreement on a global minimum tax in 2021, based on the so-called “Pillar Two” proposal from the OECD.

25 min read

New Research Shows Major Changes for U.S. Companies Earning Profits from Ireland

New data show that the recent policy changes that have been implemented by the U.S., Ireland, and dozens of other countries are having an impact. The question for policymakers is whether they will take the time to understand these impacts before jumping to the next project to change international tax rules yet again.

3 min read

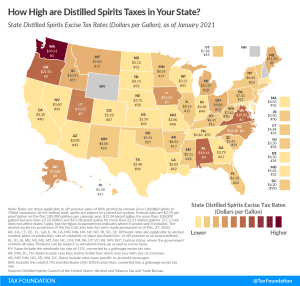

Distilled Spirits Taxes by State, 2021

Of all alcoholic beverages subject to taxation, stiff drinks—and all distilled spirits—face the stiffest tax rates. Like many excise taxes, the treatment of distilled spirits varies widely across the states.

2 min read

Details and Analysis of President Biden’s FY 2022 Budget Proposals

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Tracking the 2021 Biden Tax Plan and Federal Tax Proposals

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

Expensing Is Infrastructure, Too

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

House and Senate Proposals Would Make Incremental Reforms to Retirement Savings

While falling short of comprehensively reforming the complex U.S. retirement savings system, House and Senate lawmakers have proposed bipartisan bills to help simplify and expand access to retirement savings accounts to more workers.

4 min read

Banning Tobacco Flavors Could Prove Costly for D.C.

Early signs indicate that flavors bans will not decrease tobacco consumption. It is not in the interest of the District of Columbia to pursue a public health measure that merely sends tax revenue to its neighboring jurisdictions without improving public health.

3 min read

Combined Effect of a Higher Corporate Rate and Permanent Bonus Depreciation

The negative effects of President Biden’s proposed 28 percent corporate income tax rate could be tempered by improving how the corporate income tax base treats investment expenses.

4 min read

Carve-ins and Carve-outs: Open Questions for Global Tax Reform

There has been some confusion about how some parts of the recent G7 agreement on new tax rules for multinational companies might work. The new policies would target the largest and most profitable multinationals and bring in a global minimum tax.

5 min read

Louisiana Fiscal Session Finishes Strong with Tax Reform

It took until the last day of the session, but Louisiana lawmakers succeeded in passing a tax reform package Thursday that would simplify a complicated tax code and make the state more economically competitive.

4 min read

Who Bears the Burden of Corporation Taxation? A Review of Recent Evidence

The Biden administration has pledged to not raise taxes on anyone earning less than $400,000 a year. However, the administration’s corporate tax proposals would likely violate that pledge, given that corporations are comprised of people who also might earn less than $400,000.

3 min read

Infrastructure Funding for Highways Digs into Issues of Outdated Taxes and Narrow Bases

As spending priorities are dividing lawmakers trying to negotiate among the various federal infrastructure plans, less time is being spent on the funding of one of the key components—our highways, both current and future taxes and fees. One of the current taxes, a federal excise tax on heavy commercial vehicles and trailers, is an important revenue generator, but its flawed tax design has a negative impact on investment and leads to unstable revenue.

4 min read

Broad-Based Taxes on Consumption and User Fees Are Efficient Ways to Raise Federal Revenue for Infrastructure

Rather than relying on damaging corporate tax hikes, policymakers should consider user fees and consumption taxes as options for financing new infrastructure to ensure that a compromise does not end up being a net negative for the U.S. economy.

2 min read