Tax Policy’s Bipartisan Roots

Michael J. Graetz is the Columbia Alumni Professor of Tax Law and a leading expert on national and international tax law.

5 min read

Michael J. Graetz is the Columbia Alumni Professor of Tax Law and a leading expert on national and international tax law.

5 min read

With the adoption of its new budget in mid-November, North Carolina has reinforced its position as a leader in pro-growth tax reform, becoming the 12th state to enact income tax rate reductions in 2021 alone.

7 min readLearn more about the House Build Back Better Act, including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals.

15 min read

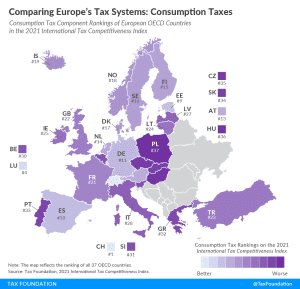

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

As lawmakers today look for ways to boost American industry and reduce costs for consumers, they should pay attention to the mountains of evidence that the Trump-Biden tariffs have harmed American consumers and businesses.

6 min read

Temporary tax relief measures, like refund checks or gas tax holidays, are not necessarily bad, and can be justified as ways to return excess revenues to taxpayers, but they often miss an opportunity to do better by taxpayers in the long run.

7 min read

Low-skilled workers have been the hardest hit by the pandemic-induced economic slowdown. When deciding on bonus depreciation, which is currently set to expire in 2026, policymakers should remember that disadvantaged workers would be the most likely to benefit from making it permanent.

2 min read

Coming out of the pandemic, the state of Ohio is estimating significant tax revenue growth, and some lawmakers are looking to take advantage and repeal the Commercial Activity Tax (CAT), one of only a few gross receipts taxes still levied in the country.

7 min read

Mississippi lawmakers should deliver tax relief in 2022, but they need not take an all-or-nothing approach. There are many ways to improve the state’s tax code, even if full income tax repeal doesn’t remain on the table.

6 min read

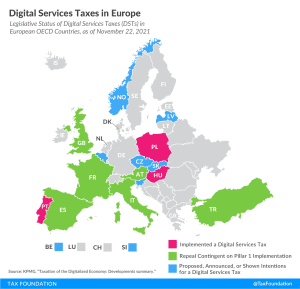

Despite ongoing multilateral negotiations in the OECD, about half of all European OECD countries have either announced, proposed, or implemented their own unilateral digital services tax.

7 min read

When looking at the tax burden on businesses over time, it is important to provide a complete picture by accounting for the different types of businesses in the U.S. and the timing effects of the 2017 tax law. Doing so provides important context on existing tax burdens and for considering the impact of raising taxes on corporations and pass-through firms.

3 min read

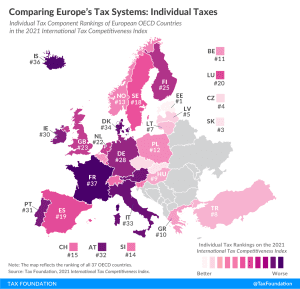

France’s individual income tax system is the least competitive of all OECD countries. It takes French businesses on average 80 hours annually to comply with the income tax.

3 min read

The persistently high inflation in recent months has made some lawmakers question the need for additional deficit spending, In the short term, the Build Back Better Act would likely contribute to inflation, but the magnitude of that contribution is unclear.

3 min read

The Build Back Better Act would raise taxes to pay for social spending programs. But the design of some of the tax increases may end up hurting private pensions, among other problems.

6 min read

Norway’s proposed reductions in income tax have the potential to increase disposable income for workers that can potentially raise consumption and contribute to economic growth. However, the increase of the wealth and indirect taxes is likely to step up the complexity of the tax system and create additional distortions.

3 min read

One unintended consequence of the tax proposals in the Build Back Better Act is a higher potential burden on wireless spectrum investments, which could slow the build out of 5G technology as the U.S. races to compete with other countries—moving in the opposite direction of countries like China that are actively subsidizing 5G expansion.

5 min read

Rep. Mace (R-SC)’s States Reform Act would deschedule, regulate, and tax cannabis products with a novel federal excise tax design—based on quantities and predefined categories, not dissimilar from how the federal government taxes alcohol and tobacco.

7 min read

Due to the House Build Back Better tax plan’s economically costly and inefficient tax increases, our analysis finds that long-run GDP would drop by a little over $1 for every $1 in new tax revenue.

6 min read