Sources of Government Revenue in the OECD, 2024

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

The “Bring Chicago Home” ballot measure would make Chicago’s tax structure substantially less neutral by raising taxes on some property transfers while decreasing taxes on others.

7 min read

The global economy needs policymakers who are invested in seeing growth recover and avoiding unnecessary barriers to cross-border trade and investment. The challenges countries face will become even more difficult to solve in a stagnant global economy.

Portugal’s turnover tax on real property transfers places a serious drag on economic growth by making it harder for people to relocate for better jobs and living conditions while constraining investment into the development of housing and buildings.

5 min read

If student athletes are taxed on their earnings, it’s time the NCAA should be taxed on theirs.

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

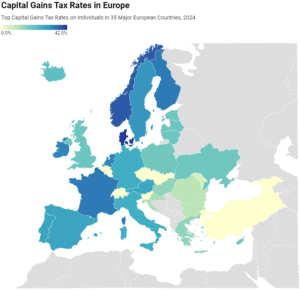

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

A tax based on alcohol content would be the most neutral, straightforward means of raising revenue from alcohol. But since such a tax would constitute a redesign of the entire alcohol tax system at both the state and federal levels, the next best approach is to create more categories for new products.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

If a multilateral solution to remove digital services taxes (DSTs) is not agreed to, then DSTs will continue to spread and mutate with negative impacts on some of the most innovative companies in the world.

Though providing permanent R&D expensing alone would not be a China-competition magic bullet, it is a no-brainer place to start. In this technological race, we should first make sure we have not tied our own shoes together.

4 min read

Vermont lawmakers are considering the adoption of two new taxes on high earners, which proponents have branded “wealth taxes.”

4 min read

Don’t be fooled by tax myths and misconceptions this tax filing season.

3 min read

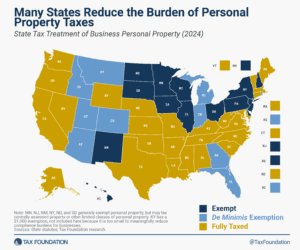

Does your state have a small business exemption for machinery and equipment?

3 min read

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read

Expanding Virginia’s sales tax base to include B2B digital transactions could lead to tax pyramiding, hide the true cost of government, and make the sales tax system much less neutral and transparent.

5 min read