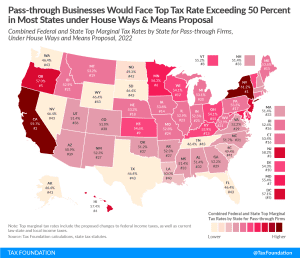

Top Tax Rate on Pass-through Business Income Would Exceed 50 Percent in Most States Under House Dems’ Plan

Under the House Democrats’ reconciliation plan, the top tax rate on pass-through business income would exceed 50 percent in most states. Pass-through businesses, such as sole proprietorships, S corporations, and partnerships, make up a majority of businesses and majority of private sector employment in the United States.

3 min read